Question: Using Financial Ratios 4 - 4 . ( Analyzing liquidity ) ( Related to Checkpoint 4 . 1 on page 1 1 9 ) Apex

Using Financial Ratios

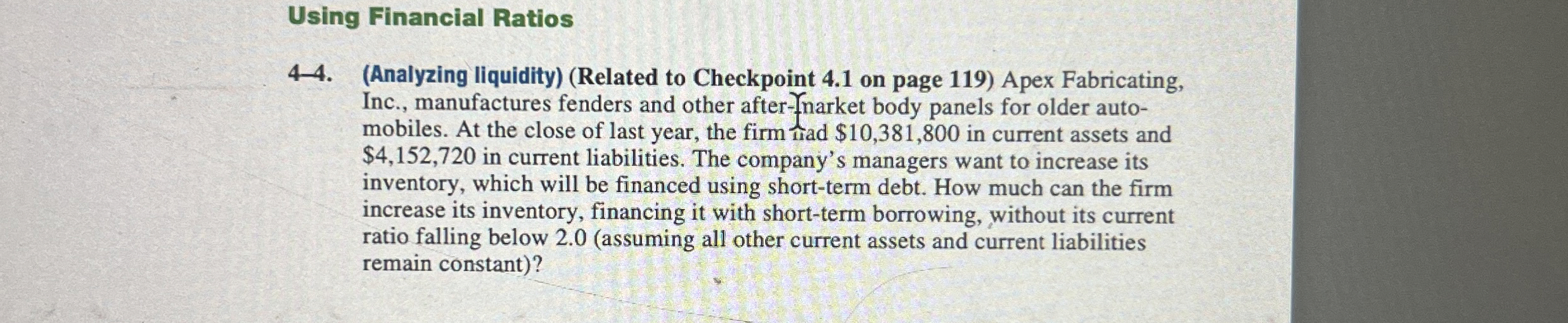

Analyzing liquidityRelated to Checkpoint on page Apex Fabricating, Inc., manufactures fenders and other afterfnarket body panels for older automobiles. At the close of last year, the firm Had $ in current assets and $ in current liabilities. The company's managers want to increase its inventory, which will be financed using shortterm debt. How much can the firm increase its inventory, financing it with shortterm borrowing, without its current ratio falling below assuming all other current assets and current liabilities remain constant

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock