Question: *using formula and show your calculation steps QUESTION 1 Kayangan Berhad is interested in measurinng its overall cost of capital. The company ask their head

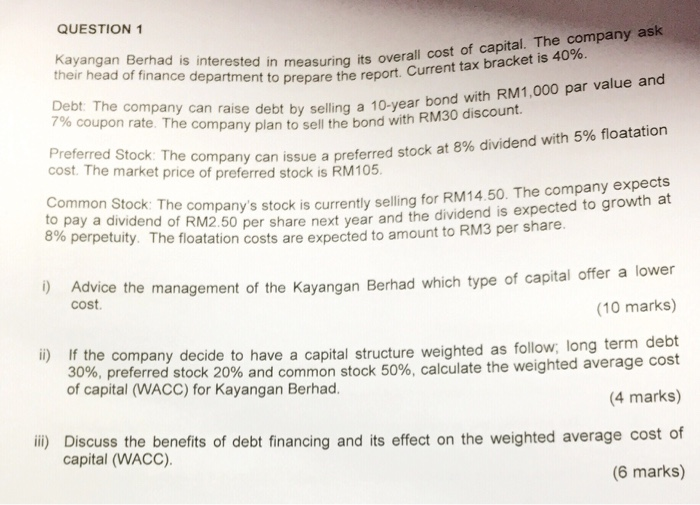

QUESTION 1 Kayangan Berhad is interested in measurinng its overall cost of capital. The company ask their head of finance department to prepare the report. Current tax bracket is 40%. Debt The company can raise debt by selling a 10-year bond with RM1,000 par value and 7% coupon rate. The company plan to sell the bond with RM30 discount. Preferred Stock: The company can issue a preferred stock at 8% dividend with 5% floatation cost. The market price of preferred stock is RM105 Common Stock: The company's stock is currently selling for RM 14.50. The company expects to pay a dividend of RM2.50 per share next year and the dividend is expected to growth at 89% perpetuity. The floatation costs are expected to amount to RM3 per share. Advice the management of the Kayangan Berhad which type of capital offer a lower cost (10 marks) ) If the company decide to have a capital structure weighted as follow; long term debt 30%, preferred stock 20% and common stock 50%, calculate the weighted average cost of capital (WACC) for Kayangan Berhad. (4 marks) ii Discuss the benefits of debt financing and its effect on the weighted average cost of capital (WACC). (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts