Question: Using formulas and writing them down on paper. Not supposed to use Excel a. What is stock screening. Provide an example of technical stock screening.

Using formulas and writing them down on paper. Not supposed to use Excel

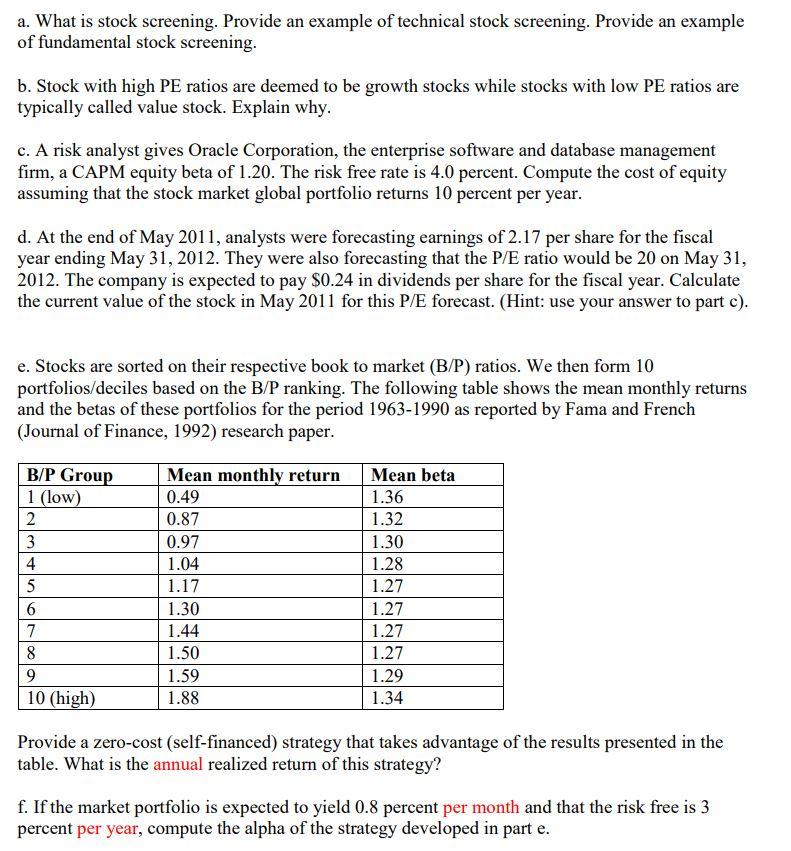

a. What is stock screening. Provide an example of technical stock screening. Provide an example of fundamental stock screening. b. Stock with high PE ratios are deemed to be growth stocks while stocks with low PE ratios are typically called value stock. Explain why. c. A risk analyst gives Oracle Corporation, the enterprise software and database management firm, a CAPM equity beta of 1.20. The risk free rate is 4.0 percent. Compute the cost of equity assuming that the stock market global portfolio returns 10 percent per year. d. At the end of May 2011, analysts were forecasting earnings of 2.17 per share for the fiscal year ending May 31, 2012. They were also forecasting that the P/E ratio would be 20 on May 31, 2012. The company is expected to pay $0.24 in dividends per share for the fiscal year. Calculate the current value of the stock in May 2011 for this P/E forecast. (Hint: use your answer to part c). e. Stocks are sorted on their respective book to market (B/P) ratios. We then form 10 portfolios/deciles based on the B/P ranking. The following table shows the mean monthly returns and the betas of these portfolios for the period 1963-1990 as reported by Fama and French (Journal of Finance, 1992) research paper. B/P Group 1 (low) 2 3 4 5 6 7 8 9 10 (high) Mean monthly return 0.49 0.87 0.97 1.04 1.17 1.30 1.44 1.50 1.59 Mean beta 1.36 1.32 1.30 1.28 1.27 1.27 1.27 1.27 1.29 1.34 1.88 Provide a zero-cost (self-financed) strategy that takes advantage of the results presented in the table. What is the annual realized return of this strategy? f. If the market portfolio is expected to yield 0.8 percent per month and that the risk free is 3 percent per year, compute the alpha of the strategy developed in part e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts