Question: *using generic template, please show formulas used. You consider purchasing a house for $400,000 and have a 20% down payment. The bank offers a 30-year

*using generic template, please show formulas used.

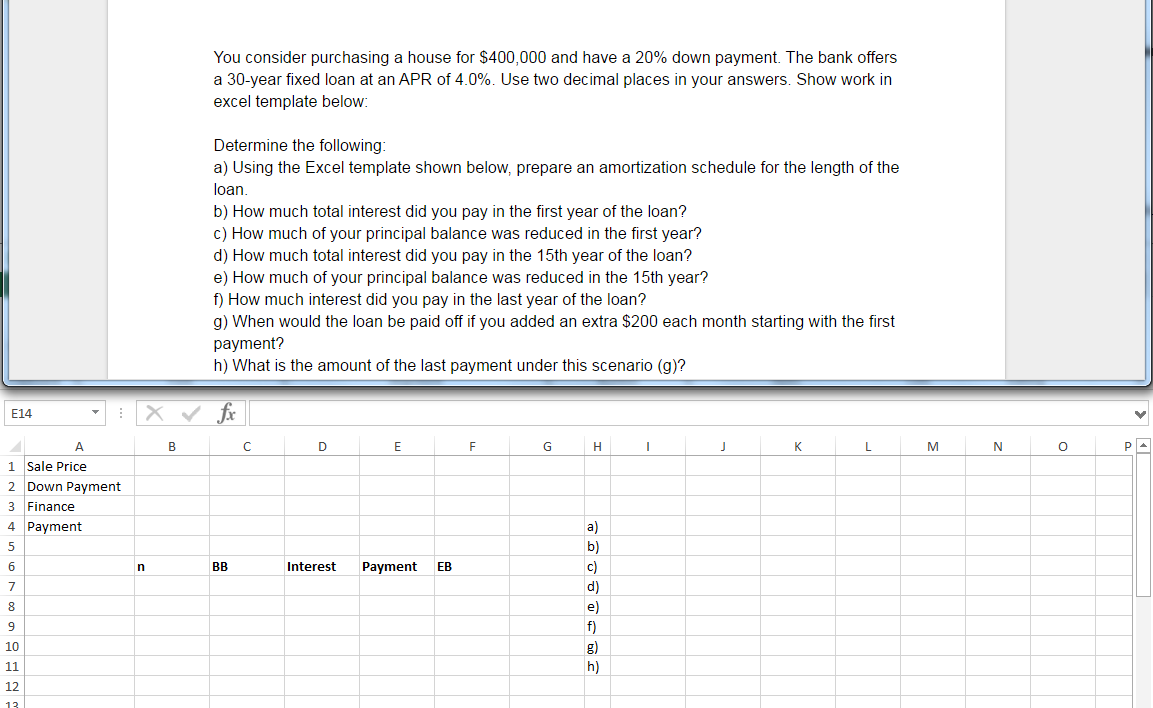

You consider purchasing a house for $400,000 and have a 20% down payment. The bank offers a 30-year fixed loan at an APR of 4.0%. Use two decimal places in your answers. Show work in excel template below: Determine the following: Using the Excel template shown below; prepare an amortization schedule for the length of the loan. How much total interest did you pay in the first year of the loan? How much of your principal balance was reduced in the first year? How much total interest did you pay in the 15th year of the loan? How much of your principal balance was reduced in the 15th year? How much interest did you pay in the last year of the loan? When would the loan be paid off if you added an extra $200 each month starting with the first payment? What is the amount of the last payment under this scenario (g)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts