Question: USING MATLAB write two codes for 2 and 3 thank you! 2. The author of this book now lives in Australia. In 2009, individual citizens

USING MATLAB write two codes for 2 and 3 thank you!

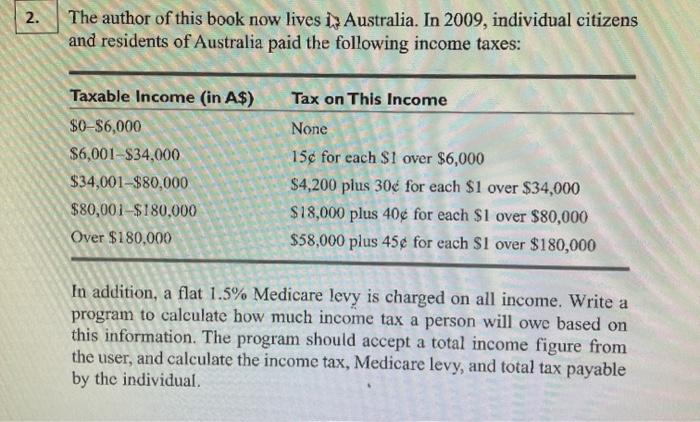

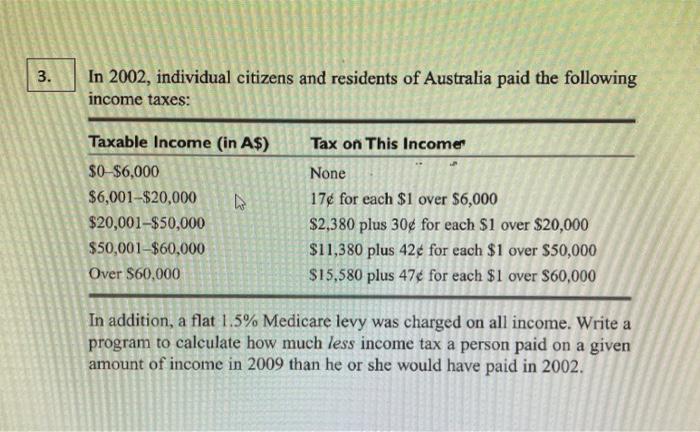

2. The author of this book now lives in Australia. In 2009, individual citizens and residents of Australia paid the following income taxes: Taxable income (in A$) $0-$6,000 $6,001-$34,000 $34,001-$80,000 $80,001 $180,000 Over $180,000 Tax on This Income None 15 for each $1 over $6,000 $4,200 plus 30 for each $1 over $34,000 $18,000 plus 40 for each $1 over $80,000 $58,000 plus 45 for each $1 over $180,000 In addition, a flat 1.5% Medicare levy is charged on all income. Write a program to calculate how much income tax a person will owe based on this information. The program should accept a total income figure from the user, and calculate the income tax, Medicare levy, and total tax payable by the individual. 3. In 2002, individual citizens and residents of Australia paid the following income taxes: Taxable Income (in A$) $0-$6,000 $6,001-$20,000 $20,001-$50,000 $50,001-$60,000 Over $60,000 Tax on This Income None 17 for each $1 over $6,000 $2,380 plus 30 for each $1 over $20,000 $11,380 plus 42 for each $1 over $50,000 $15,580 plus 47 for each $1 over $60,000 In addition, a flat 1.5% Medicare levy was charged on all income. Write a program to calculate how much less income tax a person paid on a given amount of income in 2009 than he or she would have paid in 2002

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts