Question: Using Microsoft Word and Excel, complete the following exercises in Chapter 2, page 40: #2 #3 #4 #5 (Use NPV to compare Dust Devils, Osprey,

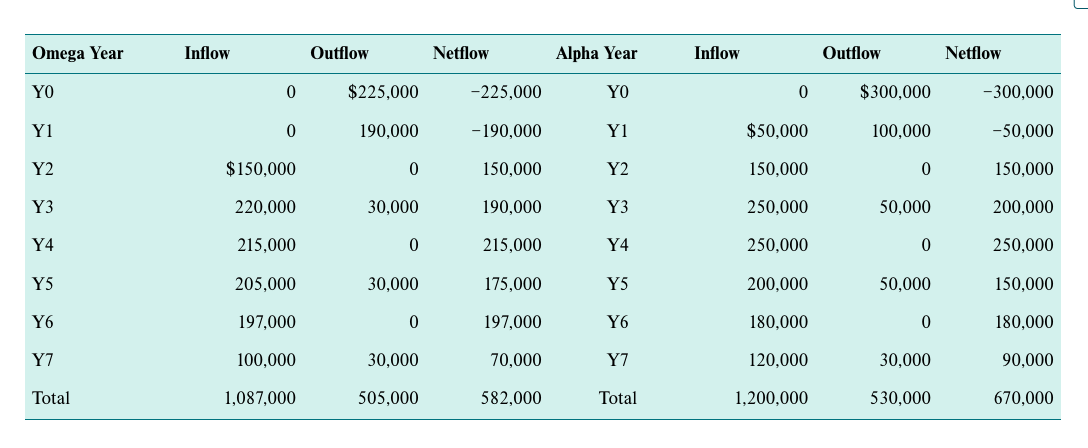

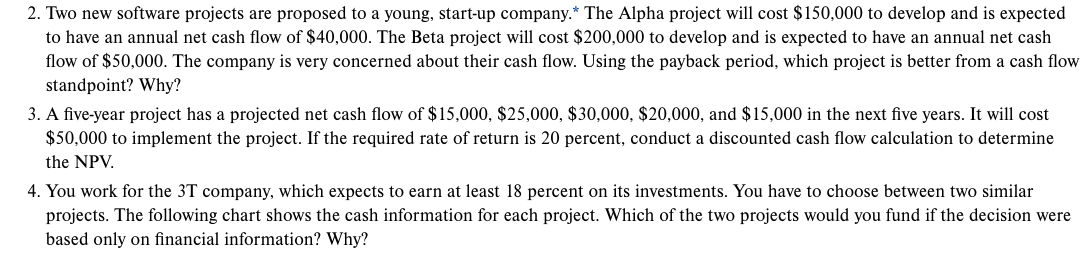

Using Microsoft Word and Excel, complete the following exercises in Chapter 2, page 40: \#2 #3 \#4 \#5 (Use NPV to compare Dust Devils, Osprey, and Voyagers) \#6 (Use NPV to compare Time Fades Away, On the Beach, and Tonight's the Night) Answer the questions in Microsoft Word (clearly state which question you are answering) and use Excel to for computations. Students will turn in both the Excel and Word document. Excel formulas MUST be present in your spreadsheet! Put your name at the top of each document. Review the video which provides directions on calculating Payback and NPV. 2. Two new software projects are proposed to a young, start-up company. The Alpha project will cost $150,000 to develop and is expected to have an annual net cash flow of $40,000. The Beta project will cost $200,000 to develop and is expected to have an annual net cash flow of $50,000. The company is very concerned about their cash flow. Using the payback period, which project is better from a cash flow standpoint? Why? 3. A five-year project has a projected net cash flow of $15,000,$25,000,$30,000,$20,000, and $15,000 in the next five years. It will cost $50,000 to implement the project. If the required rate of return is 20 percent, conduct a discounted cash flow calculation to determine the NPV. 4. You work for the 3T company, which expects to earn at least 18 percent on its investments. You have to choose between two similar projects. The following chart shows the cash information for each project. Which of the two projects would you fund if the decision were based only on financial information? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts