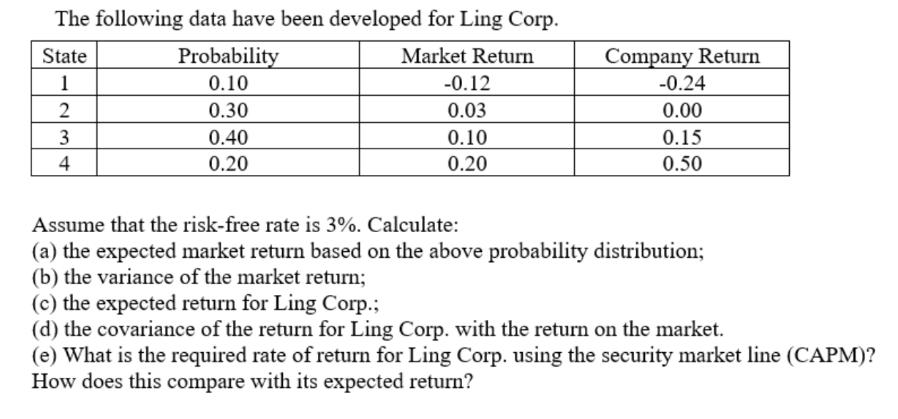

Question: The following data have been developed for Ling Corp. State Market Return 1 2 3 4 Probability 0.10 0.30 0.40 0.20 -0.12 0.03 0.10

The following data have been developed for Ling Corp. State Market Return 1 2 3 4 Probability 0.10 0.30 0.40 0.20 -0.12 0.03 0.10 0.20 Company Return -0.24 0.00 0.15 0.50 Assume that the risk-free rate is 3%. Calculate: (a) the expected market return based on the above probability distribution; (b) the variance of the market return; (c) the expected return for Ling Corp.; (d) the covariance of the return for Ling Corp. with the return on the market. (e) What is the required rate of return for Ling Corp. using the security market line (CAPM)? How does this compare with its expected return?

Step by Step Solution

3.56 Rating (163 Votes )

There are 3 Steps involved in it

To answer your questions lets go step by step a The expected market return can be calculated by multiplying each market return by its respective proba... View full answer

Get step-by-step solutions from verified subject matter experts