Question: Using MS excel calculate the IRR and ERR EXAMPLE 5-13. A piece of new equipment has been proposed by engineers to increase the productivity of

Using MS excel calculate the IRR and ERR

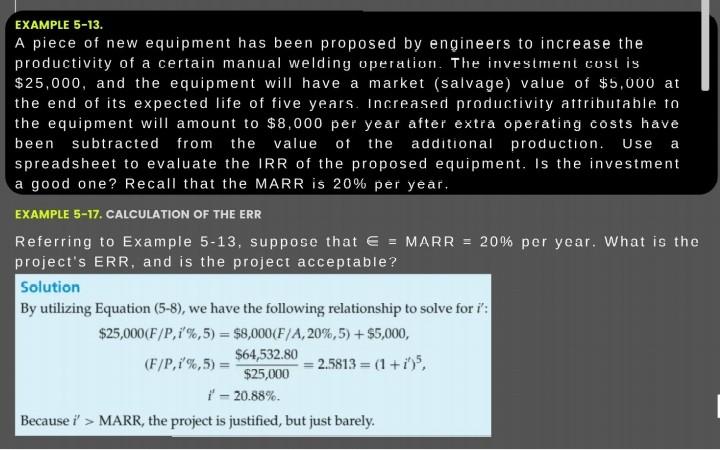

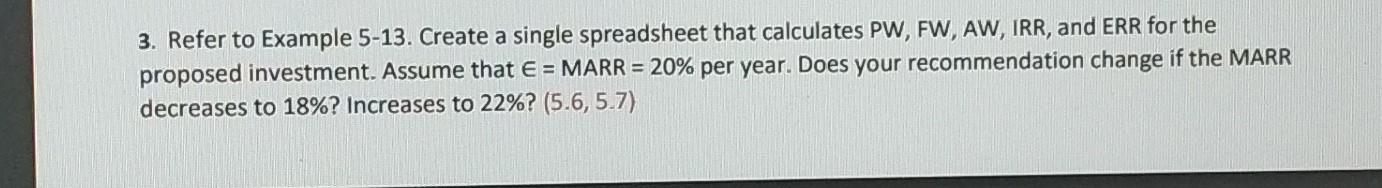

EXAMPLE 5-13. A piece of new equipment has been proposed by engineers to increase the productivity of a certain manual welding operation. The investment cost is $25,000, and the equipment will have a market (salvage) value of $5,000 at the end of its expected life of five years. Increased productivity attributable to the equipment will amount to $8,000 per year after extra operating costs have been subtracted from the value of the additional production. Use a spreadsheet to evaluate the IRR of the proposed equipment. Is the investment a good one? Recall that the MARR is 20% per year. EXAMPLE 5-17. CALCULATION OF THE ERR Referring to Example 5-13, suppose that = MARR = 20% per year. What is the project's ERR, and is the project acceptable? Solution By utilizing Equation (5-8), we have the following relationship to solve for i': $25,000(F/P,1%,5) = $8,000(F/A, 20%,5) + $5,000, $64,532.80 (F/P.i'%,5) = = 2.5813 = (1 + i), $25,000 1'- 20.88% Because i' > MARR, the project is justified, but just barely. 3. Refer to Example 5-13. Create a single spreadsheet that calculates PW, FW, AW, IRR, and ERR for the proposed investment. Assume that E = MARR = 20% per year. Does your recommendation change if the MARR decreases to 18%? Increases to 22%? (5.6,5.7)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts