Question: Using Net Asset Value (NAV) and other relevant data, you investigate the performance of three fund manager s: M, P, and S. You utilize the

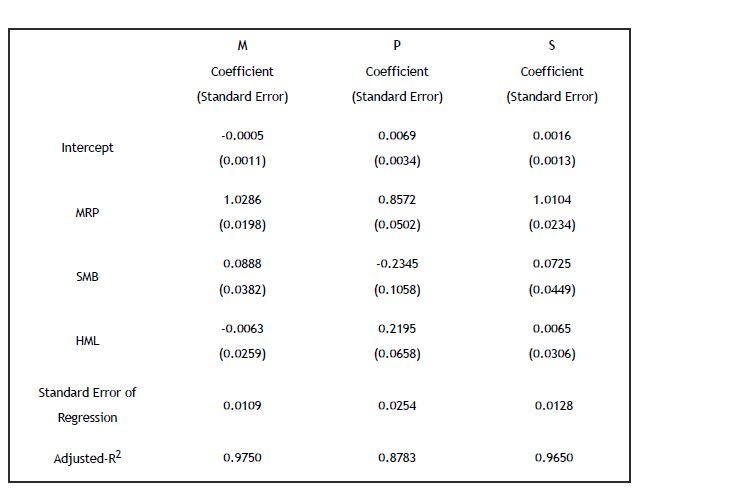

Using Net Asset Value (NAV) and other relevant data, you investigate the performance of three fund manager s: M, P, and S. You utilize the Fama-French 3 Factor model for all fund managers: rpt-rft = p + 1pMRPt + 2pSMBt + 3pHMLt + pt Where rpt = portfolio return at month-t MRP = rmt-rft SMB = Small minus Big HML = High minus Low rft = riskless return at month-t rmt = market return at month-t pt = regression residuals which are expected to be white noise The regression results are presented in Table 1. Tabel 1. Regression results of M, P, and S Funds based on Fama-French Three Factor Model Funds (all necessar y auto regressive terms are already applied but not reported). Note: MRP = rmt-rft; SMB=Small minus Big; HM L=High minus Low M

Which fund(s) generate significant abnormal return (more than the expected return based on FF3F Model)? Hint: you must calculate the t-statistics.

Which fund performs the worst?

What is the information ratio of Fund S?

Coefficient Coefficient (Standard Error) Coefficient (Standard Error) (Standard Error) 0.0069 0.0016 Intercept -0.0005 (0.0011) (0.0034) (0.0013) 1.0104 MRP 1.0286 (0.0198) 0.8572 (0.0502) (0.0234) 0.0888 -0.2345 0.0725 SMB (0.0382) (0.1058) (0.0449) -0.0063 0.0065 HML 0.2195 (0.0658) (0.0259) (0.0306) Standard Error of Regression 0.0109 0.0254 0.0128 Adjusted-R2 0.9750 0.8783 0.9650 Coefficient Coefficient (Standard Error) Coefficient (Standard Error) (Standard Error) 0.0069 0.0016 Intercept -0.0005 (0.0011) (0.0034) (0.0013) 1.0104 MRP 1.0286 (0.0198) 0.8572 (0.0502) (0.0234) 0.0888 -0.2345 0.0725 SMB (0.0382) (0.1058) (0.0449) -0.0063 0.0065 HML 0.2195 (0.0658) (0.0259) (0.0306) Standard Error of Regression 0.0109 0.0254 0.0128 Adjusted-R2 0.9750 0.8783 0.9650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts