Question: Using Net Asset Value (NAV) and other relevant data, you investigate the performance of three fund managers: M, P, and S. You utilize the following

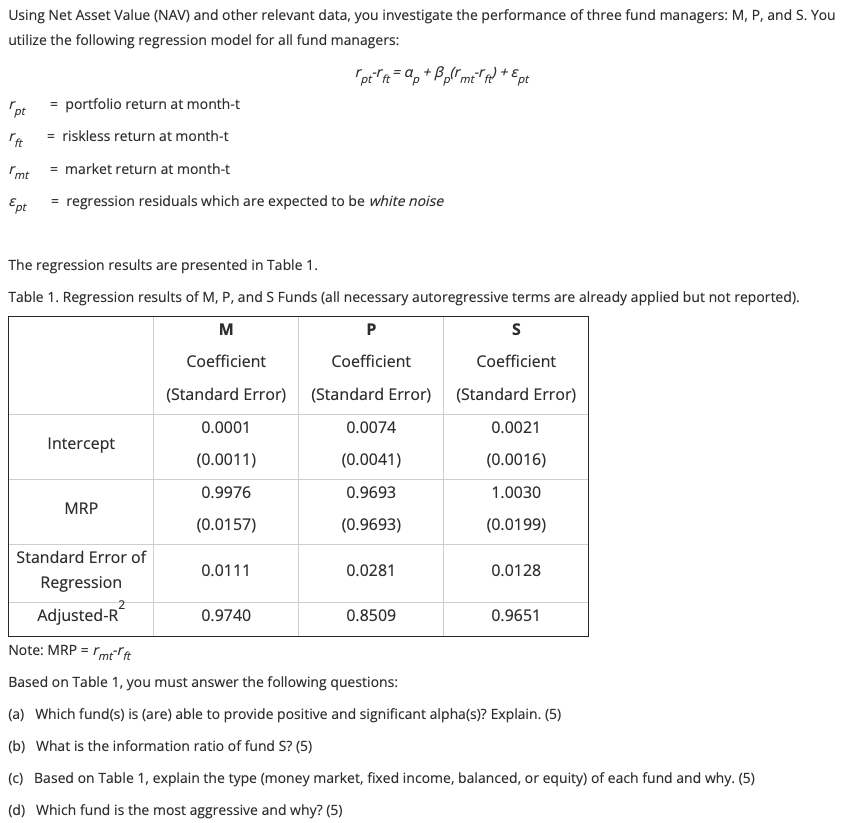

Using Net Asset Value (NAV) and other relevant data, you investigate the performance of three fund managers: M, P, and S. You utilize the following regression model for all fund managers: "pt" ft=ap+p(mtf) + Ept pt = portfolio return at month-t rft riskless return at month-t "mt = market return at month-t = Ept regression residuals which are expected to be white noise The regression results are presented in Table 1. Table 1. Regression results of M, P, and S Funds (all necessary autoregressive terms are already applied but not reported). M P S Coefficient Coefficient Coefficient (Standard Error) (Standard Error) (Standard Error) 0.0001 0.0074 0.0021 Intercept (0.0011) (0.0041) (0.0016) 0.9976 0.9693 1.0030 MRP (0.0157) (0.9693) (0.0199) Standard Error of 0.0111 0.0281 0.0128 Regression Adjusted-R 0.9740 0.8509 0.9651 Note: MRP = mt ft Based on Table 1, you must answer the following questions: (a) Which fund(s) is (are) able to provide positive and significant alpha(s)? Explain. (5) (b) What is the information ratio of fund S? (5) (c) Based on Table 1, explain the type (money market, fixed income, balanced, or equity) of each fund and why. (5) (d) Which fund is the most aggressive and why? (5) Using Net Asset Value (NAV) and other relevant data, you investigate the performance of three fund managers: M, P, and S. You utilize the following regression model for all fund managers: "pt" ft=ap+p(mtf) + Ept pt = portfolio return at month-t rft riskless return at month-t "mt = market return at month-t = Ept regression residuals which are expected to be white noise The regression results are presented in Table 1. Table 1. Regression results of M, P, and S Funds (all necessary autoregressive terms are already applied but not reported). M P S Coefficient Coefficient Coefficient (Standard Error) (Standard Error) (Standard Error) 0.0001 0.0074 0.0021 Intercept (0.0011) (0.0041) (0.0016) 0.9976 0.9693 1.0030 MRP (0.0157) (0.9693) (0.0199) Standard Error of 0.0111 0.0281 0.0128 Regression Adjusted-R 0.9740 0.8509 0.9651 Note: MRP = mt ft Based on Table 1, you must answer the following questions: (a) Which fund(s) is (are) able to provide positive and significant alpha(s)? Explain. (5) (b) What is the information ratio of fund S? (5) (c) Based on Table 1, explain the type (money market, fixed income, balanced, or equity) of each fund and why. (5) (d) Which fund is the most aggressive and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts