Question: Using Percentage-of-Completion and Completed Contract Methods Halsey Building Company signed a contract to build an office building for $50,000,000. The scheduled construction costs follow. Year

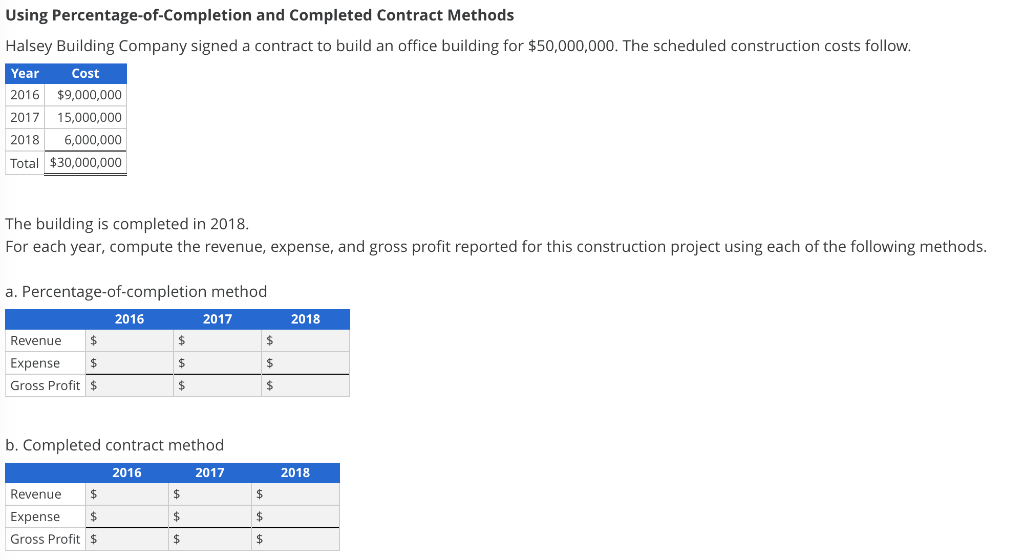

Using Percentage-of-Completion and Completed Contract Methods Halsey Building Company signed a contract to build an office building for $50,000,000. The scheduled construction costs follow. Year Cost 2016 $9,000,000 2017 15,000,000 2018 6,000,000 Total $30,000,000 The building is completed in 2018. For each year, compute the revenue, expense, and gross profit reported for this construction project using each of the following methods. a. Percentage-of-completion method 2016 2017 2018 %2 $ Revenue $ Expense $ Gross Profit $ $ $ $ $ b. Completed contract method 2016 2017 2018 $ Revenue $ Expense $ Gross Profit $ $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts