Question: Using Percentage-of-Completion and Completed Contract Methods Halsey Building Company signed a contract to build an office building for $50,000,000. The scheduled construction costs follow. Year

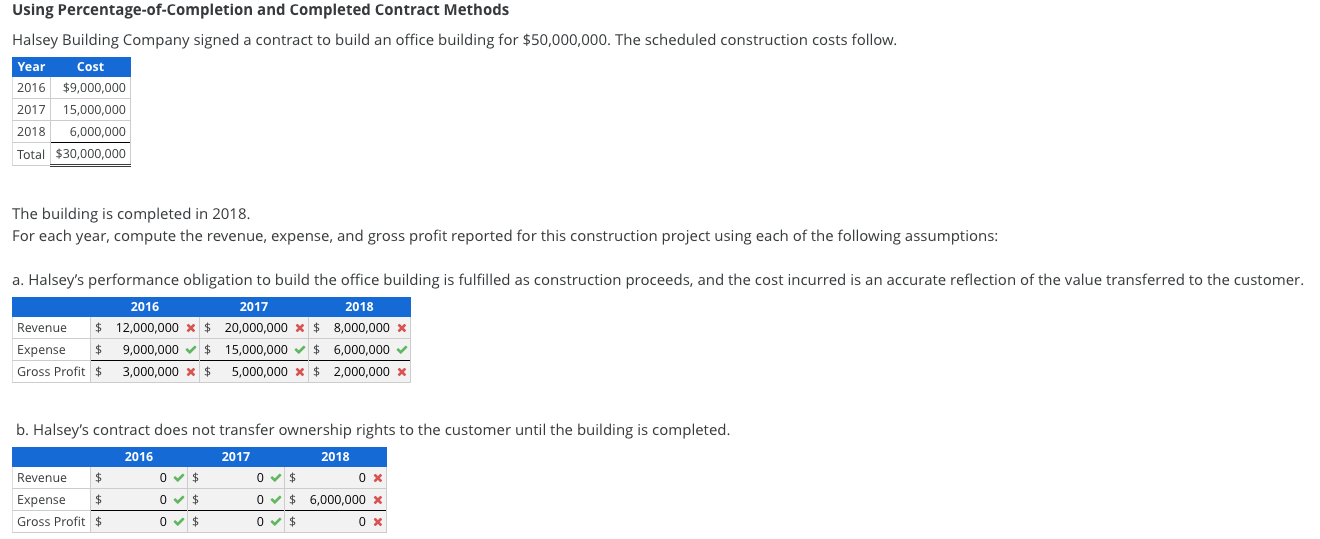

Using Percentage-of-Completion and Completed Contract Methods Halsey Building Company signed a contract to build an office building for $50,000,000. The scheduled construction costs follow. Year Cost 2016 $9,000,000 2017 15,000,000 2018 6,000,000 Total $30,000,000 The building is completed in 2018. For each year, compute the revenue, expense, and gross profit reported for this construction project using each of the following assumptions: a. Halsey's performance obligation to build the office building is fulfilled as construction proceeds, and the cost incurred is an accurate reflection of the value transferred to the customer. 2016 2017 2018 Revenue $ 12,000,000 x $ 20,000,000 x $ 8,000,000 X Expense 9,000,000 $ 15,000,000 $ 6,000,000 Gross Profit $ 3,000,000 x $ 5,000,000 x $ 2,000,000 X ta 2018 b. Halsey's contract does not transfer ownership rights to the customer until the building is completed. 2016 2017 Revenue 0$ 0$ 0 x Expense 0$ 0$ 6,000,000 x Gross Profit $ 0$ 0 $ 0 X $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts