Question: using python : use python to code: Question 2 The hedge fund company adopts Valne al Risk (Par) approach to have a better visibility on

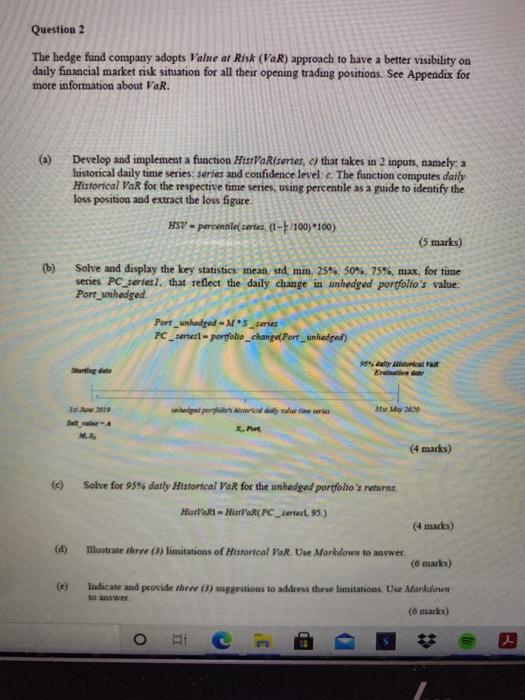

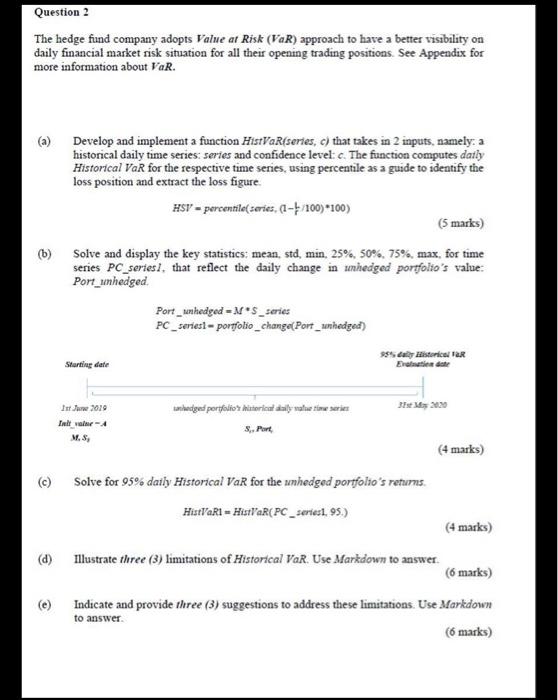

Question 2 The hedge fund company adopts Valne al Risk (Par) approach to have a better visibility on daily financial market risk situation for all their opening trading positions. See Appendix for more information about VaR. (a) Develop and implement a function HistVaR series, c) that takes in 2 inputs, namely a historical daily time series series and confidence level e. The function computes datly Historical VaR for the respective time series, using percentile as a guide to identify the loss position and extract the loss figure. HSY - percennie serdes. (1-100)*100) (5 marks) (6) Solve and display the key statistics mean, std, min, 25% 50% 75%, max. for time series PC_series), that reflect the daily change in unhedged portfolio's value: Port_unhedged. Port_unlodged - M*5_series PC_sertedl - portfolio_changal Port_nnhedged) dalya Stortinget I 2010 urgapurai M20, (4 marks) Solve for 95% datly Historical VaR for the unhedged portfolio's returns. Hiutat MataR(FC_, 95.) (4 marks) (d) Tllustrate three (3) limitations of Historical VaR Use Markdown to answer (6 marks) c toWE Indicate and provide three (3) suggestions to address these limitations. Use Markdown (6 marks) o Question 2 The hedge fund company adopts Value at Risk (VaR) approach to have a better visibility on daily financial market risk situation for all their opening trading positions. See Appendix for more information about VaR. (a) Develop and implement a function HistVaR series, c) that takes in 2 inputs, namely, a historical daily time series: series and confidence level: c. The function computes datly Historical VaR for the respective time series, using percentile as a guide to identify the loss position and extract the loss figure. HSV - percentile series, (1-1/100)*100) (5 marks) (b) Solve and display the key statistics: mean, std, min. 25%, 50%, 75%, max, for time series PC_series, that reflect the daily change in medged portfolio's value: Port_unhedged Port_nhedged - M*$_series PC _seriest - portfolio_changel Port_unhedged) istorical TaR Starting der tanhedged portfolio? historical Sally alte time series Frame 2010 Intr- M.S, 5. Part (4 marks) (c) Solve for 95% daily Historical VaR for the unhedged portfolio's returns HistVaRI = HistVaR( PC _seriesi, 95) (4 marks) (d) Illustrate three (3) limitations of Historical VAR. Use Markdown to answer. (6 marks) Indicate and provide three (3) suggestions to address these limitations. Use Markdown to answer. (6 marks) Question 2 The hedge fund company adopts Valne al Risk (Par) approach to have a better visibility on daily financial market risk situation for all their opening trading positions. See Appendix for more information about VaR. (a) Develop and implement a function HistVaR series, c) that takes in 2 inputs, namely a historical daily time series series and confidence level e. The function computes datly Historical VaR for the respective time series, using percentile as a guide to identify the loss position and extract the loss figure. HSY - percennie serdes. (1-100)*100) (5 marks) (6) Solve and display the key statistics mean, std, min, 25% 50% 75%, max. for time series PC_series), that reflect the daily change in unhedged portfolio's value: Port_unhedged. Port_unlodged - M*5_series PC_sertedl - portfolio_changal Port_nnhedged) dalya Stortinget I 2010 urgapurai M20, (4 marks) Solve for 95% datly Historical VaR for the unhedged portfolio's returns. Hiutat MataR(FC_, 95.) (4 marks) (d) Tllustrate three (3) limitations of Historical VaR Use Markdown to answer (6 marks) c toWE Indicate and provide three (3) suggestions to address these limitations. Use Markdown (6 marks) o Question 2 The hedge fund company adopts Value at Risk (VaR) approach to have a better visibility on daily financial market risk situation for all their opening trading positions. See Appendix for more information about VaR. (a) Develop and implement a function HistVaR series, c) that takes in 2 inputs, namely, a historical daily time series: series and confidence level: c. The function computes datly Historical VaR for the respective time series, using percentile as a guide to identify the loss position and extract the loss figure. HSV - percentile series, (1-1/100)*100) (5 marks) (b) Solve and display the key statistics: mean, std, min. 25%, 50%, 75%, max, for time series PC_series, that reflect the daily change in medged portfolio's value: Port_unhedged Port_nhedged - M*$_series PC _seriest - portfolio_changel Port_unhedged) istorical TaR Starting der tanhedged portfolio? historical Sally alte time series Frame 2010 Intr- M.S, 5. Part (4 marks) (c) Solve for 95% daily Historical VaR for the unhedged portfolio's returns HistVaRI = HistVaR( PC _seriesi, 95) (4 marks) (d) Illustrate three (3) limitations of Historical VAR. Use Markdown to answer. (6 marks) Indicate and provide three (3) suggestions to address these limitations. Use Markdown to answer. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts