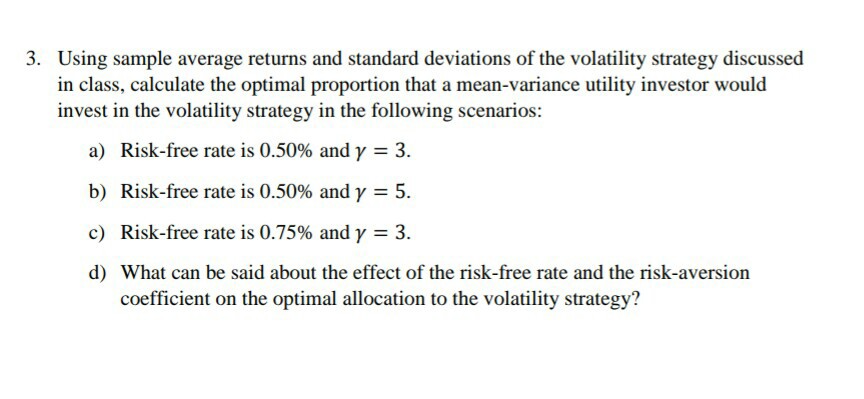

Question: Using sample average returns and standard deviations of the volatility strategy discussed in class, calculate the optimal proportion that a mean-variance utility investor would invest

Using sample average returns and standard deviations of the volatility strategy discussed in class, calculate the optimal proportion that a mean-variance utility investor would invest in the volatility strategy in the following scenarios: 3. a) Risk-free rate is 0.50% and = 3. b) Risk-free rate is 0.50% and = 5. c) Risk-free rate is 0.75% and = 3. d) What can be said about the effect of the risk-free rate and the risk-aversion coefficient on the optimal allocation to the volatility strategy? Using sample average returns and standard deviations of the volatility strategy discussed in class, calculate the optimal proportion that a mean-variance utility investor would invest in the volatility strategy in the following scenarios: 3. a) Risk-free rate is 0.50% and = 3. b) Risk-free rate is 0.50% and = 5. c) Risk-free rate is 0.75% and = 3. d) What can be said about the effect of the risk-free rate and the risk-aversion coefficient on the optimal allocation to the volatility strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts