Question: Using Solver or Goal Seek, find two envelope portfolios that would yield a standard deviation of 7%. What would be the corresponding expected returns for

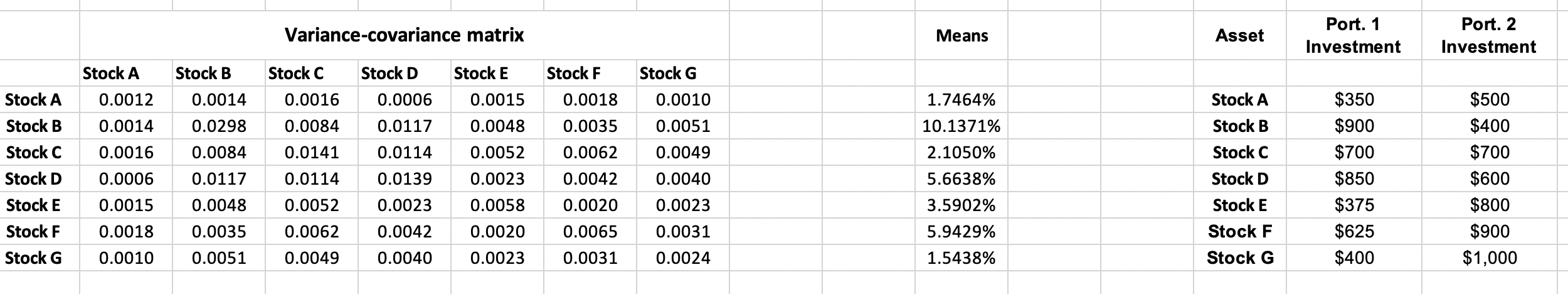

Using Solver or Goal Seek, find two envelope portfolios that would yield a standard deviation of 7%. What would be the corresponding expected returns for each of these portfolios? Variance-covariance matrix Means Asset Port. 1 Investment Port. 2 Investment Stock B Stock C Stock D Stock E Stock F Stock G Stock A 0.0012 Stock A 0.0014 0.0016 0.0006 0.0015 0.0018 0.0010 Stock A 0.0298 0.0084 0.0117 0.0048 0.0035 0.0051 0.0014 0.0016 0.0006 0.0084 0.0141 0.0062 0.0114 0.0139 0.0052 0.0023 0.0049 0.0040 0.0117 0.0114 0.0042 Stock B Stock C Stock D Stock E Stock F Stock G 1.7464% 10.1371% 2.1050% 5.6638% 3.5902% 5.9429% 1.5438% Stock B Stock C Stock D Stock E Stock F Stock G $350 $900 $700 $850 $375 $625 $400 $500 $400 $700 $600 $800 $900 $1,000 0.0048 0.0052 0.0023 0.0058 0.0020 0.0023 0.0015 0.0018 0.0010 0.0035 0.0062 0.0020 0.0042 0.0040 0.0065 0.0031 0.0031 0.0024 0.0051 0.0049 0.0023 Using Solver or Goal Seek, find two envelope portfolios that would yield a standard deviation of 7%. What would be the corresponding expected returns for each of these portfolios? Variance-covariance matrix Means Asset Port. 1 Investment Port. 2 Investment Stock B Stock C Stock D Stock E Stock F Stock G Stock A 0.0012 Stock A 0.0014 0.0016 0.0006 0.0015 0.0018 0.0010 Stock A 0.0298 0.0084 0.0117 0.0048 0.0035 0.0051 0.0014 0.0016 0.0006 0.0084 0.0141 0.0062 0.0114 0.0139 0.0052 0.0023 0.0049 0.0040 0.0117 0.0114 0.0042 Stock B Stock C Stock D Stock E Stock F Stock G 1.7464% 10.1371% 2.1050% 5.6638% 3.5902% 5.9429% 1.5438% Stock B Stock C Stock D Stock E Stock F Stock G $350 $900 $700 $850 $375 $625 $400 $500 $400 $700 $600 $800 $900 $1,000 0.0048 0.0052 0.0023 0.0058 0.0020 0.0023 0.0015 0.0018 0.0010 0.0035 0.0062 0.0020 0.0042 0.0040 0.0065 0.0031 0.0031 0.0024 0.0051 0.0049 0.0023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts