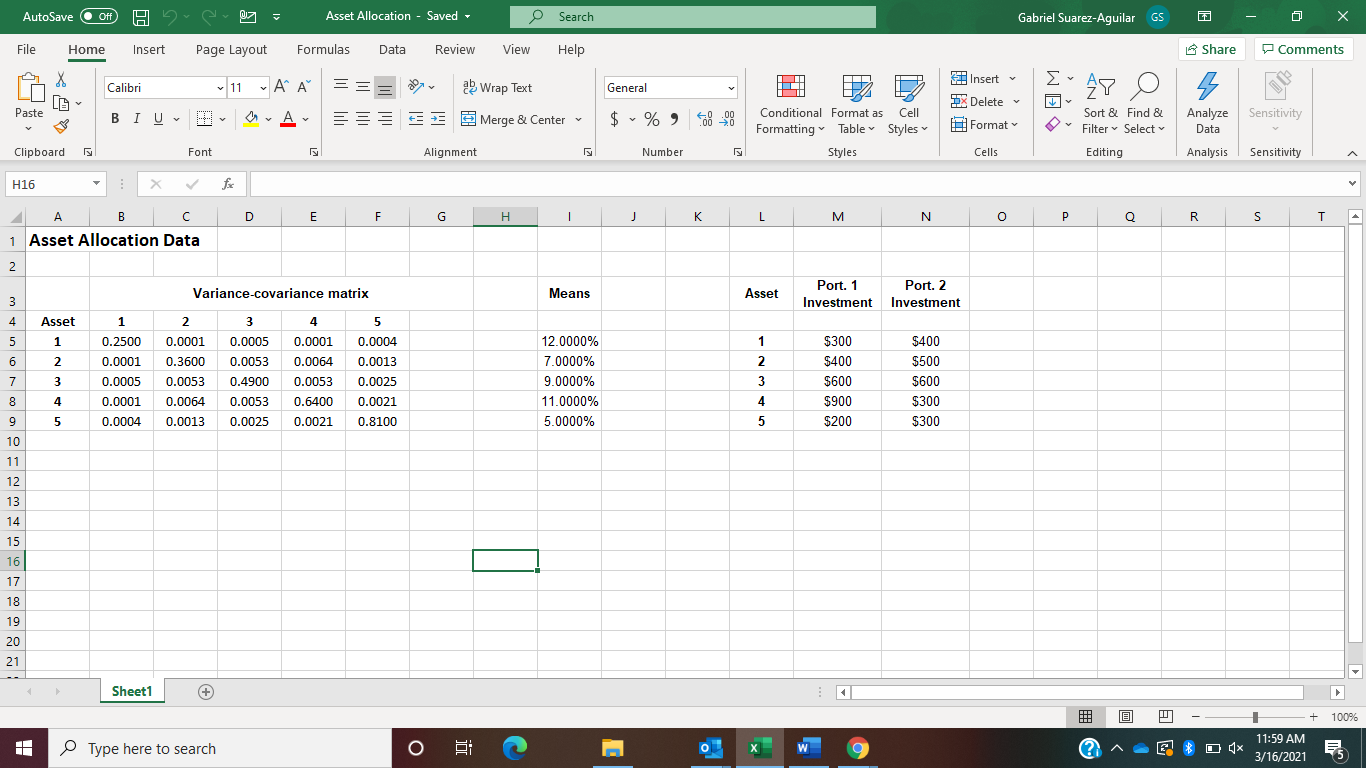

Question: Using the following screenshot, determine the following: a. Create a one-way data table that determines the different means and standard deviations for combinations of Portfolio

Using the following screenshot, determine the following: a. Create a one-way data table that determines the different means and standard deviations for combinations of Portfolio 1 and Portfolio 2 by varying the proportion of Portfolio 1

. b. Graph the combinations of the portfolios from the one-way data table and add the individual asset means and standard deviations to the graph.

c. Could the portfolio combinations be on the efficient frontier? Why or why not?

d. Using Solver or Goal Seek, find an envelope portfolio that would yield an expected return of 9%. What would be the corresponding portfolio standard deviation?

e. Using Solver or Goal Seek, find two envelope portfolios that would yield a standard deviation of 50%. What would be the corresponding expected returns for each of these portfolios?

f. Using Solver, find the envelope portfolio that would yield the smallest (minimum) standard deviation. What would be the corresponding expected return for this portfolio?

AutoSave Off Have Asset Allocation - Saved - O Search Gabriel Suarez-Aguilar GS File Home Insert Page Layout Formulas Data Review View Help Share Comments Insert Calibri 11 A A == ab Wrap Text General AY O s Analyze Sensitivity Data Paste BIU A y 2X Delete Format Es Merge & Center y $ %, 809 Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Editing Clipboard Font Alignment Number Cells Analysis Sensitivity H16 X D E F J K L M N O P Q R S T A B 1 Asset Allocation Data 2 Variance-covariance matrix Means Asset Port. 1 Investment Port. 2 Investment 3 4 Asset 5 1 2 3 1 2 6 1 0.2500 0.0001 0.0005 0.0001 0.0004 3 0.0005 0.0053 0.4900 2 0.0001 0.3600 0.0053 0.0064 0.0013 4 0.0001 0.0064 0.0053 0.6400 0.0021 5 0.0004 0.0013 0.0025 0.0021 0.8100 7 12.0000% 7.0000% 9.0000% 11.0000% 5.0000% $300 $400 $600 $900 $200 $400 $500 $600 $300 $300 4 3 4 5 8 9 0.0053 0.0025 5 10 11 12 13 14 15 16 17 18 19 20 21 Sheet1 + + 100% Type here to search o > E W D 4x 11:59 AM 3/16/2021 AutoSave Off Have Asset Allocation - Saved - O Search Gabriel Suarez-Aguilar GS File Home Insert Page Layout Formulas Data Review View Help Share Comments Insert Calibri 11 A A == ab Wrap Text General AY O s Analyze Sensitivity Data Paste BIU A y 2X Delete Format Es Merge & Center y $ %, 809 Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Editing Clipboard Font Alignment Number Cells Analysis Sensitivity H16 X D E F J K L M N O P Q R S T A B 1 Asset Allocation Data 2 Variance-covariance matrix Means Asset Port. 1 Investment Port. 2 Investment 3 4 Asset 5 1 2 3 1 2 6 1 0.2500 0.0001 0.0005 0.0001 0.0004 3 0.0005 0.0053 0.4900 2 0.0001 0.3600 0.0053 0.0064 0.0013 4 0.0001 0.0064 0.0053 0.6400 0.0021 5 0.0004 0.0013 0.0025 0.0021 0.8100 7 12.0000% 7.0000% 9.0000% 11.0000% 5.0000% $300 $400 $600 $900 $200 $400 $500 $600 $300 $300 4 3 4 5 8 9 0.0053 0.0025 5 10 11 12 13 14 15 16 17 18 19 20 21 Sheet1 + + 100% Type here to search o > E W D 4x 11:59 AM 3/16/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts