Question: Using Table 11-1 on page 306, what specific constraints on corporate entrepreneurship would you identify for Apple? What other potential limitations on corporate innovation could

- Using Table 11-1 on page 306, what specific constraints on corporate entrepreneurship would you identify for Apple?

- What other potential limitations on corporate innovation could Apple experience? Why?

- Discuss the ethical dilemma of rogue middle managers as it could apply to Apple.

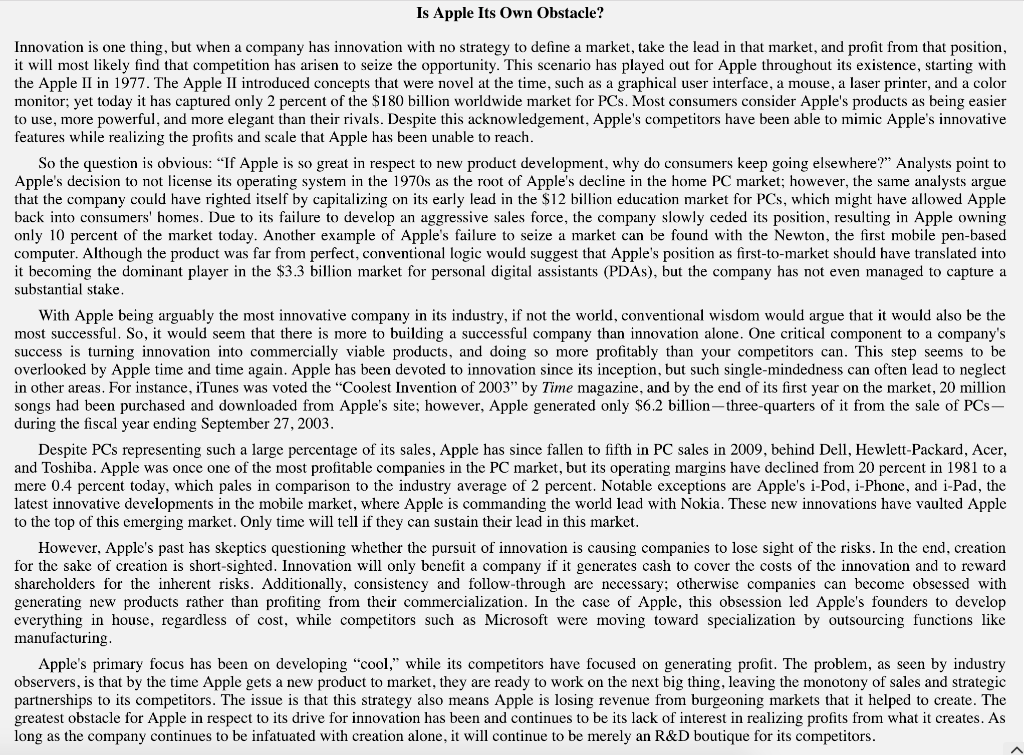

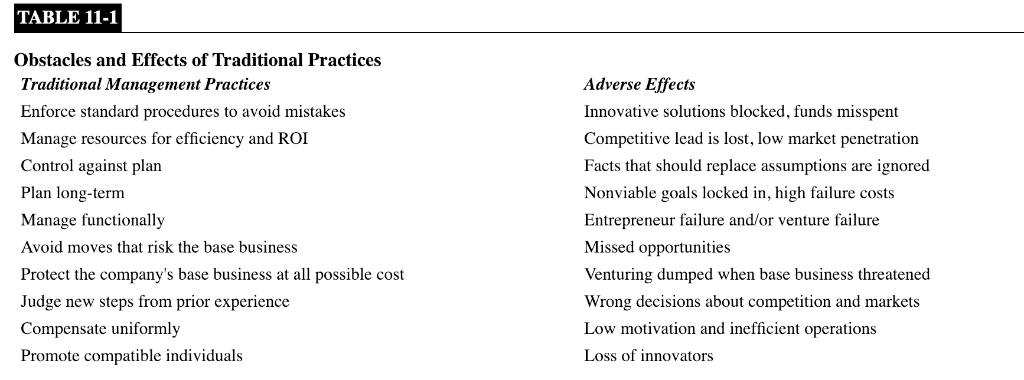

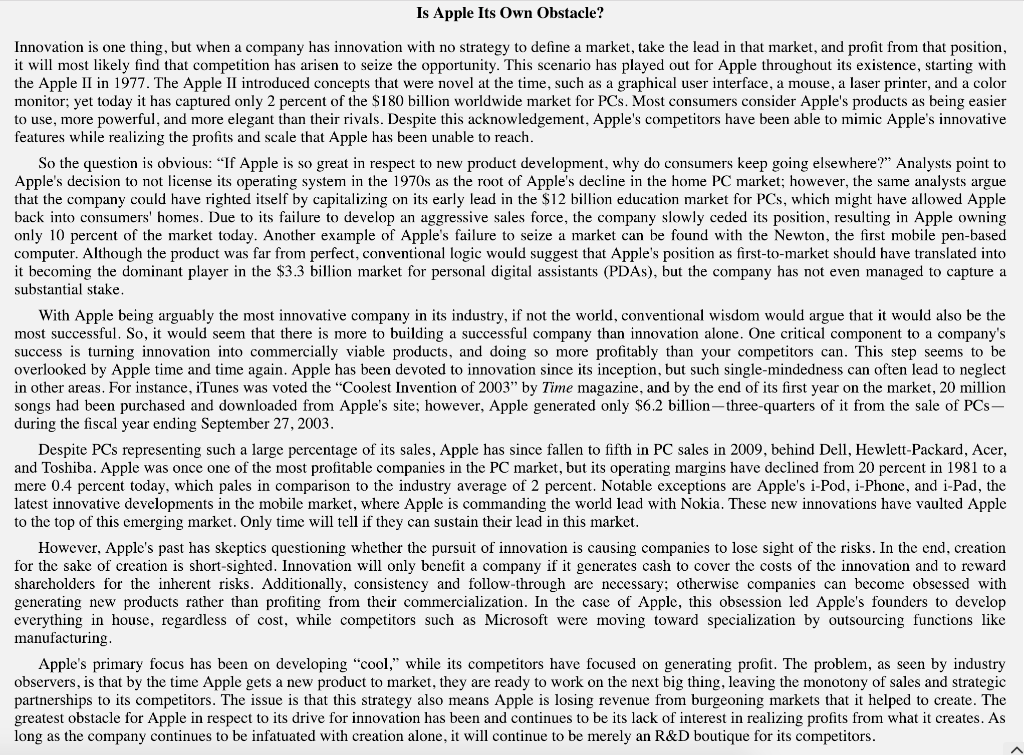

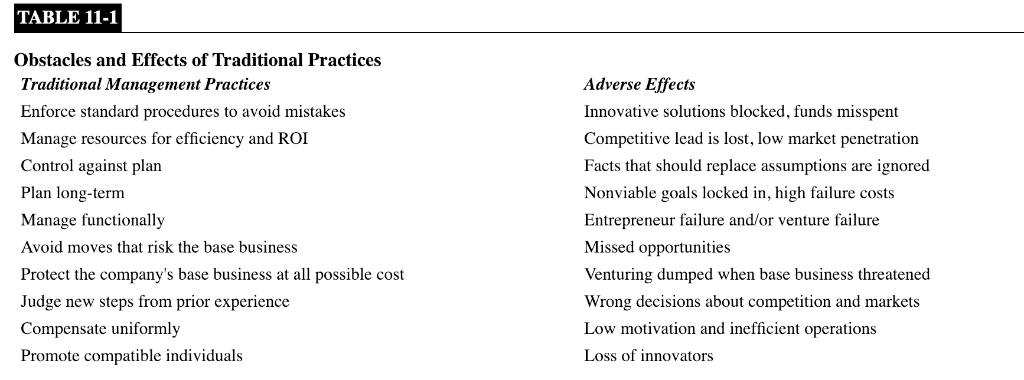

Is Apple Its Own Obstacle? Innovation is one thing, but when a company has innovation with no strategy to define a market, take the lead in that market, and profit from that position, it will most likely find that competition has arisen to seize the opportunity. This scenario has played out for Apple throughout its existence, starting with the Apple II in 1977. The Apple II introduced concepts that were novel at the time, such as a graphical user interface, a mouse, a laser printer, and a color monitor; yet today it has captured only 2 percent of the $180 billion worldwide market for PCs. Most consumers consider Apple's products as being easier to use, more powerful, and more elegant than their rivals. Despite this acknowledgement, Apple's competitors have been able to mimic Apple's innovative features while realizing the profits and scale that Apple has been unable to reach. So the question is obvious: If Apple is so great in respect to new product development, why do consumers keep going elsewhere?" Analysts point to Apple's decision to not license its operating system in the 1970s as the root of Apple's decline in the home PC market; however, the same analysts argue that the company could have righted itself by capitalizing on its early lead in the $12 billion education market for PCs, which might have allowed Apple back into consumers' homes. Due to its failure to develop an aggressive sales force, the company slowly ceded its position, resulting in Apple owning only 10 percent of the market today. Another example of Apple's failure to seize a market can be found with the Newton, the first mobile pen-based computer. Although the product was far from perfect, conventional logic would suggest that Apple's position as first-to-market should have translated into it becoming the dominant player in the $3.3 billion market for personal digital assistants (PDAs), but the company has not even managed to capture a substantial stake. With Apple being arguably the most innovative company in its industry, if not the world, conventional wisdom would argue that it would also be the most successful. So, it would seem that there is more to building a successful company than innovation alone. One critical component to a company's success is turning innovation into commercially viable products, and doing so more profitably than your competitors can. This step seems to be overlooked by Apple time and time again. Apple has been devoted to innovation since its inception, but such single-mindedness can often lead to neglect in other areas. For instance, iTunes was voted the "Coolest Invention of 2003" by Time magazine, and by the end of its first year on the market, 20 million songs had been purchased and downloaded from Apple's site; however, Apple generated only $6.2 billion-three-quarters of it from the sale of PCs- during the fiscal year ending September 27, 2003. Despite PCs representing such a large percentage of its sales, Apple has since fallen to fifth in PC sales in 2009, behind Dell, Hewlett-Packard, Acer, and Toshiba. Apple was once one of the most profitable companies in the PC market, but its operating margins have declined from 20 percent in 1981 to a mere 0.4 percent today, which pales in comparison to the industry average of 2 percent. Notable exceptions are Apple's i-Pod, i-Phone, and i-Pad, the latest innovative developments in the mobile market, where Apple is commanding the world lead with Nokia. These new innovations have vaulted Apple to the top of this emerging market. Only time will tell if they can sustain their lead in this market. However, Apple's past has skeptics questioning whether the pursuit of innovation is causing companies to lose sight of the risks. In the end, creation for the sake of creation is short-sighted. Innovation will only benefit a company if it generates cash to cover the costs of the innovation and to reward shareholders for the inherent risks. Additionally, consistency and follow-through are necessary; otherwise companies can become obsessed with generating new products rather than profiting from their commercialization. In the case of Apple, this obsession led Apple's founders to develop everything in house, regardless of cost, while competitors such as Microsoft were moving toward specialization by outsourcing functions like manufacturing Apple's primary focus has been on developing "cool," while its competitors have focused on generating profit. The problem, as seen by industry observers, is that by the time Apple gets a new product to market, they are ready to work on the next big thing, leaving the monotony of sales and strategic partnerships to its competitors. The issue is that this strategy also means Apple is losing revenue from burgeoning markets that it helped to create. The greatest obstacle for Apple in respect to its drive for innovation has been and continues to be its lack of interest in realizing profits from what it creates. As long as the company continues to be infatuated with creation alone, it will continue to be merely an R&D boutique for its competitors. TABLE 11-1 Obstacles and Effects of Traditional Practices Traditional Management Practices Enforce standard procedures to avoid mistakes Manage resources for efficiency and ROI Control against plan Plan long-term Manage functionally Avoid moves that risk the base business Protect the company's base business at all possible cost Judge new steps from prior experience Compensate uniformly Promote compatible individuals Adverse Effects Innovative solutions blocked, funds misspent Competitive lead is lost, low market penetration Facts that should replace assumptions are ignored Nonviable goals locked in, high failure costs Entrepreneur failure and/or venture failure Missed opportunities Venturing dumped when base business threatened Wrong decisions about competition and markets Low motivation and inefficient operations Loss of innovators