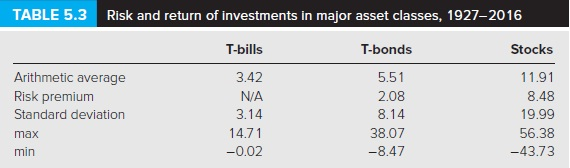

Question: Using Table 5.3 as your guide. In this table, Stocks refer to the stock market portfolio. Assume that the current risk-free interest rate is 3%.

Using Table 5.3 as your guide. In this table, Stocks refer to the stock market portfolio.

Assume that the current risk-free interest rate is 3%. (All returns in this problem are in annual term.)

Estimate the expected market return using the historical stock risk premium in the table.

Hints:

Assume that market risk premium is constant over time, therefore you can use the historical risk premium as an estimate of the future risk premium.

Use the definition (formula) of risk premium.

(Round your answer to 2 decimal places.)

Expected market return as a %?

TABLE 5.3 Risk and return of investments in major asset classes, 1927-2016 T-bills T-bonds Stocks Arithmetic average 3.42 5.51 11.91 Risk premium N/A 2.08 8.48 Standard deviation 3.14 8.14 19.99 14.71 38.07 56.38 min -0.02 -8.47 -43.73 max

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts