Question: Using the 1 2 / 3 1 / 2 0 2 3 reports, ( annual report ) A . Calculate the WACC for Wabash National

Using the reports, annual report A Calculate the WACC for Wabash National Corporation. AS a reminder, you will need to calculate CAPM to find the expected return on equity for Wabash. In your answer, highlight what you used for each component part of the WACC and CAPM calculations. For components that you need to lookup versus calculating add a cell that cites where you got the information for example, the risk free rate Free hint: you will need to calculate the beta of WNC stock against the S&P This data is also available online.

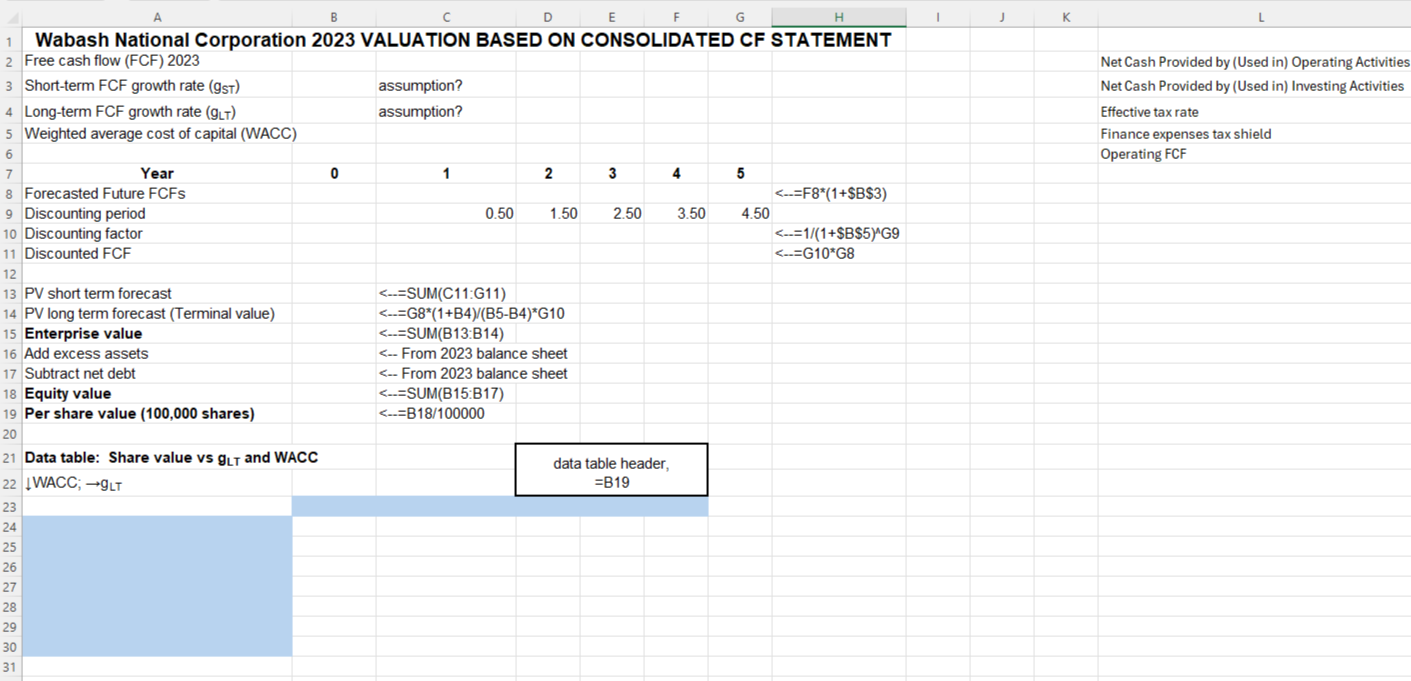

Using the public filings for Wabash National Corporation, B Calculate the equity value per share as of Use the Simplified Approach we discussed in class the version using the companys Statement of Cash Flows example image provided You will need to use a short term and long term growth rate. Both of these are assumptions that YOU will need to make. provide a reason for why each growth rate is chosen C Project FCF for five years, assign a terminal value, and find Enterprise Value. Subtract net debt and ignore excess assets in this case. To find the value per share, use current shares outstanding September For all components, either cite the source of your data or justify your assumption.

Please show steps and formulas in Excel.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock