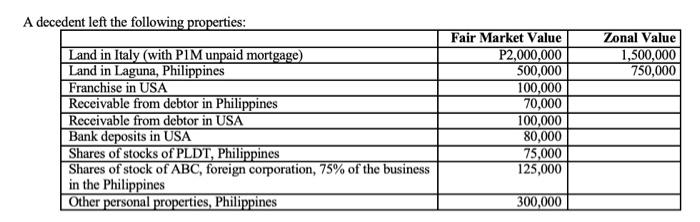

Question: Using the above data, if the decedent is a non-resident alien, his gross estate is If the decedent is a Non-Resident Alien and there is

- Using the above data, if the decedent is a non-resident alien, his gross estate is

- If the decedent is a Non-Resident Alien and there is reciprocity, the gross estate is

- the claims against the estate is P1,500,000, how much is the estate tax due?

A decedent left the following properties: Zonal Value 1,500,000 750,000 Land in Italy (with PIM unpaid mortgage) Land in Laguna, Philippines Franchise in USA Receivable from debtor in Philippines Receivable from debtor in USA Bank deposits in USA Shares of stocks of PLDT, Philippines Shares of stock of ABC, foreign corporation, 75% of the business in the Philippines Other personal properties, Philippines Fair Market Value P2,000,000 500,000 100,000 70,000 100,000 80,000 75,000 125,000 300,000 A decedent left the following properties: Zonal Value 1,500,000 750,000 Land in Italy (with PIM unpaid mortgage) Land in Laguna, Philippines Franchise in USA Receivable from debtor in Philippines Receivable from debtor in USA Bank deposits in USA Shares of stocks of PLDT, Philippines Shares of stock of ABC, foreign corporation, 75% of the business in the Philippines Other personal properties, Philippines Fair Market Value P2,000,000 500,000 100,000 70,000 100,000 80,000 75,000 125,000 300,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts