Question: Using the assumptions listed below, and your forecasted sales from question 4 above, prepare the projected Income Statement, Balance Sheet and Cash Flow Statement (using

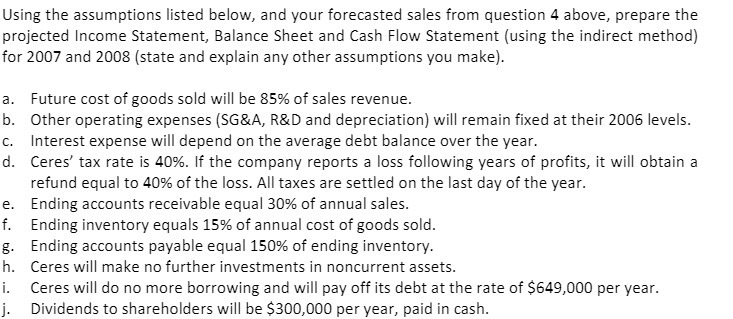

Using the assumptions listed below, and your forecasted sales from question 4 above, prepare the projected Income Statement, Balance Sheet and Cash Flow Statement (using the indirect method) for 2007 and 2008 (state and explain any other assumptions you make). a. Future cost of goods sold will be 85% of sales revenue. b. Other operating expenses (SG&A, R&D and depreciation) will remain fixed at their 2006 levels. C. Interest expense will depend on the average debt balance over the year. d. Ceres' tax rate is 40%. If the company reports a loss following years of profits, it will obtain a refund equal to 40% of the loss. All taxes are settled on the last day of the year. e. Ending accounts receivable equal 30% of annual sales. f. Ending inventory equals 15% of annual cost of goods sold. g. Ending accounts payable equal 150% of ending inventory. h. Ceres will make no further investments in noncurrent assets. i. Ceres will do no more borrowing and will pay off its debt at the rate of $649,000 per year. i. Dividends to shareholders will be $300,000 per year, paid in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts