Question: Using the attached list for average starting salaries by major, calculate the tax burden you could expect to have for your currently selected major (if

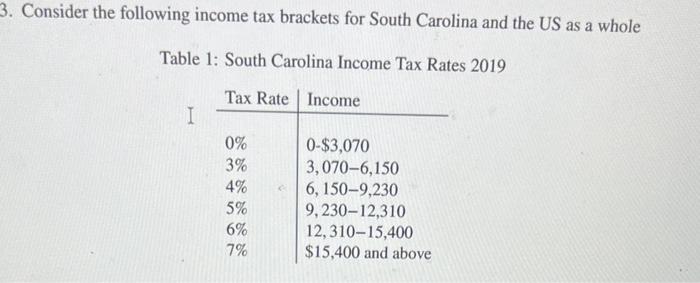

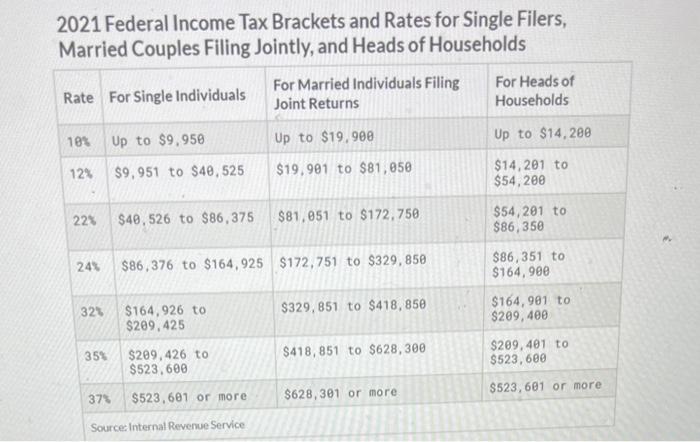

Using the attached list for average starting salaries by major, calculate the tax burden you could expect to have for your currently selected major (if you do not have a major, or yours is not listed, pick one you are interested in), assuming you work in South Carolina. Be sure to include: (a) The major you are using and the starting salary. (b) Your filing status (single, married filing jointly, etc.) (c) Your state tax burden (d) Your federal tax burden (e) Your average tax rate (total, state, and federal) (f) Your marginal tax rate (state and federal) Consider the following income tax brackets for South Carolina and the US as a whole Table 1: South Carolina Income Tax Rates 2019 2021 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts