Question: Using the attached table please answer the following questions: What was Fords return on Total Assets (%) in 2018 ( fyi: there are two interest

Using the attached table please answer the following questions:

What was Fords return on Total Assets (%) in 2018 ( fyi: there are two interest expenses)

Assume Ford did not issue any new shares from 2017 to 2018. Did their earnings per share (EPS) increase or decrease and by how much ?

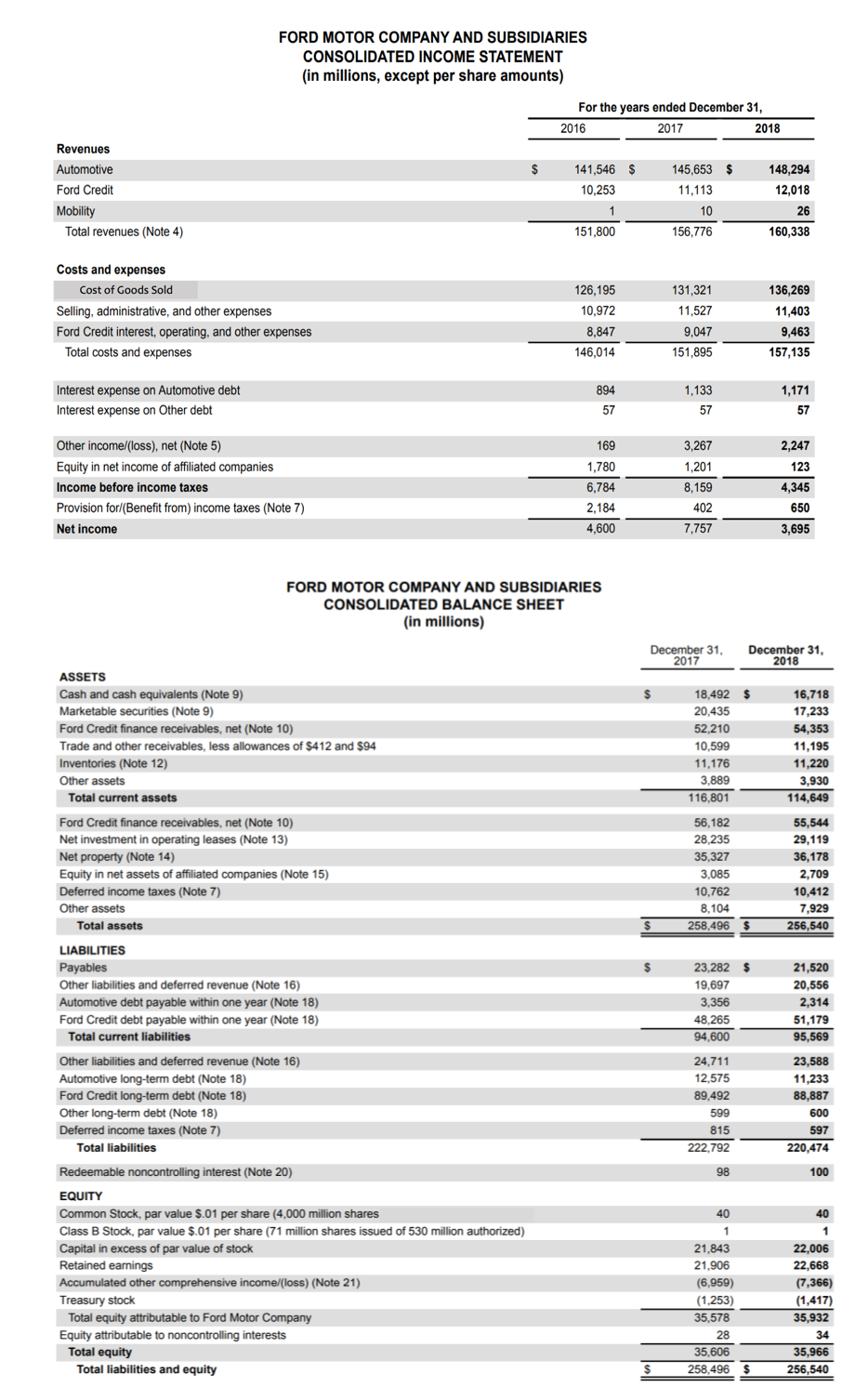

FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the years ended December 31, 2016 2017 2018 $ $ Revenues Automotive Ford Credit Mobility Total revenues (Note 4) 141,546 10,253 145,653 $ 11,113 10 156,776 148,294 12,018 26 160,338 151,800 Costs and expenses Cost of Goods Sold Selling, administrative, and other expenses Ford Credit interest, operating, and other expenses Total costs and expenses 126,195 10,972 8,847 146,014 131,321 11,527 9,047 151,895 136,269 11,403 9,463 157,135 1,133 1,171 Interest expense on Automotive debt Interest expense on Other debt 894 57 57 Other income (loss), net (Note 5) Equity in net income of affiliated companies Income before income taxes Provision for/(Benefit from) income taxes (Note 7) Net income 169 1,780 6,784 2,184 4,600 3,267 1,201 8,159 402 7,757 2,247 123 4,345 650 3,695 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions) December 31, 2017 December 31, 2018 $ ASSETS Cash and cash equivalents (Note 9) Marketable securities (Note 9) Ford Credit finance receivables, net (Note 10) Trade and other receivables, less allowances of $412 and $94 Inventories (Note 12) Other assets Total current assets 18,492 20,435 52,210 10,599 11,176 3,889 116,801 16,718 17,233 54,353 11,195 11,220 3,930 114,649 56,182 28,235 35,327 3,085 10,762 8,104 258,496 55,544 29,119 36,178 2,709 10,412 7,929 256,540 $ $ Ford Credit finance receivables, net (Note 10) Net investment in operating leases (Note 13) Net property (Note 14) Equity in net assets of affiliated companies (Note 15) Deferred income taxes (Note 7) Other assets Total assets LIABILITIES Payables Other liabilities and deferred revenue (Note 16) Automotive debt payable within one year (Note 18) Ford Credit debt payable within one year (Note 18) Total current liabilities Other liabilities and deferred revenue (Note 16) Automotive long-term debt (Note 18) Ford Credit long-term debt (Note 18) Other long-term debt (Note 18) Deferred income taxes (Note 7) Total liabilities 23,282 19,697 3,356 48,265 94,600 21,520 20,556 2,314 51,179 95,569 24,711 12,575 89,492 599 815 222,792 23,588 11,233 88,887 600 597 220,474 100 1 Redeemable noncontrolling interest (Note 20) EQUITY Common Stock, par value $.01 per share (4,000 million shares Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) Capital in excess of par value of stock Retained earnings Accumulated other comprehensive income/loss) (Note 21) Treasury stock Total equity attributable to Ford Motor Company Equity attributable to noncontrolling interests Total equity Total liabilities and equity 21,843 21,906 (6,959) (1,253) 35,578 28 35,606 258,496 22,006 22,668 (7,366) (1,417) 35,932 35,966 256,540 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts