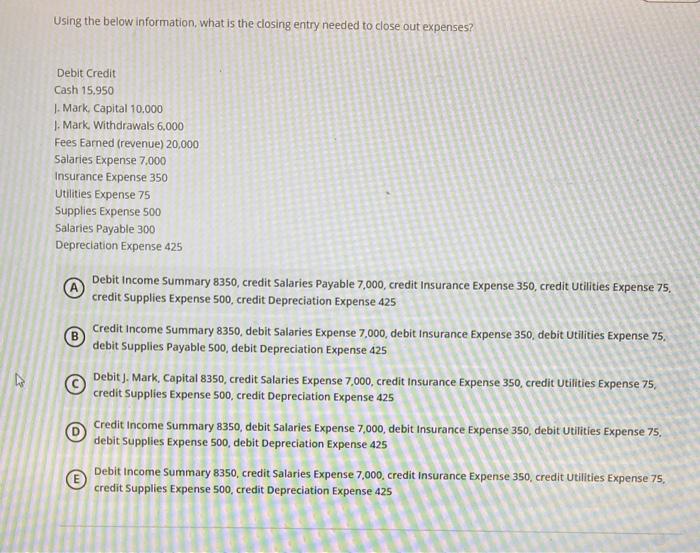

Question: Using the below information, what is the closing entry needed to close out expenses? Debit Credit Cash 15.950 1. Mark, Capital 10.000 1. Mark Withdrawals

Using the below information, what is the closing entry needed to close out expenses? Debit Credit Cash 15.950 1. Mark, Capital 10.000 1. Mark Withdrawals 6.000 Fees Earned (revenue) 20,000 Salaries Expense 7.000 Insurance Expense 350 Utilities Expense 75 Supplies Expense 500 Salaries Payable 300 Depreclation Expense 425 (A) Debit Income Summary 8350, credit Salaries Payable 7,000, credit Insurance Expense 350, credit Utilities Expense 75, credit Supplies Expense 500, credit Depreciation Expense 425 (B) Credit Income Summary 8350, debit Salaries Expense 7,000, debit Insurance Expense 350, debit Utilities Expense 75. debit Supplies Payable 500, debit Depreciation Expense 425 (C) Debit J. Mark, Capital 8350, credit Salaries Expense 7,000, credit Insurance Expense 350, credit Utilities Expense 75. credit Supplies Expense 500, credit Depreciation Expense 425 (D) Credit income Summary 8350, debit Salaries Expense 7,000, debit Insurance Expense 350, debit Utilities Expense 75. debit Supplies Expense 500, debit Depreciation Expense 425 (E) Debit Income Summary 8350, credit Salaries Expense 7,000, credit Insurance Expense 350, credit Utilities Expense 75, credit Supplies Expense 500, credit Depreciation Expense 425

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts