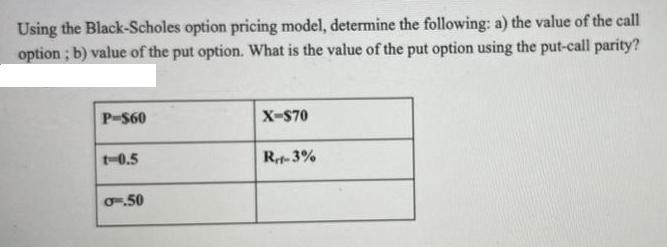

Question: Using the Black-Scholes option pricing model, determine the following: a) the value of the call option; b) value of the put option. What is

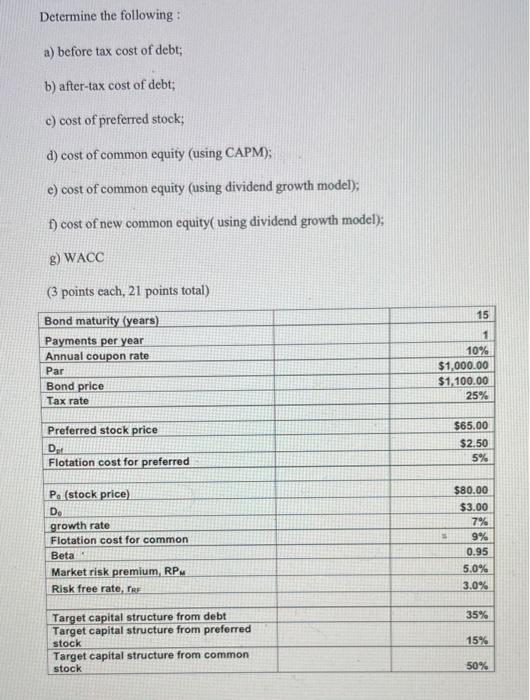

Using the Black-Scholes option pricing model, determine the following: a) the value of the call option; b) value of the put option. What is the value of the put option using the put-call parity? P-$60 t-0.5 OF.50 X-$70 Rrt-3% Determine the following: a) before tax cost of debt; b) after-tax cost of debt; c) cost of preferred stock; d) cost of common equity (using CAPM); e) cost of common equity (using dividend growth model); f) cost of new common equity( using dividend growth model); g) WACC (3 points cach, 21 points total) Bond maturity (years) Payments per year Annual coupon rate Par Bond price Tax rate Preferred stock price Dat Flotation cost for preferred Po (stock price) Do growth rate Flotation cost for common Beta Market risk premium, RPM Risk free rate, TRE Target capital structure from debt Target capital structure from preferred stock Target capital structure from common stock 15 1 10% $1,000.00 $1,100.00 25% = $65.00 $2.50 5% $80.00 $3.00 7% 9% 0.95 5.0% 3.0% 35% 15% 50%

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

To determine the value of the call and put options using the BlackScholes option pricing model we need the following inputs S Current price of the und... View full answer

Get step-by-step solutions from verified subject matter experts