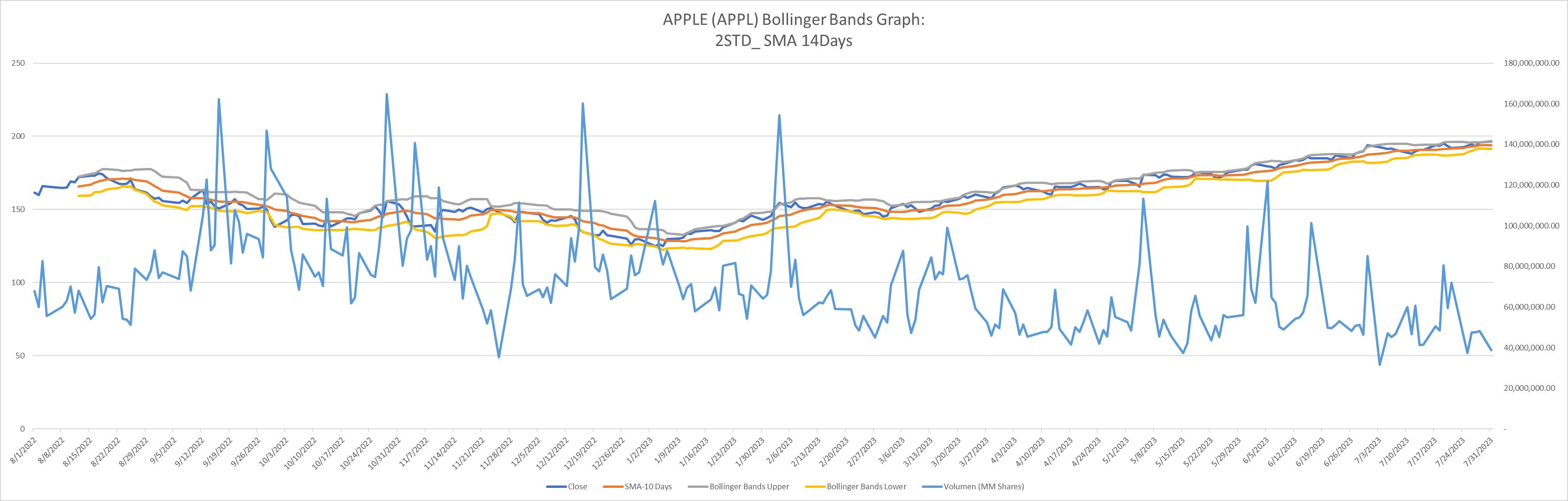

Question: Using the Bollinger Bands char Answer the Following: The dates on which you could have bought the stock at the lowest possible price? The

Using the Bollinger Bands char Answer the Following:

The dates on which you could have bought the stock at the lowest possible price?

The dates on which you could have bought the stock at the lowest possible price?

• The dates on which you could have sold the stock at the highest possible price?

• The behavior of the volume of shares sold. When the volume went up, what effect did it have on the price?

• When the volume went down, what effect it had on the pric?

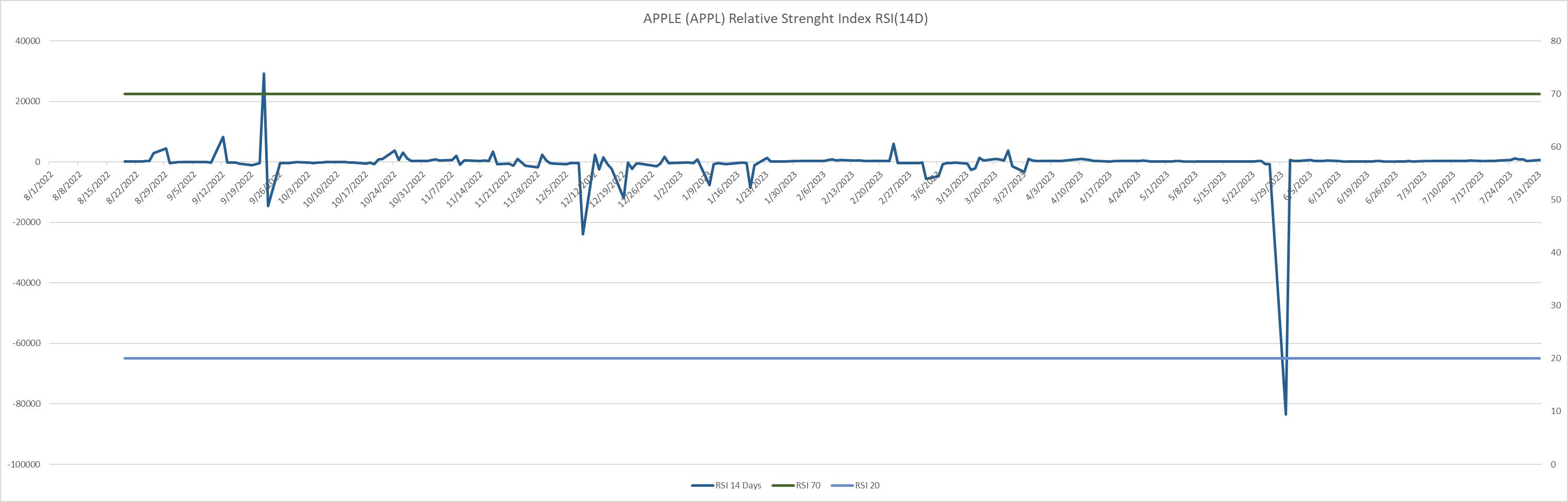

2. Using the RSI chart answer the following:

At what times did the RSI index go out of the strength ranges?

What would you do if the strength index went above the 70 level?

What would you do if the strength index fell below the 20 level?

250 200 150 100 50 0 luhih 8/1/2022 8/8/2022 8/15/2022 8/22/2022 9/5/2022 8/29/2022 9/12/2022 9/19/2022 9/26/2022 10/3/2022 10/10/2022 10/17/2022 10/24/2022 10/31/2022 11/7/2022 11/14/2022 11/21/2022 11/28/2022 12/5/2022 12/12/2022 12/19/2022 Close 1/2/2023 12/26/2022 APPLE (APPL) Bollinger Bands Graph: 2STD_SMA 14Days hi 1/9/2023 SMA-10 Days 1/16/2023 wil V 1/23/2023 1/30/2023 2/6/2023 Bollinger Bands Upper 2/13/2023 3/6/2023 2/20/2023 2/27/2023 3/13/2023 3/20/2023 Bollinger Bands Lower 3/27/2023 4/3/2023 Volumen (MM Shares) 4/10/2023 4/17/2023 4/24/2023 5/1/2023 5/8/2023 5/15/2023 5/22/2023 5/29/2023 6/5/2023 6/12/2023 6/19/2023 7/3/2023 6/26/2023 7/10/2023 7/17/2023 7/24/2023 7/31/2023 180,000,000.00 160,000,000.00 140,000,000.00 120,000,000.00 100,000,000.00 80,000,000.00 60,000,000.00 40,000,000.00 20,000,000.00

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

The analysis of the Bollinger Bands and RSI charts provides insights into opti... View full answer

Get step-by-step solutions from verified subject matter experts