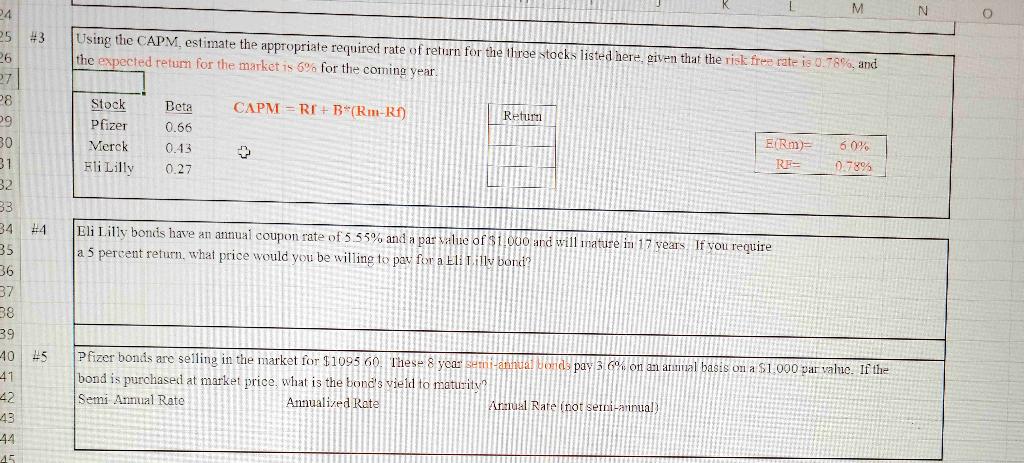

Question: Using the CAPM, estimate the appropriate required rate of return for the three tock, listed here, given that the risk free rat- is o. 78%,

Using the CAPM, estimate the appropriate required rate of return for the three tock, listed here, given that the risk free rat- is o. 78%, and the expected retum for the market is 6% for the coming year. \begin{tabular}{|lll|l|} \hline Stock & Beta & CAPM=RT+BA(RmRf) \\ Pfizer & 0.66 & \\ Merck & 0.43 & Returm \\ Fli Lilly & 0.27 & \\ \hline \end{tabular} Eli Lilly bonds have an annual coupon rate of 5.55% and a par whiw of $1000 and will mature in 17 years. If you require a 5 percent return, what price would you be willing to pay for a 1 I T illy bond? Pfizer bonds are selling in the market for $109560. Thes 8 year senit-annua honds pay 3.66 on an armial basis on a s1 000 par value. If the bond is purchased at market price, what is the boncls vield to maturity? Semi Annual Rate Annualized Rate Armual Rate (not semi-annual)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts