Question: Using the Case Study Notes and the accompanying spreadsheet, calculate the WACC of each Microsoft segment comparable. Describe the primary WACC drivers that explain the

Using the Case Study Notes and the accompanying spreadsheet, calculate the WACC of each Microsoft segment comparable. Describe the primary WACC drivers that explain the differences between the WACC of Microsoft and its comparables.

Can someone help me with this case? please

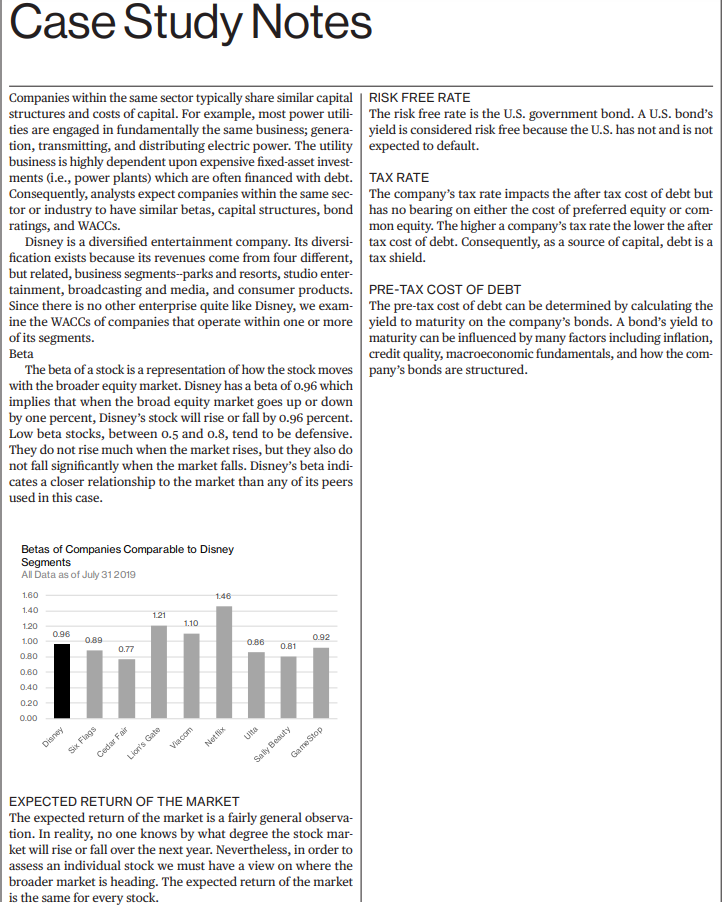

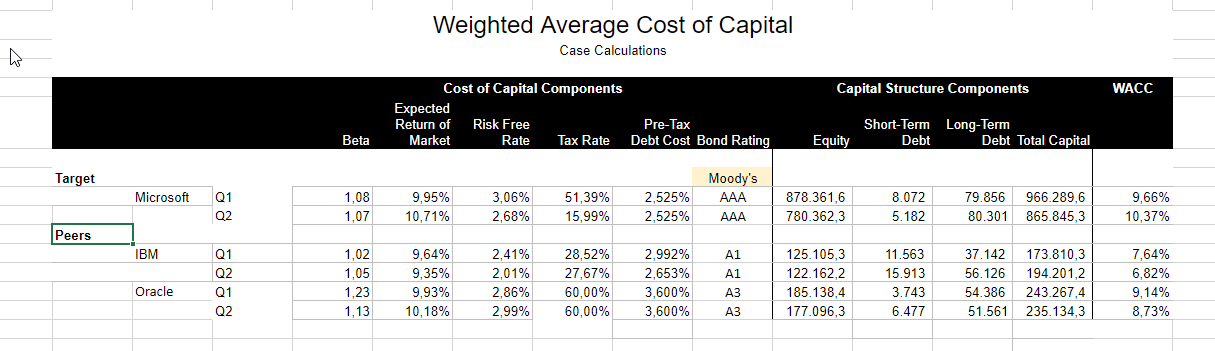

Case Study Notes Companies within the same sector typically share similar capital | RISK FREE RATE structures and costs of capital. For example, most power utili- The risk free rate is the U.S. government bond. A U.S. bond's ties are engaged in fundamentally the same business; genera- yield is considered risk free because the U.S. has not and is not tion, transmitting, and distributing electric power. The utility expected to default. business is highly dependent upon expensive fixed-asset invest- ments (i.e., power plants) which are often financed with debt. TAX RATE Consequently, analysts expect companies within the same sec- The company's tax rate impacts the after tax cost of debt but tor or industry to have similar betas, capital structures, bond has no bearing on either the cost of preferred equity or com- ratings, and WACCs. mon equity. The higher a company's tax rate the lower the after Disney is a diversified entertainment company. Its diversi- tax cost of debt. Consequently, as a source of capital, debt is a fication exists because its revenues come from four different, tax shield. but related, business segments-parks and resorts, studio enter- tainment, broadcasting and media, and consumer products. PRE-TAX COST OF DEBT Since there is no other enterprise quite like Disney, we exam- The pre-tax cost of debt can be determined by calculating the ine the WACCs of companies that operate within one or more yield to maturity on the company's bonds. A bond's yield to of its segments. maturity can be influenced by many factors including inflation, Beta credit quality, macroeconomic fundamentals, and how the com- The beta of a stock is a representation of how the stock moves pany's bonds are structured. with the broader equity market. Disney has a beta of 0.96 which implies that when the broad equity market goes up or down by one percent, Disney's stock will rise or fall by 0.96 percent. Low beta stocks, between 0.5 and 0.8, tend to be defensive. They do not rise much when the market rises, but they also do not fall significantly when the market falls. Disney's beta indi- cates a closer relationship to the market than any of its peers used in this case. Betas of Companies Comparable to Disney Segments All Data as of July 31 2019 1.60 1.46 1.40 1.21 1.20 1.10 0.96 1.00 0.89 0.92 0.86 0.77 0.81 0.80 0.60 0.40 0.20 0.00 Net Ulta Disney Cedar Fair Viacom Six Flags Lion's Gate GameStop Saly Booty EXPECTED RETURN OF THE MARKET The expected return of the market is a fairly general observa- tion. In reality, no one knows by what degree the stock mar- ket will rise or fall over the next year. Nevertheless, in order to assess an individual stock we must have a view on where the broader market is heading. The expected return of the market is the same for every stock. Weighted Average Cost of Capital Case Calculations Capital Structure Components WACC Cost of Capital Components Expected Return of Risk Free Market Rate Tax Rate Pre-Tax Debt Cost Bond Rating Short-Term Long-Term Debt Debt Total Capital Beta Equity Target Microsoft Q1 Q2 8.072 1,08 1,07 9,95% 10,71% 3,06% 2,68% 51,39% 15,99% Moody's AAA AAA 2,525% 2,525% 878.361,6 780.362,3 79.856 80.301 966.289,6 865.845,3 9,66% 10,37% 5.182 Peers IBM 1,02 1,05 Q1 02 Q1 Q2 9,64% 9,35% 9,93% 10.18% 2.41% 2,01% 2,86% 2,99% 28,52% 27,67% 60,00% 60,00% 2.992% 2,653% 3,600% 3,600% A1 A1 A3 125.105.3 122.162,2 185.138,4 177.096,3 11.563 15.913 3.743 6.477 37.142 56.126 54.386 51.561 173.810,3 194.201,2 243.267,4 235.134,3 7,64% 6,82% 9,14% 8,73% Oracle 1,23 1,13 Case Study Notes Companies within the same sector typically share similar capital | RISK FREE RATE structures and costs of capital. For example, most power utili- The risk free rate is the U.S. government bond. A U.S. bond's ties are engaged in fundamentally the same business; genera- yield is considered risk free because the U.S. has not and is not tion, transmitting, and distributing electric power. The utility expected to default. business is highly dependent upon expensive fixed-asset invest- ments (i.e., power plants) which are often financed with debt. TAX RATE Consequently, analysts expect companies within the same sec- The company's tax rate impacts the after tax cost of debt but tor or industry to have similar betas, capital structures, bond has no bearing on either the cost of preferred equity or com- ratings, and WACCs. mon equity. The higher a company's tax rate the lower the after Disney is a diversified entertainment company. Its diversi- tax cost of debt. Consequently, as a source of capital, debt is a fication exists because its revenues come from four different, tax shield. but related, business segments-parks and resorts, studio enter- tainment, broadcasting and media, and consumer products. PRE-TAX COST OF DEBT Since there is no other enterprise quite like Disney, we exam- The pre-tax cost of debt can be determined by calculating the ine the WACCs of companies that operate within one or more yield to maturity on the company's bonds. A bond's yield to of its segments. maturity can be influenced by many factors including inflation, Beta credit quality, macroeconomic fundamentals, and how the com- The beta of a stock is a representation of how the stock moves pany's bonds are structured. with the broader equity market. Disney has a beta of 0.96 which implies that when the broad equity market goes up or down by one percent, Disney's stock will rise or fall by 0.96 percent. Low beta stocks, between 0.5 and 0.8, tend to be defensive. They do not rise much when the market rises, but they also do not fall significantly when the market falls. Disney's beta indi- cates a closer relationship to the market than any of its peers used in this case. Betas of Companies Comparable to Disney Segments All Data as of July 31 2019 1.60 1.46 1.40 1.21 1.20 1.10 0.96 1.00 0.89 0.92 0.86 0.77 0.81 0.80 0.60 0.40 0.20 0.00 Net Ulta Disney Cedar Fair Viacom Six Flags Lion's Gate GameStop Saly Booty EXPECTED RETURN OF THE MARKET The expected return of the market is a fairly general observa- tion. In reality, no one knows by what degree the stock mar- ket will rise or fall over the next year. Nevertheless, in order to assess an individual stock we must have a view on where the broader market is heading. The expected return of the market is the same for every stock. Weighted Average Cost of Capital Case Calculations Capital Structure Components WACC Cost of Capital Components Expected Return of Risk Free Market Rate Tax Rate Pre-Tax Debt Cost Bond Rating Short-Term Long-Term Debt Debt Total Capital Beta Equity Target Microsoft Q1 Q2 8.072 1,08 1,07 9,95% 10,71% 3,06% 2,68% 51,39% 15,99% Moody's AAA AAA 2,525% 2,525% 878.361,6 780.362,3 79.856 80.301 966.289,6 865.845,3 9,66% 10,37% 5.182 Peers IBM 1,02 1,05 Q1 02 Q1 Q2 9,64% 9,35% 9,93% 10.18% 2.41% 2,01% 2,86% 2,99% 28,52% 27,67% 60,00% 60,00% 2.992% 2,653% 3,600% 3,600% A1 A1 A3 125.105.3 122.162,2 185.138,4 177.096,3 11.563 15.913 3.743 6.477 37.142 56.126 54.386 51.561 173.810,3 194.201,2 243.267,4 235.134,3 7,64% 6,82% 9,14% 8,73% Oracle 1,23 1,13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts