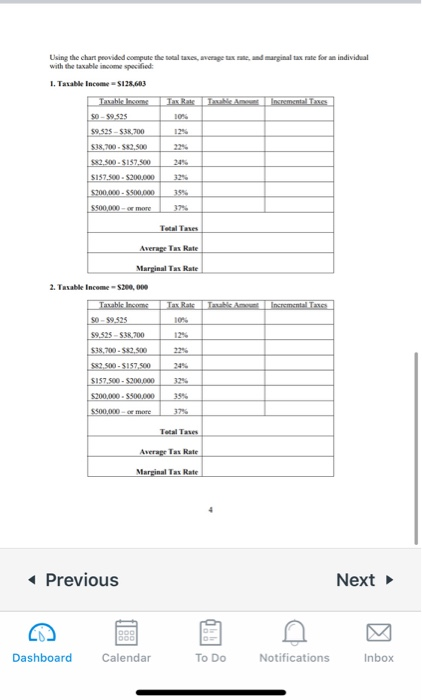

Question: Using the chart provided compute the total taxes, average tax rate, and marginal tax rate for an individual with the taxable income specified 1. Taxable

Using the chart provided compute the total taxes, average tax rate, and marginal tax rate for an individual with the taxable income specified 1. Taxable income-5128,663 Tavale Incam Incrementales 50 - 59.525 BON 59.525 - 538,700 125 538,700 - $2.500 5X2.500 - $157.500 S157.500 - $200.000 32% $200,000 - $500.000 $500,000 - more Total Tes Average Tax Rate Marginal Tax Rate Incrementales Tax Rate Tubi Am 10% 2. Tsable Income $200,000 Taxable ince S0-59.525 $9.525 - $38.700 538.700.582.500 $2.500 - 5157.500 $157.500 - $200.000 S200,000 - $500,000 35% $500,000 - more 37% Total Tanes Average Tax Rate Marginal Tax Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts