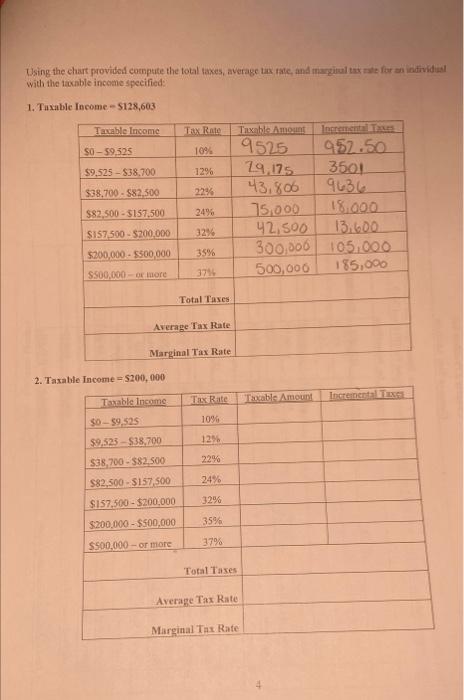

Question: Using the chart provided compute the total taxes, average tax rate, and margiul tax rate for an individual with the taxable income specified: 1. Tuxable

Using the chart provided compute the total taxes, average tax rate, and margiul tax rate for an individual with the taxable income specified: 1. Tuxable income-5128,603 Tax Rate Taxable Income SO-59525 $9,525 - $38.700 1094 1296 $38.700 - $82.500 22% Taxable Amount 9525 952.50 29,175 3501 43,806 9636 75,000 42,500 13.600 300,000 105.000 500,000 185,000 $82,500 - $157,500 2496 3256 S157.500 - $200,000 $200,000 - $500,000 S500,000 or more 35% 375 Total Taxes Average Tax Rate Marginal Tax Rate 2. Taxable income = $200,000 Taxable Amount Incremental Taxable income $0 - 59,525 Tax Rate 10% 129 $9.523_$38.700 $38,700 - $82.500 $82,500 - $157,500 22% 24% $157,500 - $200,000 32% $200,000 - $500,000 35% S500,000 - or more 379 Total Taxes Average Tax Rate Marginal Tax Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts