Using the CPA way make:

- Analysis for ALL financial accounting issues (eg. Provide the relevant GAAP criteria and support the analysis with case facts)

- Recommendation based on GAAP supported/ case specific analysis

- Exhibit that adjusts the relevant Financial Statement figures based on your recommendation

- Outline any differences between IFRS + ASPE for the issues discussed in your case AND discuss if the analysis would be the same or different under the other framework (eg - if your case analysis used ASPE, what would the IFRS GAAP differences, if any, AND would the analysis be the same or different under IFRS)

Teleflix, Inc. is one of the world's leading Internet television networks, with millions of subscribers across the globe. Teleflix's library of digital content offers subscribers millions of hours of TV shows and movies per month, including original series. Members can watch as much as they want, anytime, anywhere, on nearly any Internet-connected screen. Members can play, pause, and resume watching, all without commercials or commitments. The Montreal-based company is organized into three operating segments:

- Domestic Streaming: This segment focuses on revenues generated from Canadian subscribers. Subscribers pay $9.99 per month for unlimited content streaming on any two devices.

- International Streaming: This segment focuses on revenues generated from the United States, United Kingdom, and Australian subscribers. Subscribers purchase a monthly plan that ranges from $7.99 to $14.99 to receive unlimited content.

- Domestic DVD: This segment derives its revenue predominantly from DVD-by-mail subscriptions. The DVD mail service is offered because it is difficult, if not impossible, to obtain a license for new, blockbuster releases in a streaming format. The price per plan varies from $4.99 to $19.99 per month. The plans vary based on the number of DVDs that can be received per month and the overall quality of the video (DVD, Blu-ray, or Blu-ray 3D). Due to the logistics costs, this plan is available only in Canada.

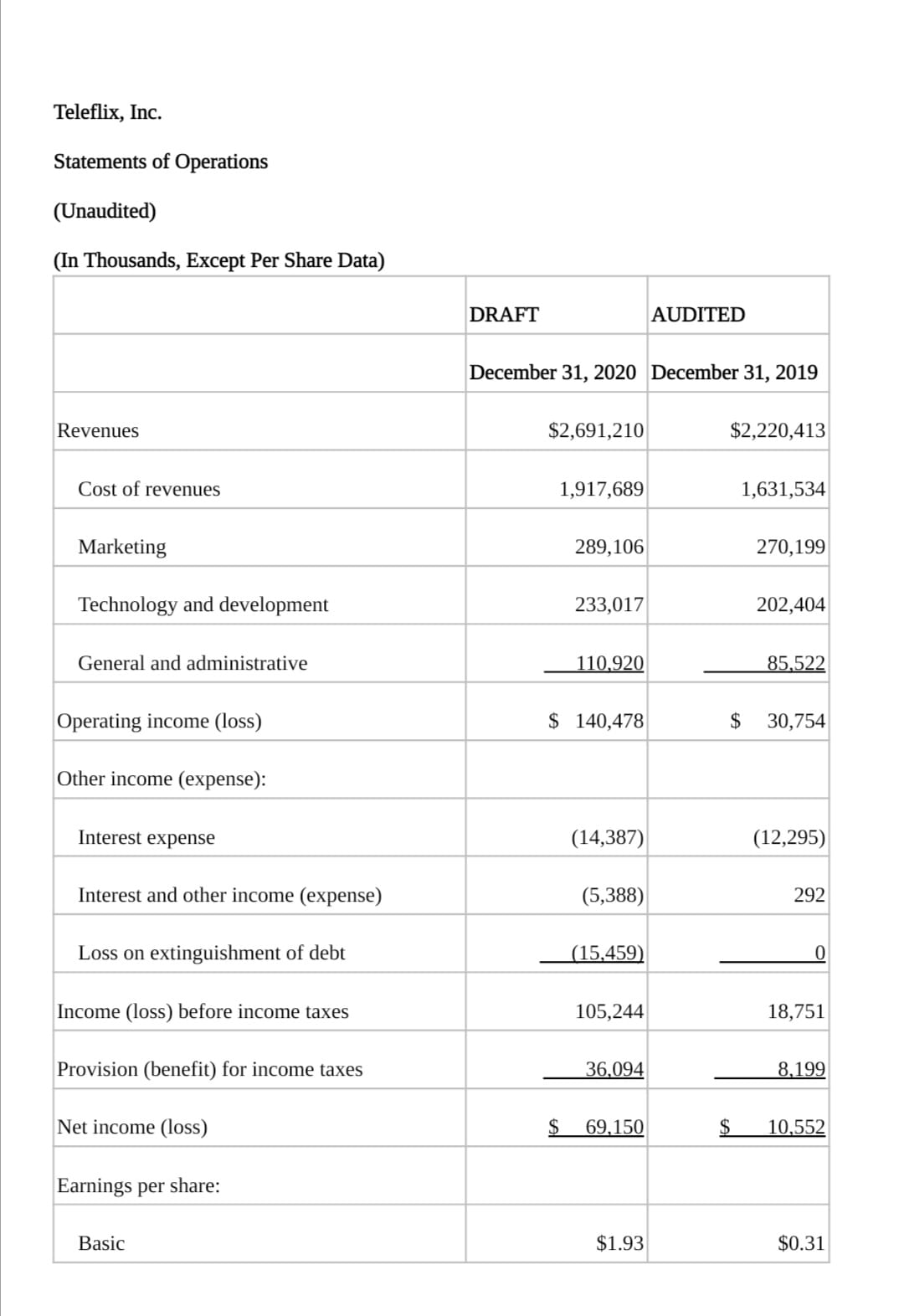

Teleflix is preparing for its 2020 year-end audit. The company is under some financial pressure to meet or exceed analysts' forecast estimates. (Analysts expect that diluted EPS will be $1.75 per share.) Investors are focusing on reported earnings because streaming content is becoming more accessible and competition is heating up. In addition to earnings, analysts will have a close eye on the company's debt to equity ratio, which is currently above industry standards. Considering all that has taken place in the industry, the company's share price has experienced volatility rates of 35% over the past year and is currently trading at $180 per share.

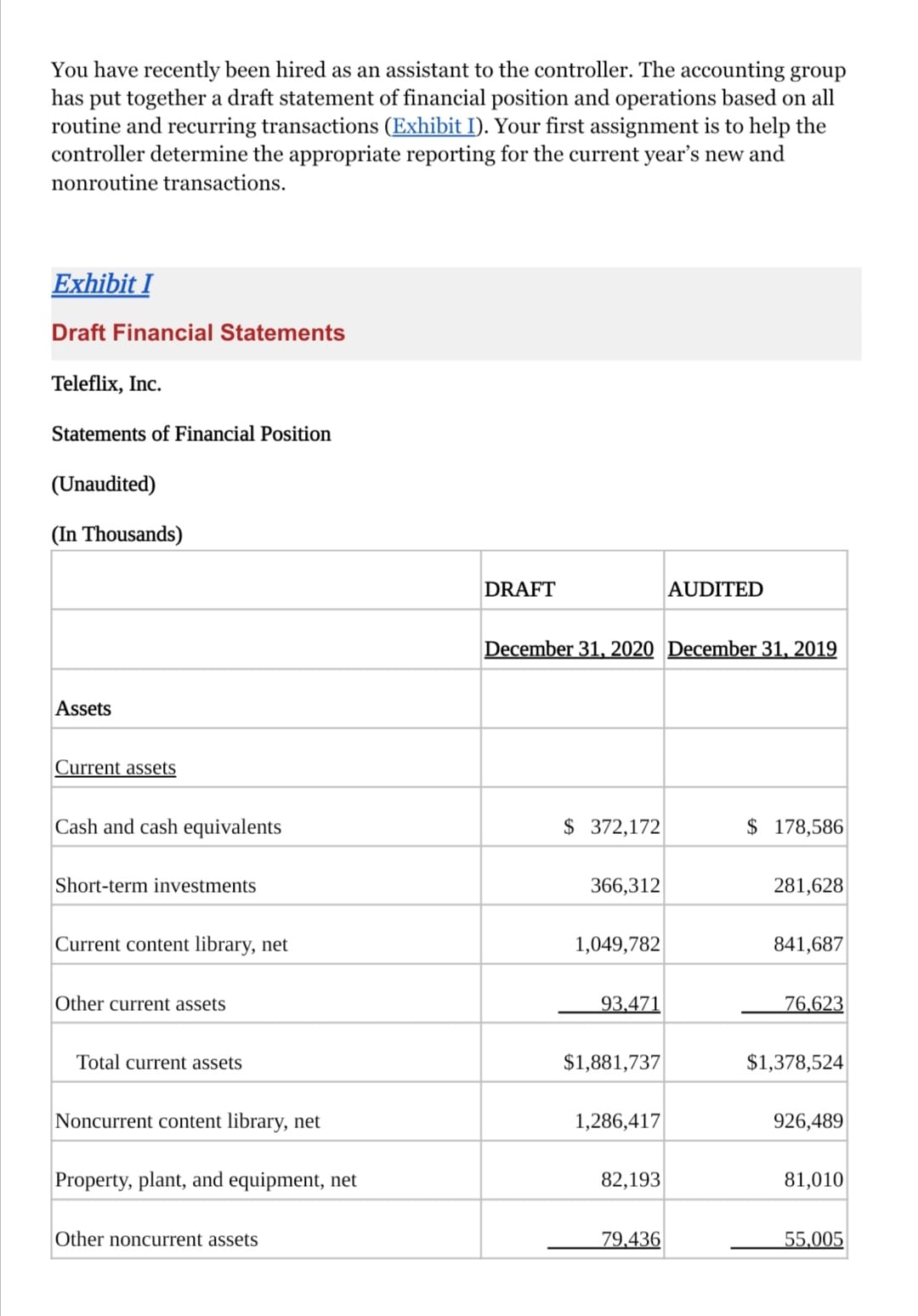

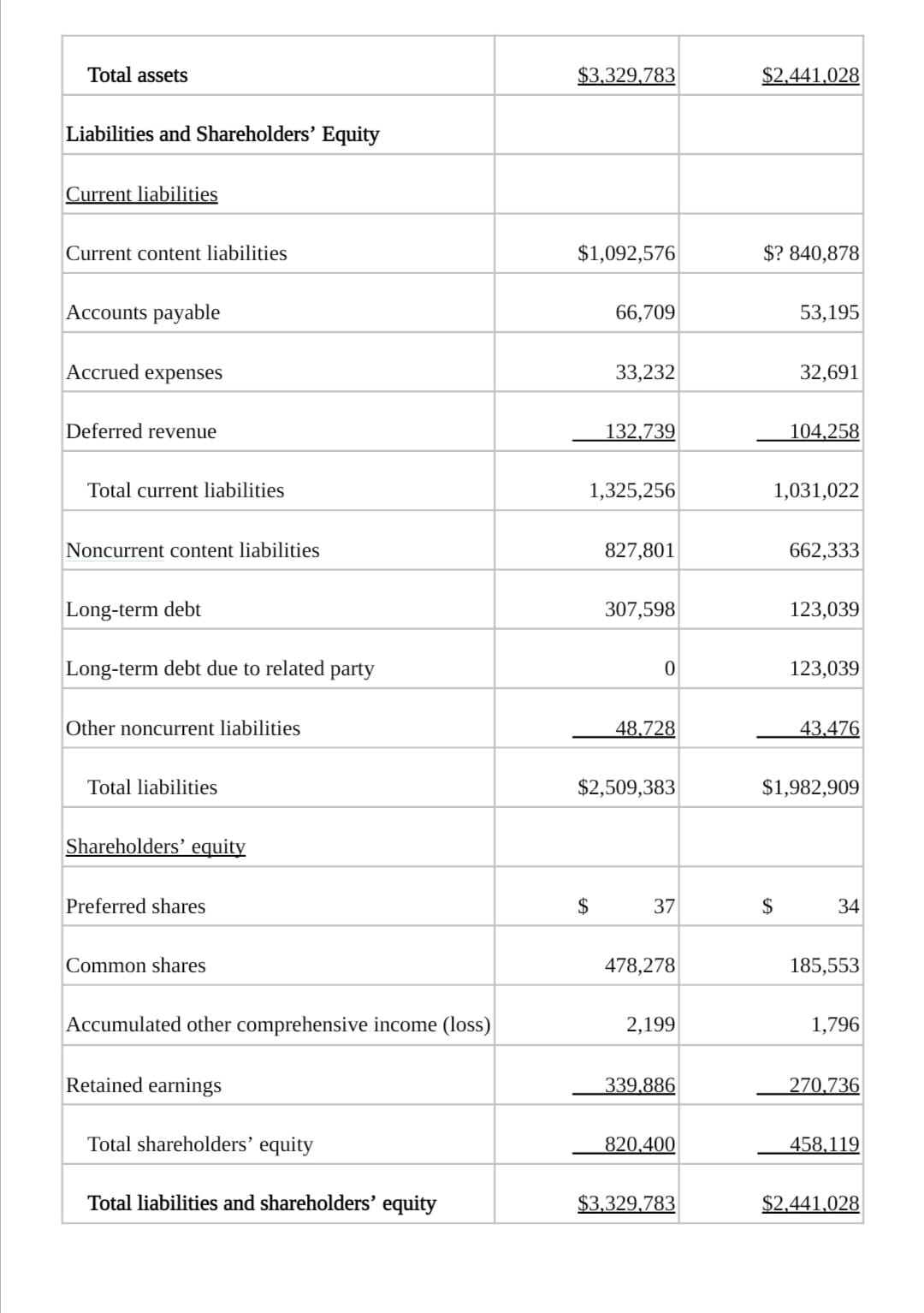

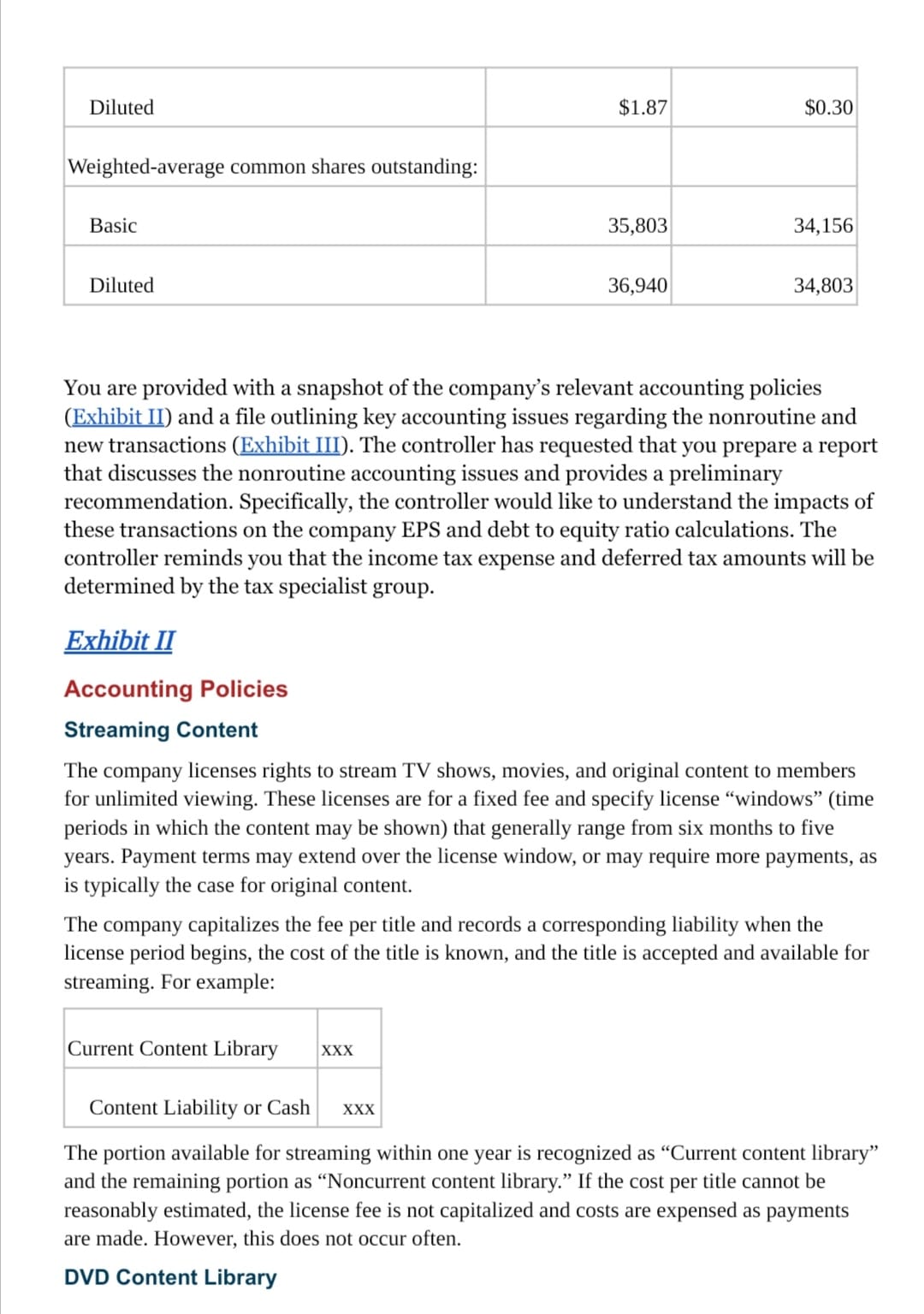

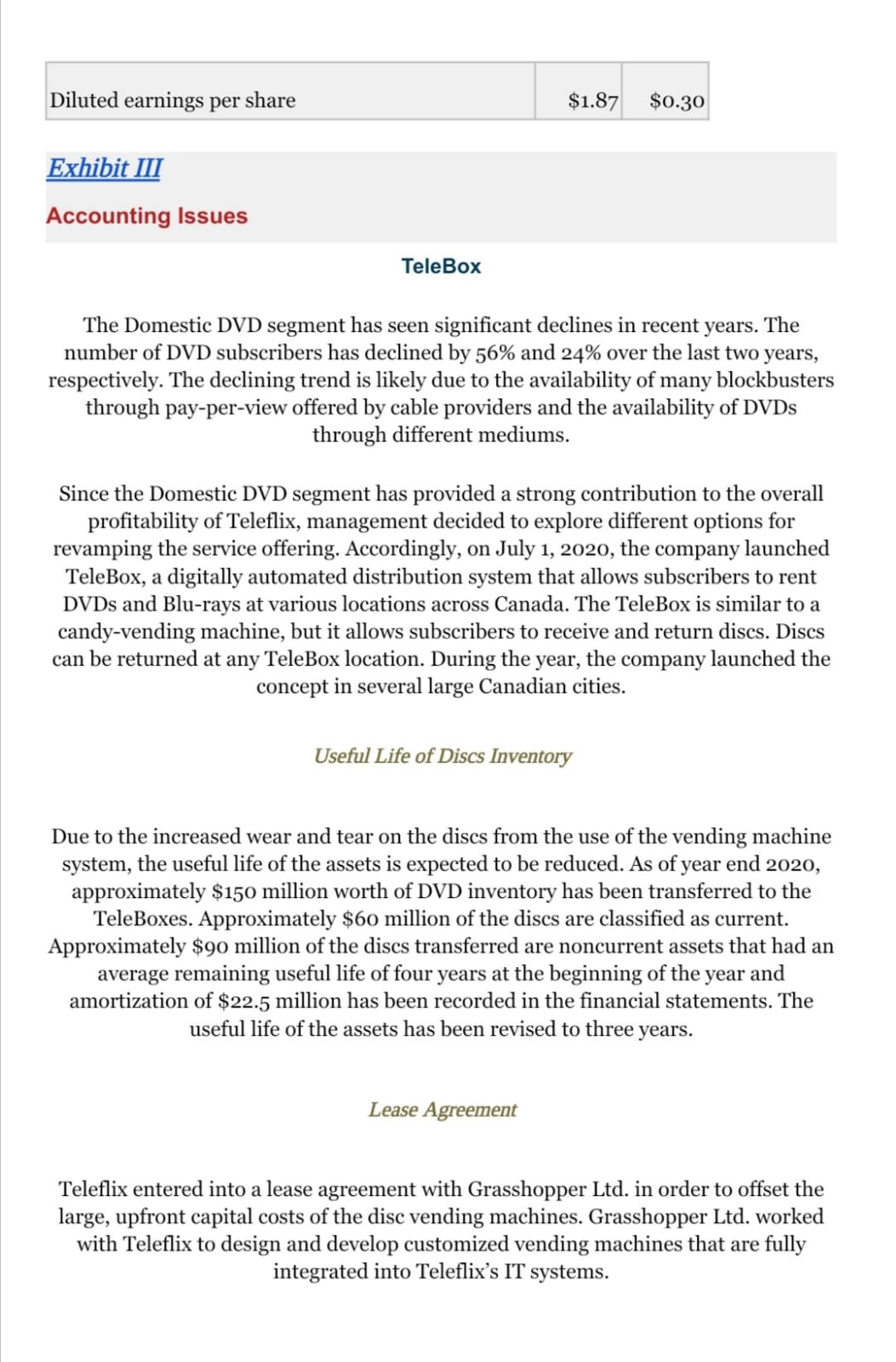

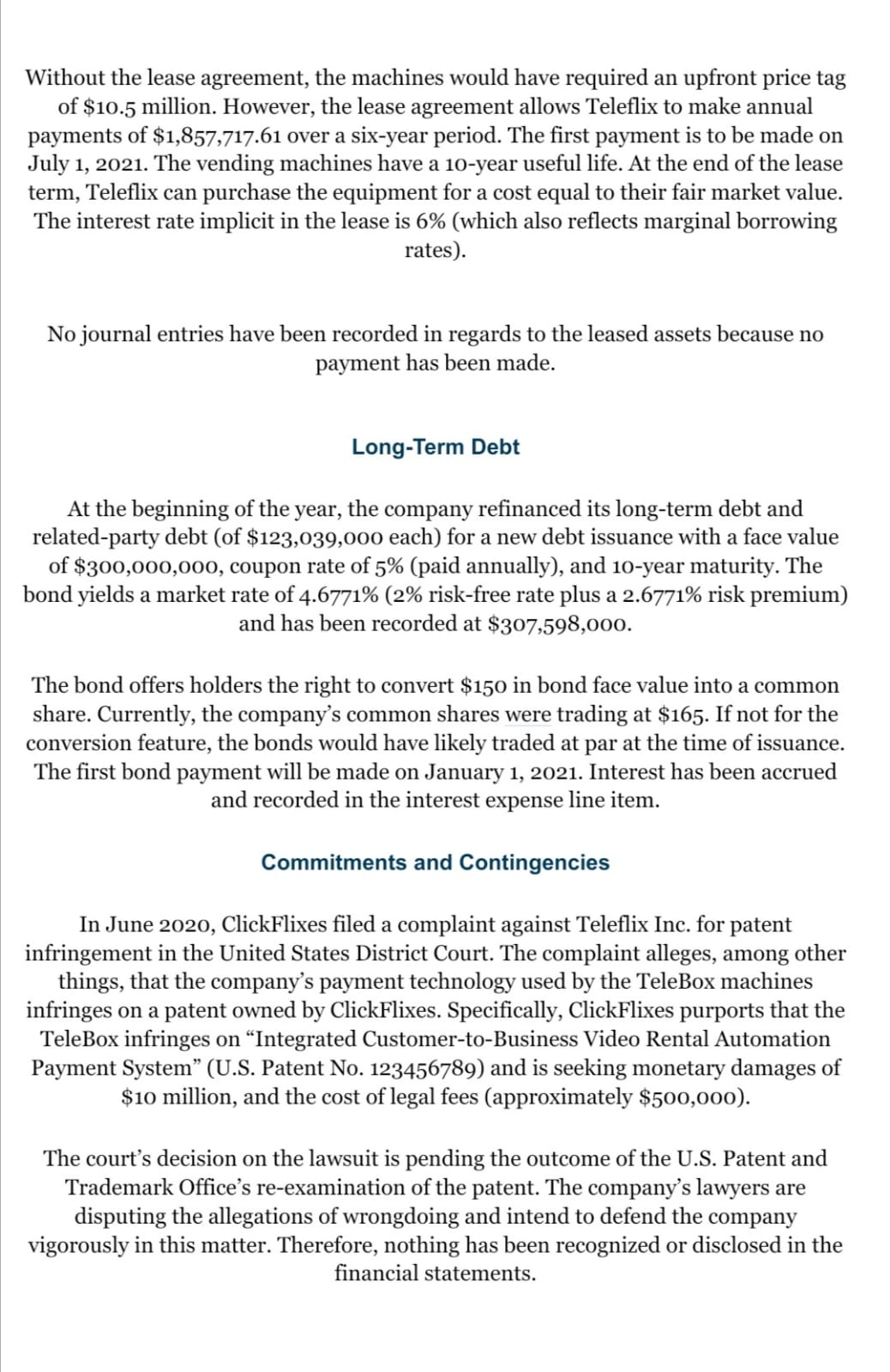

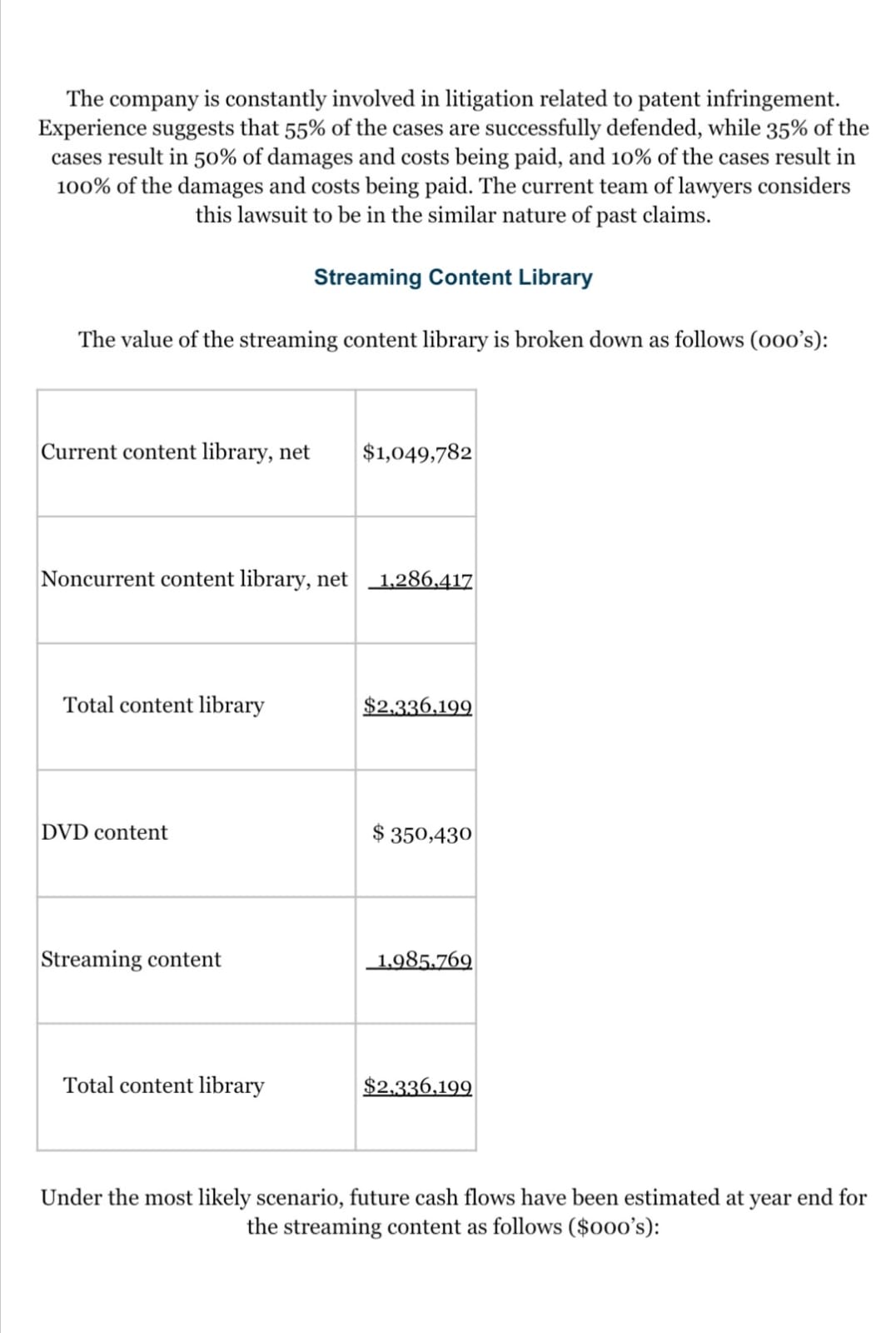

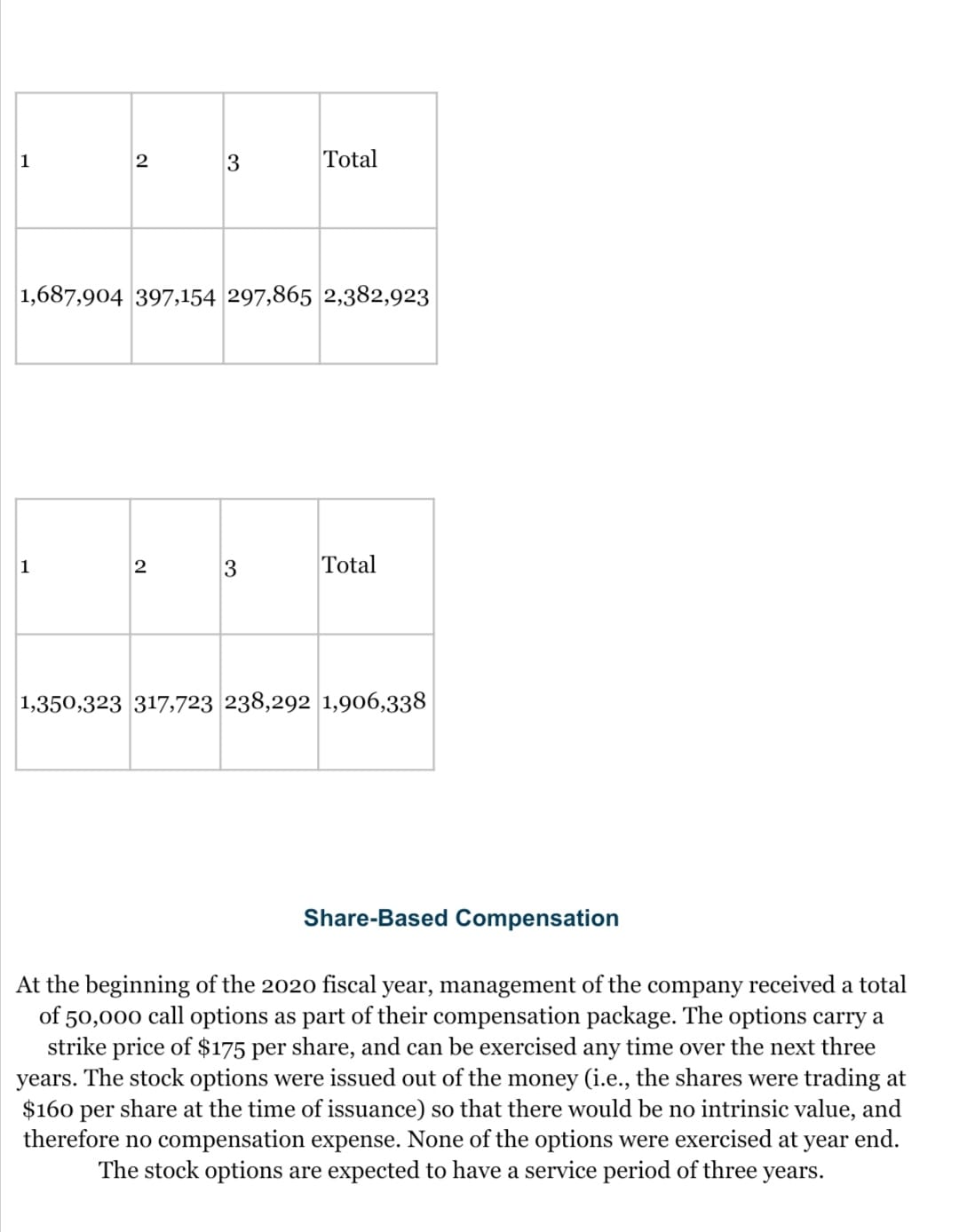

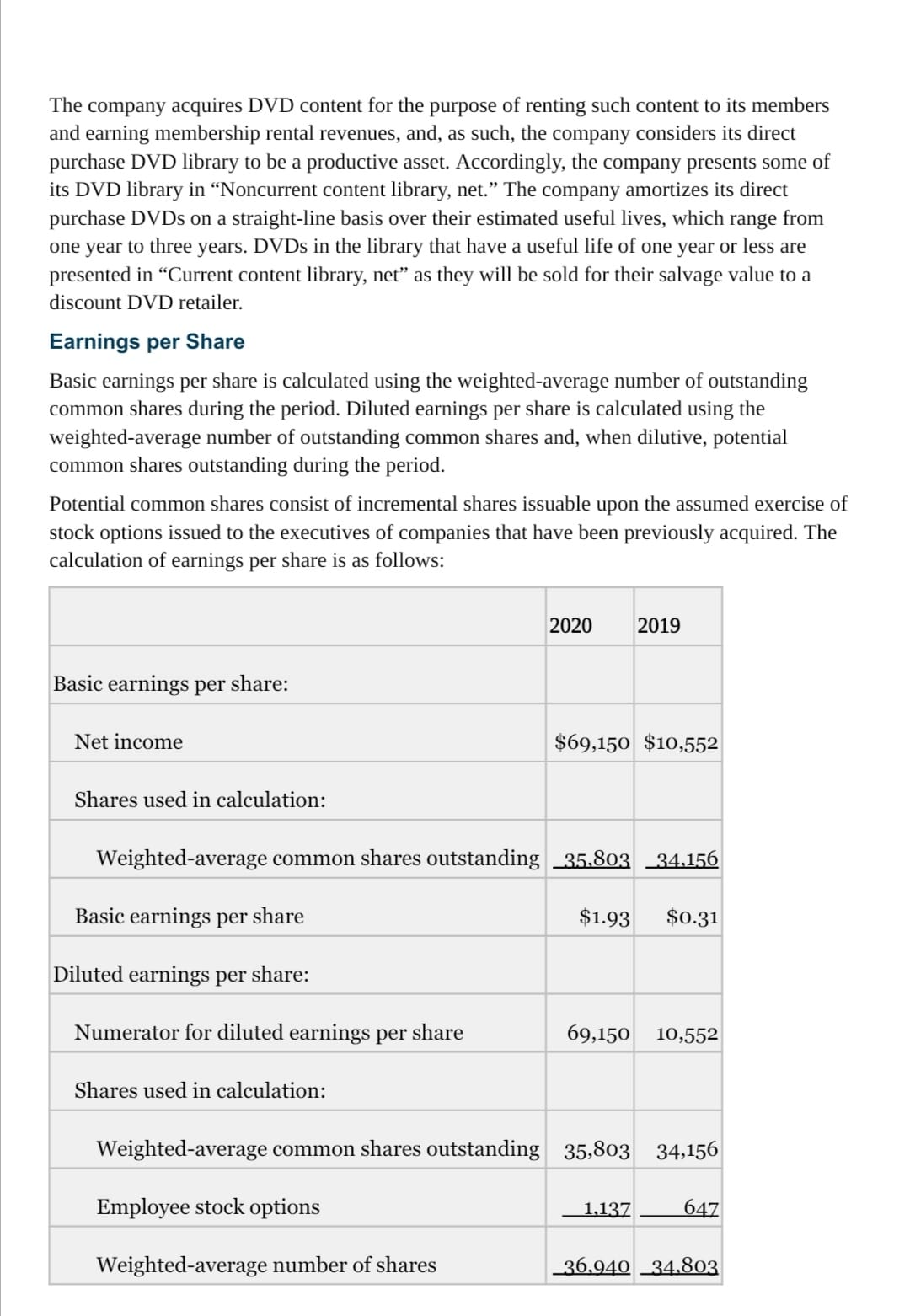

You have recently been hired as an assistant to the controller. The accounting group has put together a draft statement of nancial position and operations based on all routine and recurring transactions (Exhibit 1). Your rst assignment is to help the mntroller determine the appropriate reporting for the current year's new and nonroutine transactions. Exhibit I Draft Financial Statements Teleix, Inc. Statements of Financial Position (Unaudited) (In thousands) DRAFT AUDITED W W Assets Current assets Cash and cash equivalents Short-term investments Current content library, net Other current assets 3,421 ,23 Total current assets $1,881,737 $1,378,524 Noncurrent content library, net 1, 286, 417 926,489 Property, plant, and equipment, net 82,193 81,010 Total assets $3.329,783 $2.441.028 Liabilities and Shareholders' Equity Current liabilities Current content liabilities $1,092,576 $? 840,878 Accounts payable 66,709 53,195 Accrued expenses 33,232 32,691 Deferred revenue 132,739 104.258 Total current liabilities 1,325,256 1,031,022 Noncurrent content liabilities 827,801 662,333 Long-term debt 307,598 123,039 Long-term debt due to related party 0 123,039 Other noncurrent liabilities 48.728 43.476 Total liabilities $2,509,383 $1,982,909 Shareholders' equity Preferred shares $ 37 $ 34 Common shares 478,278 185,553 Accumulated other comprehensive income (loss) 2,199 1,796 Retained earnings 339.886 270,736 Total shareholders' equity 820.400 458,119 Total liabilities and shareholders' equity $3,329,783 $2,441.028Teleflix, Inc. Statements of Operations (Unaudited) (In Thousands, Except Per Share Data) DRAFT AUDITED December 31, 2020 December 31, 2019 Revenues $2,691,210 $2,220,413 Cost of revenues 1,917,689 1,631,534 Marketing 289,106 270,199 Technology and development 233,017 202,404 General and administrative 110.920 85.522 Operating income (loss) $ 140,478 $ 30,754 Other income (expense): Interest expense (14,387) (12,295) Interest and other income (expense) (5,388) 292 Loss on extinguishment of debt (15,459) 0 Income (loss) before income taxes 105,244 18,751 Provision (benefit) for income taxes 36.094 8,199 Net income (loss) $ 69,150 $ 10.552 Earnings per share: Basic $1.93 $0.31Weighted-average common shares outstanding: You are provided with a snapshot of the company's relevant accounting policies W and a le outlining key accounting issues regarding the nonroutine and new transactions W. The controller has requested that you prepare a report that discusses the nonroutine accounting issues and provides a preliminary recommendation. Specically, the controller would like to understand the impacts of these transactions on the company EPS and debt to equity ratio calculations. The controller reminds you that the income tax expense and deferred tax amounts will be determined by the tax specialist group. Exhibit Accounting Policies Streaming Content The company licenses rights to stream TV shows, movies, and original content to members for unlimited viewing. These licenses are for a fixed fee and specify license \"windows\" (time periods in which the content may be shown) that generally range from six months to five years. Payment terms may extend over the license window, or may require more payments, as is typically the case for original content. The company capitalizes the fee per title and records a corresponding liability when the license period begins, the cost of the title is known, and the title is accepted and available for streaming. For example: Current Content Library xxx Content Liability or Cash xxx The portion available for streaming within one year is recognized as \"Current content library and the remaining portion as \"Noncurrent content library.\" If the cost per title cannot be reasonably estimated, the license fee is not capitalized and costs are expensed as payments are made. However, this does not occur often. DVD Content Library Diluted earnings per share I $1.87 $0.30 Exhibit HI Accounting Issues TeleBox The Domestic DVD segment has seen signicant declines in recent years. The number of DVD subscribers has declined by 56% and 24% over the last two years, respectively. The declining trend is likely due to the availability of many blockbusters through pay-per-view offered by cable providers and the availability of DVDs through different mediums. Since the Domestic DVD segment has provided a strong contribution to the overall protability of Telejx, management decided to explore different options for revamping the service offering. Accordingly, on July 1, 2020, the company launched TeleBox, a digitally automated distribution system that allows subscribers to rent DVDs and Blu-rays at various locations across Canada. The TeleBox is similar to a candy-vending machine, but it allows subscribers to receive and return discs. Discs can be returned at any Telech location. During the year, the company launched the concept in several large Canadian cities. Useil Life of Discs Inventory Due to the increased wear and tear on the discs from the use of the vending machine system, the useful life of the assets is expected to be reduced. As of year end 2020, approximately $150 million worth of DVD inventory has been transferred to the TeleBoxes. Approximately $60 million of the discs are classied as current. Approximately $90 million of the discs transferred are noncurrent assets that had an average remaining useful life of four years at the beginning of the year and amortization of $22.5 million has been recorded in the nancial statements. The useful life of the assets has been revised to three years. Lease Agreement Teleix entered into a lease agreement with Grasshopper Ltd. in order to offset the large, upfront capital costs of the disc vending machines. Grasshopper Ltd. worked with Teleix to design and develop customized vending machines that are fully integrated into Teleix's IT systems. Without the lease agreement, the machines would have required an upfront price tag of $10.5 million. However, the lease agreement allows Teleix to make annual payments of $1,857,717.61 over a six-year period. The rst payment is to be made on July 1, 2021. The vending machines have a 10-year useful life. At the end of the lease term, Teleix can purchase the equipment for a cost equal to their fair market value. The interest rate implicit in the lease is 6% (which also reects marginal borrowing rates). No journal entries have been recorded in regards to the leased assets because no payment has been made. Long-Term Debt At the beginning of the year, the company renanced its longterm debt and related-party debt (of $123,039,000 each) for a new debt issuance with a face value of $300,000,000, coupon rate of 5% (paid annually), and 10-year maturity. The bond yields a market rate of 4. 677196 (2% riskfree rate plus a 2.6771% risk premium) and has been recorded at $307,598,000. The bond offers holders the right to convert $150 in bond face value into a common share. Currently, the company's common shares were trading at $165. If not for the conversion feature, the bonds would have likely traded at par at the time of issuance. The rst bond payment will be made on January 1, 2021. Interest has been accrued and recorded in the interest expense line item. Commitments and Contingencies In June 2020, ClickFlixes led a complaint against Teleix Inc. for patent infringement in the United States District Court- The complaint alleges, among other things, that the company's payment technology used by the TeleBox machines infringes on a patent owned by ClickFlixes. Specically, ClickFlixes purports that the TeleBox infringes on \"Integrated Customer-to-Business Video Rental Automation Payment System\" (US. Patent No. 123456789) and is seeking monetary damages of $10 million, and the cost of legal fees (approximately $500,000). The court's decision on the lawsuit is pending the outcome of the US. Patent and Trademark Office's re-examination of the patent. The company's lawyers are disputing the allegations of wrongdoing and intend to defend the company vigorously in this matter. Therefore, nothing has been recognized or disclosed in the nancial statements. The company is constantly involved in litigation related to patent infringement. Experience suggests that 55% of the cases are successfully defended, while 35% of the cases result in 50% of damages and costs being paid, and 10% of the cases result in 100% of the damages and costs being paid. The current team of lawyers considers this lawsuit to be in the similar nature of past claims. Streaming Content Library The value of the streaming content library is broken down as follows (000's): Current content library, net $1,049,782 Noncurrent content library, net Total content library DVD content a; 350,430 Streaming content Total content library Under the most likely scenario, future cash ows have been estimated at year end for the streaming content as follows ($000's): 1,687,904 397.154 297.865 2.382.923 3 Total 1.350.323 317.723 238,292 1,906,338 Share-Based Compensation At the beginning of the 2020 scal year, management of the company received a total of 50,000 call options as part of their compensation package. The options carry a strike price of $175 per share, and can be exercised any time over the next three years. The stock options were issued out of the money (i.e., the shares were trading at $160 per share at the time of issuance) so that there would be no intrinsic value, and therefore no compensation expense. None of the options were exercised at year end. The stock options are expected to have a service period of three years. The company acquires DVD content for the purpose of renting such content to its members and earning membership rental revenues, and, as such, the company considers its direct purchase DVD library to be a productive asset. Accordingly, the c0mpany presents some of its DVD library in \"Noncurrent content library, net.\" The company amortizes its direct purchase DVDs on a straight-line basis over their estimated useful lives, which range from one year to three years. DVDs in the library that have a useful life of one year or less are presented in \"Current content library, net" as they will be sold for their salvage value to a discount DVD retailer. Earnings per Share Basic earnings per share is calculated using the weightedaverage number of outstanding common shares during the period. Diluted earnings per share is calculated using the weightedaverage number of outstanding common shares and, when dilutive, potential common shares outstanding during the period. Potential common shares consist of incremental shares issuable upon the assumed exercise of stock options issued to the executives of companies that have been previously acquired. The calculation of earnings per share is as follows: Basic earnings per share: Net income | $69,150 Shares used in calculation: Weighted-average common shares outstan ' Basic earnings per share Diluted earnings per share: Numerator for diluted earnings per share Shares used in calculation: Weightedaverage common shares outstanding 35,803 34,156 Employee stock options | 1,131 Q41 Weighted-average number of shares ' 3.6.9451 34393