Question: Using the data complete the contribution margin report. (I did the first column) Actual Results 4,477 44,770.0000 Master Budget 3,200 32,000.0000 $ No. of Hawklet

Using the data complete the contribution margin report. (I did the first column)

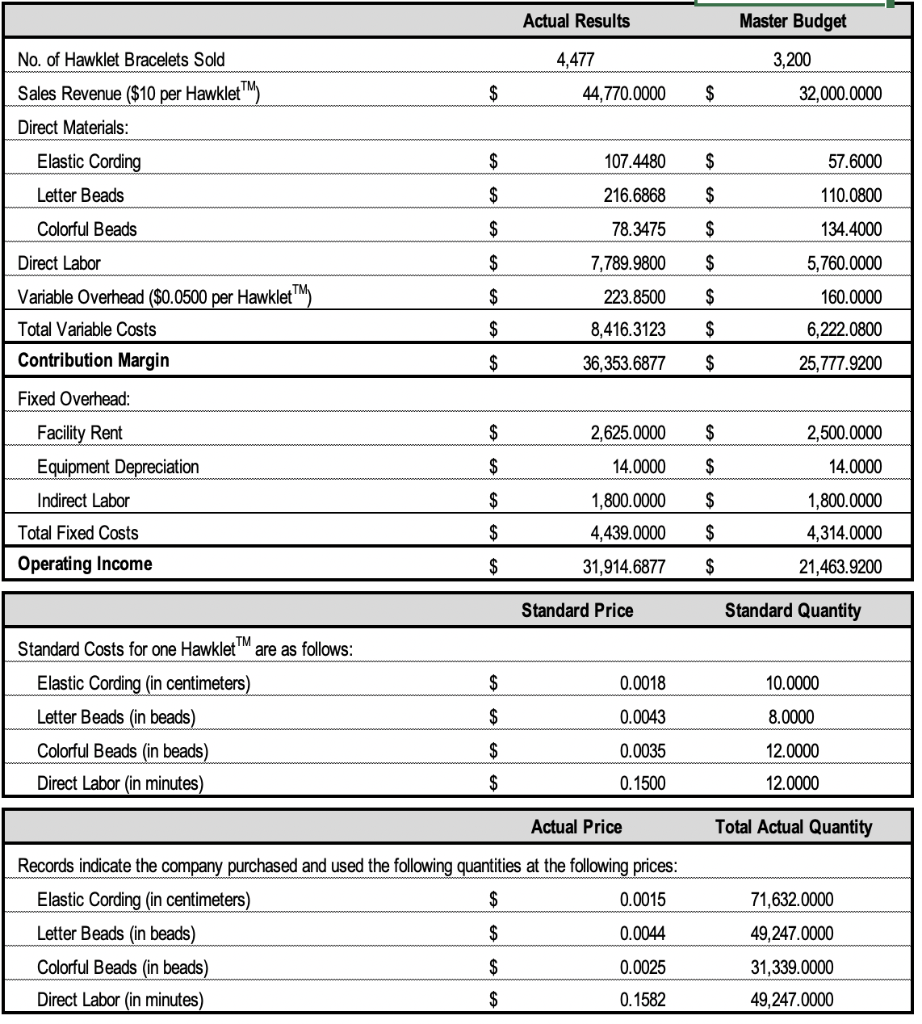

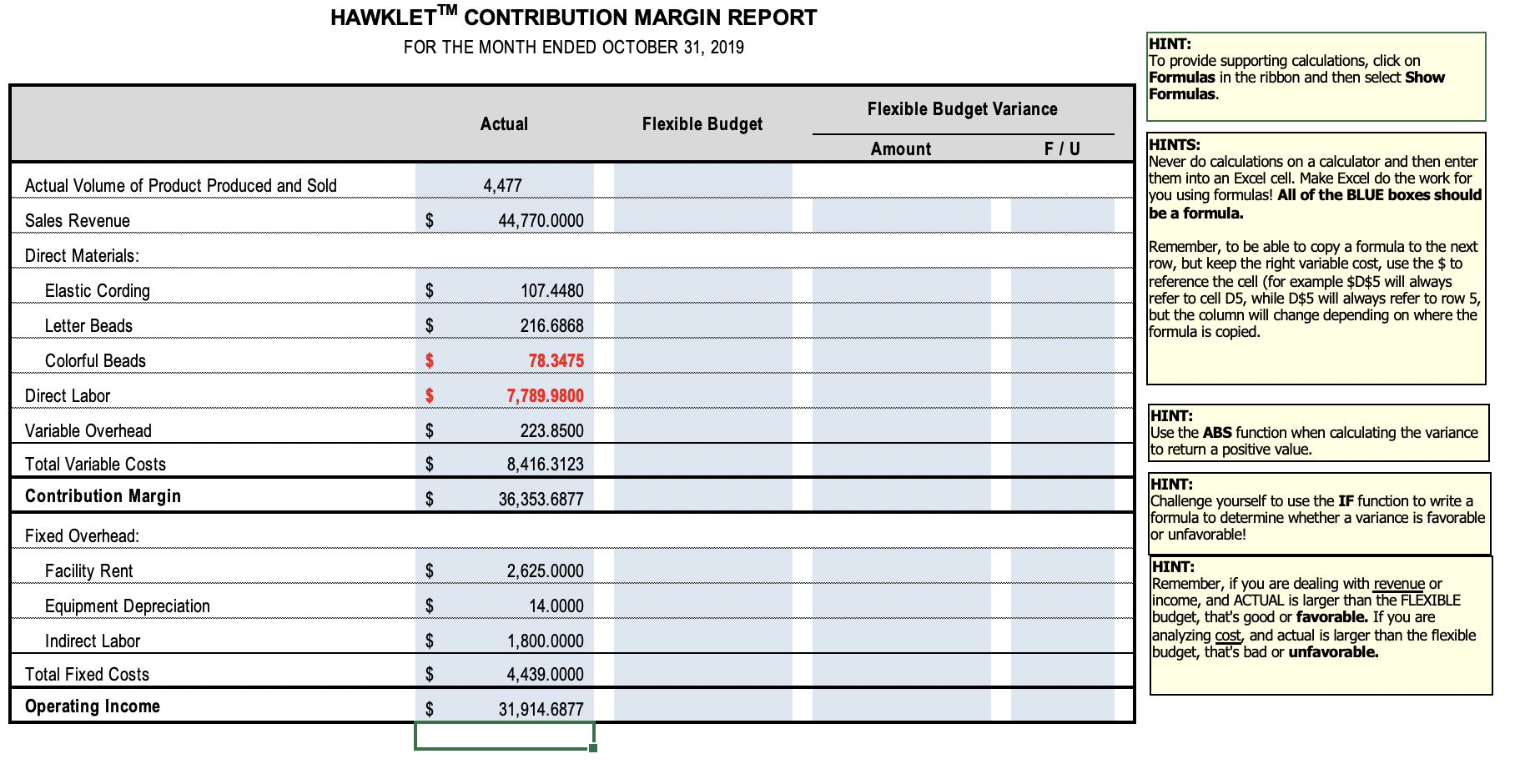

Actual Results 4,477 44,770.0000 Master Budget 3,200 32,000.0000 $ No. of Hawklet Bracelets Sold Sales Revenue ($10 per Hawklet Direct Materials: Elastic Cording Letter Beads Colorful Beads 107.4480 57.6000 216.6868 110.0800 78.3475 134.4000 Direct Labor Variable Overhead ($0.0500 per Hawklet) Total Variable Costs Contribution Margin 7,789.9800 223.8500 8,416.3123 36,353.6877 $ $ $ $ $ $ $ 5,760.0000 160.0000 6,222.0800 25,777.9200 $ $ 2,500.0000 14.0000 Fixed Overhead: Facility Rent Equipment Depreciation Indirect Labor Total Fixed Costs Operating Income 2,625.0000 14.0000 1,800.0000 4,439.0000 31,914.6877 $ $ 1,800.0000 4,314.0000 21,463.9200 Standard Price Standard Quantity 10.0000 Standard Costs for one HawkletTM are as follows: Elastic Cording (in centimeters) Letter Beads (in beads) Colorful Beads (in beads) Direct Labor (in minutes) 8.0000 0.0018 0.0043 0.0035 0.1500 12.0000 12.0000 $ Actual Price Total Actual Quantity Records indicate the company purchased and used the following quantities at the following prices: Elastic Cording (in centimeters) 0.0015 Letter Beads (in beads) 0.0044 Colorful Beads (in beads) 0.0025 Direct Labor (in minutes) 0.1582 71,632.0000 49,247.0000 31,339.0000 49,247.0000 HAWKLET CONTRIBUTION MARGIN REPORT FOR THE MONTH ENDED OCTOBER 31, 2019 HINT: To provide supporting calculations, click on Formulas in the ribbon and then select Show Formulas. Flexible Budget Variance Actual Flexible Budget Amount FIU Actual Volume of Product Produced and Sold 4,477 HINTS: Never do calculations on a calculator and then enter them into an Excel cell. Make Excel do the work for you using formulas! All of the BLUE boxes should be a formula. Sales Revenue 44.770.0000 Direct Materials: Elastic Cording $ 107.4480 216.6868 Remember, to be able to copy a formula to the next row, but keep the right variable cost, use the $ to reference the cell (for example $D$5 will always refer to cell D5, while D$5 will always refer to row 5, but the column will change depending on where the formula is copied. Letter Beads Colorful Beads 78.3475 Direct Labor Variable Overhead 7,789.9800 223.8500 8,416.3123 36,353.6877 HINT: Use the ABS function when calculating the variance to return a positive value. Total Variable Costs Contribution Margin $ IHINT: Challenge yourself to use the IF function to write a formula to determine whether a variance is favorable or unfavorable! Fixed Overhead: Facility Rent $ 2,625.0000 Equipment Depreciation 14.0000 HINT: Remember, if you are dealing with revenue or income, and ACTUAL is larger than the FLEXIBLE budget, that's good or favorable. If you are analyzing cost, and actual is larger than the flexible budget, that's bad or unfavorable. Indirect Labor 1,800.0000 $ 4,439.0000 Total Fixed Costs Operating Income $ 31,914.6877

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts