Question: Using the data for The Stephenson Company, what is Net Present Value of the proposed investment using a 12% discount rate? a. (33,285) 83,221 3,997

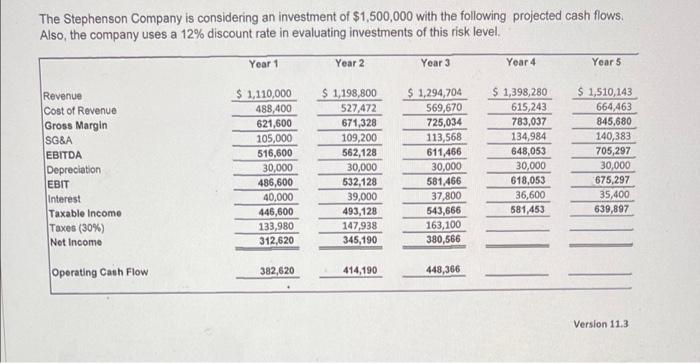

Using the data for The Stephenson Company, what is Net Present Value of the proposed investment using a 12% discount rate? a. (33,285) 83,221 3,997 125,331 Ob. Oc O d. The Stephenson Company is considering an investment of $1,500,000 with the following projected cash flows. Also, the company uses a 12% discount rate in evaluating investments of this risk level. Year 1 Year 2 Year 3 Year 4 Year 5 Revenue $1,110,000 $1,198,800 $1,294,704 $ 1,398,280 $ 1,510,143 Cost of Revenue 488,400 527,472 569,670 615,243 664,463 Gross Margin 621,600 671,328 725,034 783,037 845,680 SG&A 105,000 109,200 113,568 134,984 140,383 EBITDA 516,600 562,128 611,466 648,053 705,297 Depreciation 30,000 30,000 30,000 30,000 30,000 EBIT 486,600 532,128 581,466 618,053 675,297 Interest 40,000 39,000 37,800 36,600 35,400 Taxable Income 446,600 493,128 543,666 581,453 639,897 Taxes (30%) 133,980 147,938 163,100 Net Income 312,620 345,190 380,566 Operating Cash Flow 382,620 414,190 448,366 Version 11.3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts