Question: Using the data given, calculate for EACH location (New Orleans, Bordeaux, and Tel Aviv): TOTAL Cost of Producing 100,000 Window units. (3 Points) Cost of

Using the data given, calculate for EACH location (New Orleans, Bordeaux, and Tel Aviv):

TOTAL Cost of Producing 100,000 Window units. (3 Points)

Cost of Producing ONE unit. (1 Points)

TOTAL Cost of Distributing 100,000 Window units to the four markets. (6 Points)

TOTAL Supply Chain Costs (i.e., Production + Distribution). (3 Points)

Please upload your spreadsheet.

Which manufacturing location provides Southern Air-Conditioning with the greatest cost savings? (2 Points)

Besides cost, location determinants often include land acquisition costs, accessibility, taxes, and other similar tangible and quantifiable factors. Qualitative factors, such as culture, political climate, and risk are equally important (if not more so, in some cases). What is the role of these (and other) intangible factors, on the location you have recommended in Question 2? (5 Points)

Southern Air-Conditioning would like to locate the new plant in New Orleans. The only cost item they can impact and change is LABOR COST. Using the analysis in Question 1, what should it be, if New Orleans was to be lowest cost option? [in $/unit] (5 Points)

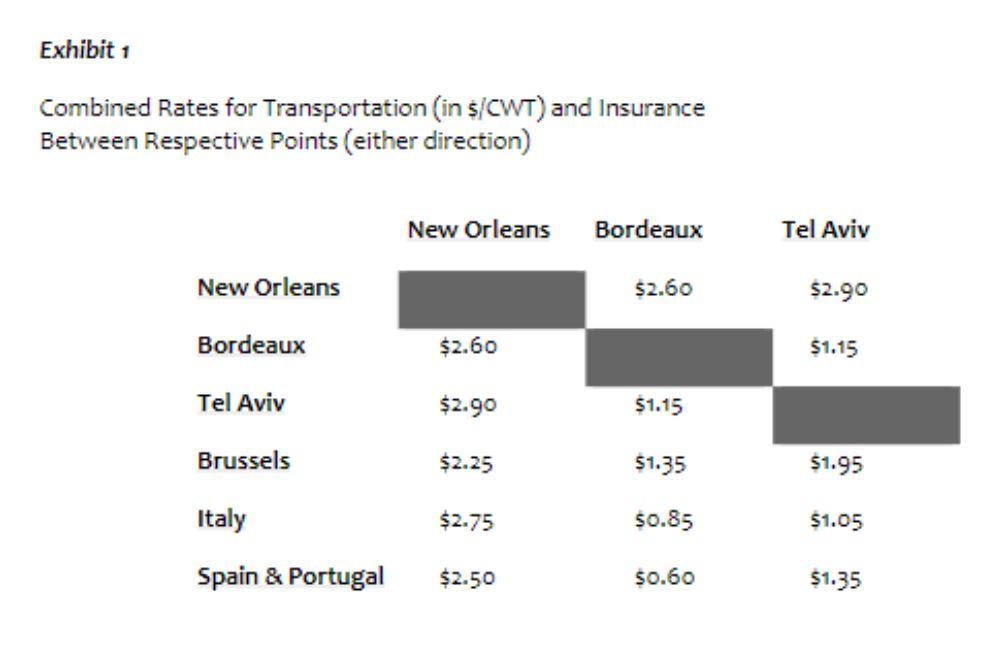

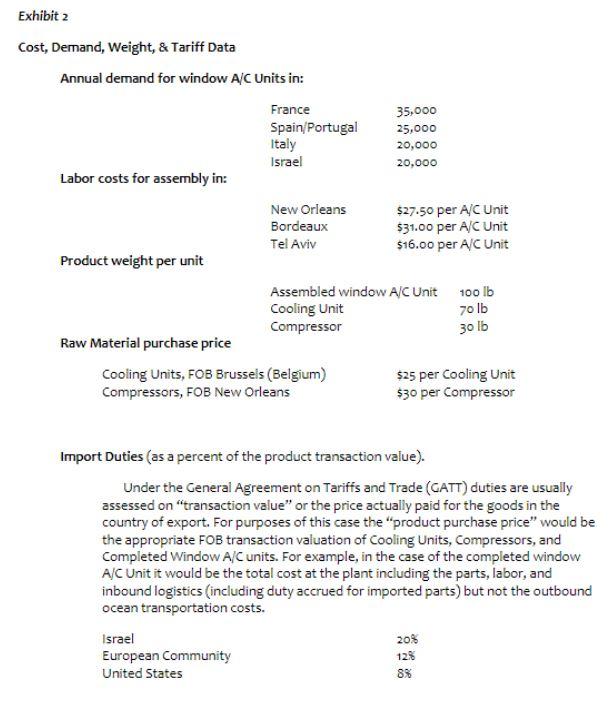

Exhibit 1 Combined Rates for Transportation (in $/CWT ) and Insurance Between Respective Points (either direction) Cost, Demand, Weight, \& Tariff Data Annual demand for window A/C Units in: Import Duties (as a percent of the product transaction value). Under the General Agreement on Tariffs and Trade (CATT) duties are usually assessed on "transaction value" or the price actually paid for the goods in the country of export. For purposes of this case the "product purchase price" would be the appropriate FOB transaction valuation of Cooling Units, Compressors, and Completed Window A/C units. For example, in the case of the completed window A/C Unit it would be the total cost at the plant including the parts, labor, and inbound logistics (including duty accrued for imported parts) but not the outbound ocean transportation costs. Exhibit 1 Combined Rates for Transportation (in $/CWT ) and Insurance Between Respective Points (either direction) Cost, Demand, Weight, \& Tariff Data Annual demand for window A/C Units in: Import Duties (as a percent of the product transaction value). Under the General Agreement on Tariffs and Trade (CATT) duties are usually assessed on "transaction value" or the price actually paid for the goods in the country of export. For purposes of this case the "product purchase price" would be the appropriate FOB transaction valuation of Cooling Units, Compressors, and Completed Window A/C units. For example, in the case of the completed window A/C Unit it would be the total cost at the plant including the parts, labor, and inbound logistics (including duty accrued for imported parts) but not the outbound ocean transportation costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts