Question: Using the data in Exhibit 8.5 for GIS, CPB, and SJM, estimate the value per share of K using an NOPAT multiple. Additional information for

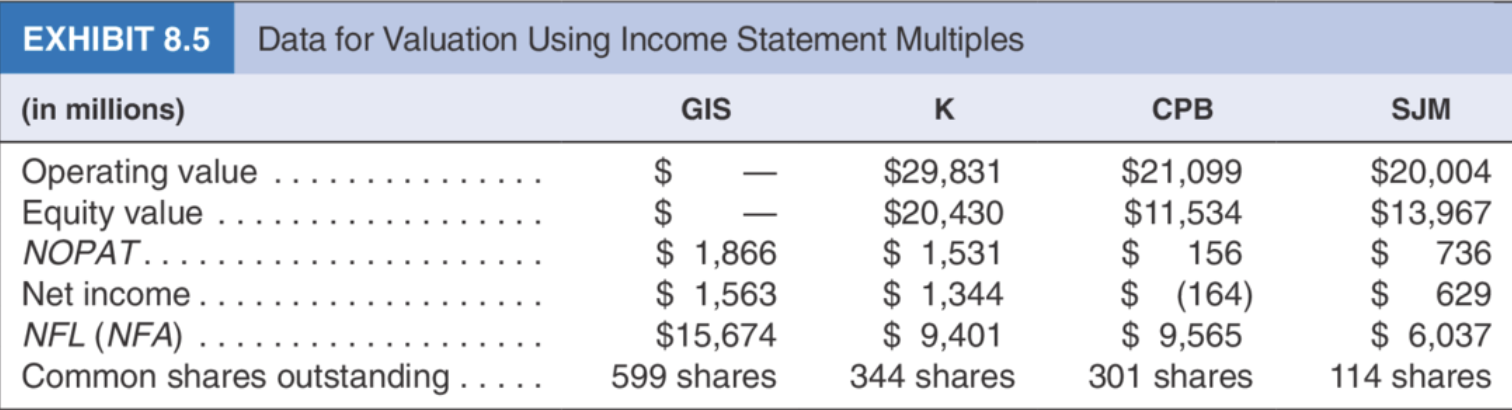

Using the data in Exhibit 8.5 for GIS, CPB, and SJM, estimate the value per share of K using an NOPAT multiple. Additional information for the process is that the operating value and equity value of GIS are $46,409 and $30,735, respectively. Determine whether, based on this estimate, K is over- or underpriced at its May 1, 2019 price of $59.39. Discuss the validity of the result and what drives your conclusions.

EXHIBIT 8.5 Data for Valuation Using Income Statement Multiples GIS K CPB SJM (in millions) Operating value Equity value NOPAT.... Net income. NFL (NFA) Common shares outstanding. $ $ $ 1,866 $ 1,563 $15,674 599 shares $29,831 $20,430 $ 1,531 $ 1,344 $ 9,401 344 shares $21,099 $11,534 $ 156 $ (164) $ 9,565 301 shares $20,004 $13,967 $ 736 $ 629 $ 6,037 114 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts