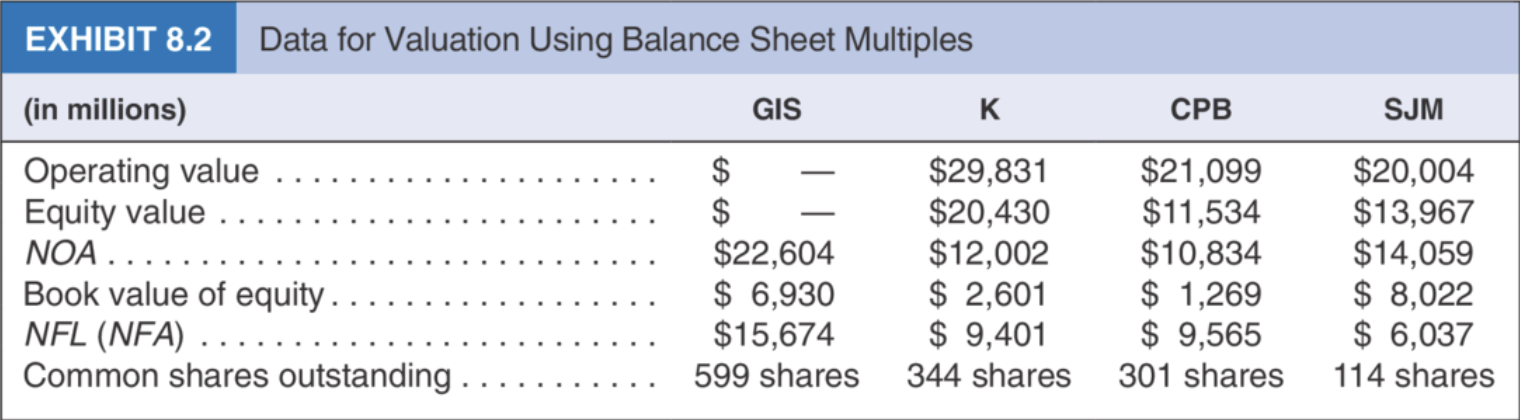

Question: Using the data in Exhibit 8.2 for GIS, CPB, and SJM, estimate the value per share of K using an NOA multiple. Additional information for

Using the data in Exhibit 8.2 for GIS, CPB, and SJM, estimate the value per share of K using an NOA multiple. Additional information for the process is that the operating value and equity value of GIS are $46,409 and $30,735 respectively. Determine whether, based on this estimate, K is over - or underpriced at its May 1, 2019, price of $59.39.

(Please show calculations on how to determine the estimate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts