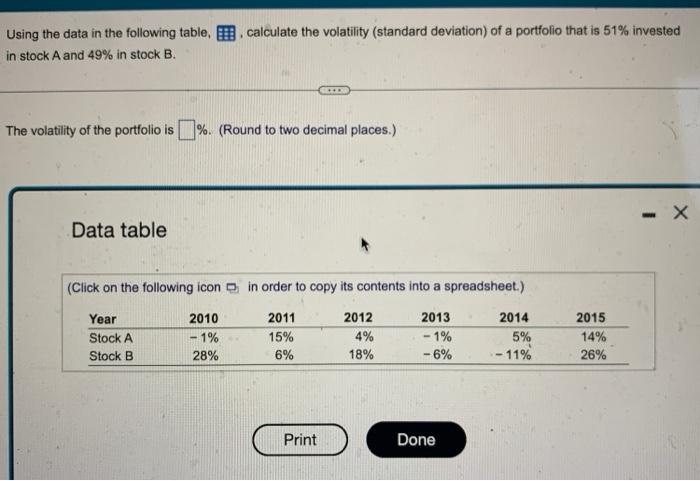

Question: Using the data in the following table, , calculate the volatility (standard deviation) of a portfolio that is 51% invested in stock A and 49%

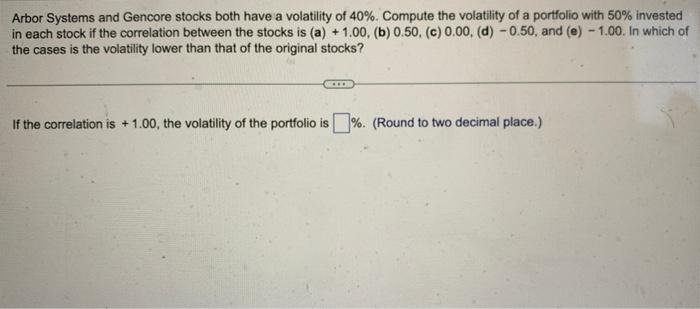

Using the data in the following table, , calculate the volatility (standard deviation) of a portfolio that is 51% invested in stock A and 49% in stock B. The volatility of the portfolio is \%. (Round to two decimal places.) Data table (Click on the following icon b in order to copy its contents into a spreadsheet.) Arbor Systems and Gencore stocks both have a volatility of 40%. Compute the volatility of a portfolio with 50% invested in each stock if the correlation between the stocks is (a) +1.00, (b) 0.50, (c) 0.00, (d) 0.50, and (e) 1.00. In which of the cases is the volatility lower than that of the original stocks? If the correlation is +1.00, the volatility of the portfolio is \%. (Round to two decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts