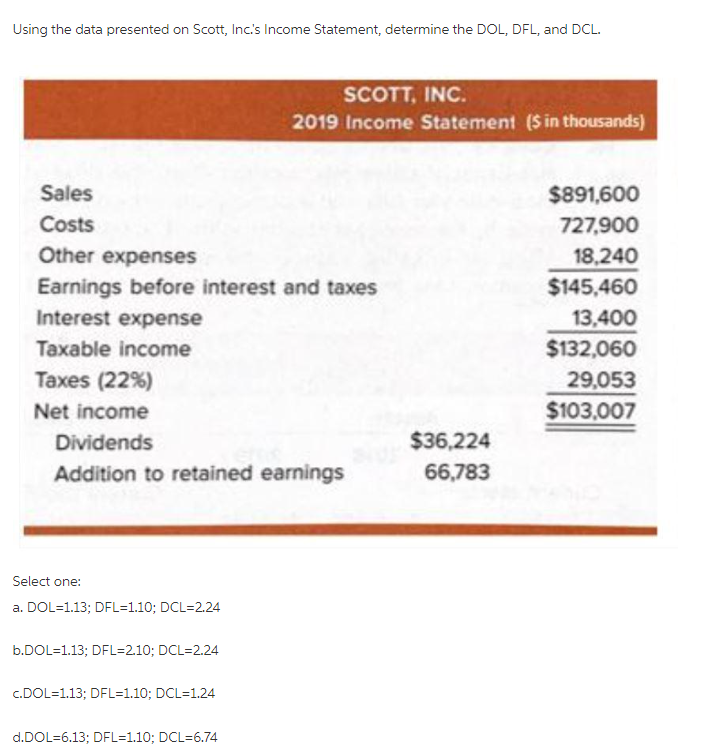

Question: Using the data presented on Scott, Inc's Income Statement, determine the DOL, DFL, and DCL. SCOTT, INC. 2019 Income Statement is in thousands) Sales Costs

Using the data presented on Scott, Inc's Income Statement, determine the DOL, DFL, and DCL. SCOTT, INC. 2019 Income Statement is in thousands) Sales Costs Other expenses Earnings before interest and taxes Interest expense Taxable income Taxes (22%) Net income Dividends Addition to retained earnings $891,600 727,900 18.240 $145,460 13,400 $132,060 29,053 $103.007 $36.224 66,783 Select one: a. DOL=1.13; DFL=1.10; DCL=2.24 b.DOL=1.13; DFL=2.10; DCL=2.24 C.DOL=1.13; DFL=1.10; DCL=1.24 d.DOL=6.13; DFL=1.10; DCL=6.74

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock