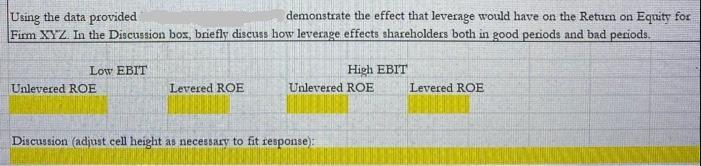

Question: Using the data provided demonstrate the effect that leverage would have on the Return on Equity for Firm XYZ. In the Discussion box, briefly

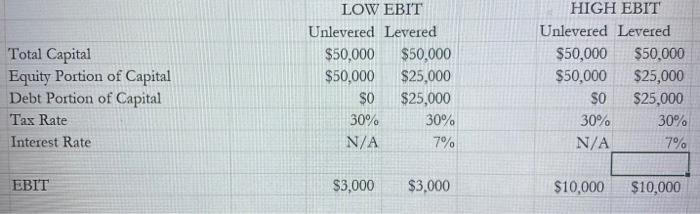

Using the data provided demonstrate the effect that leverage would have on the Return on Equity for Firm XYZ. In the Discussion box, briefly discuss how leverage effects shareholders both in good periods and bad periods. Low EBIT Unlevered ROE Levered ROE High EBIT Unlevered ROE Discussion (adjust cell height as necessary to fit response): Levered ROE Total Capital Equity Portion of Capital Debt Portion of Capital Tax Rate Interest Rate EBIT LOW EBIT Unlevered Levered $50,000 $50,000 $50,000 $25,000 $25,000 $0 30% N/A $3,000 30% 7% $3,000 HIGH EBIT Unlevered Levered $50,000 $50,000 $50,000 $25,000 $25,000 $0 30% N/A $10,000 30% 7% $10,000

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Calculate the ROE in both scenarios one with low EBIT and one with high EBIT as follows Low EBIT Sce... View full answer

Get step-by-step solutions from verified subject matter experts