Question: Using the data provided in sheets 'Weights' and 'Asset Returns', please build a portfolio that replicates the XLV - US EFT and report for the

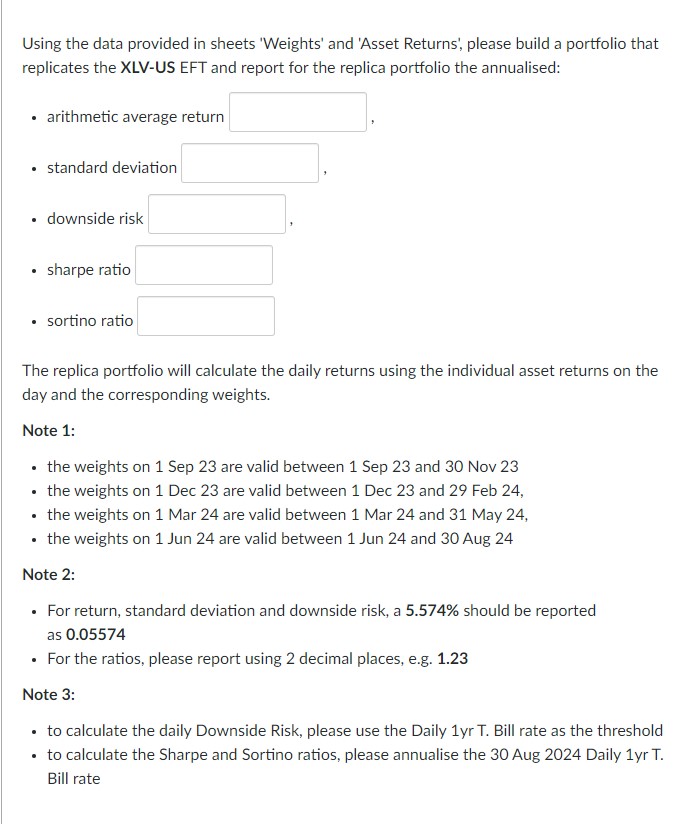

Using the data provided in sheets 'Weights' and 'Asset Returns', please build a portfolio that replicates the XLVUS EFT and report for the replica portfolio the annualised:

arithmetic average return

standard deviation

downside risk

sharpe ratio

sortino ratio

The replica portfolio will calculate the daily returns using the individual asset returns on the day and the corresponding weights.

Note :

the weights on Sep are valid between Sep and Nov

the weights on Dec are valid between Dec and Feb

the weights on Mar are valid between Mar and May

the weights on Jun are valid between Jun and Aug

Note :

For return, standard deviation and downside risk, a should be reported as

For the ratios, please report using decimal places, eg

Note :

to calculate the daily Downside Risk, please use the Daily yr T Bill rate as the threshold

to calculate the Sharpe and Sortino ratios, please annualise the Aug Daily yr T Bill rate Using the data provided in sheets 'Weights' and 'Asset Returns', please build a portfolio that replicates the XLVUS EFT and report for the replica portfolio the annualised:

arithmetic average return

standard deviation

downside risk

sharpe ratio

sortino ratio

The replica portfolio will calculate the daily returns using the individual asset returns on the day and the corresponding weights.

Note :

the weights on Sep are valid between Sep and Nov

the weights on Dec are valid between Dec and Feb

the weights on Mar are valid between Mar and May

the weights on Jun are valid between Jun and Aug

Note :

For return, standard deviation and downside risk, a should be reported as

For the ratios, please report using decimal places, eg

Note :

to calculate the daily Downside Risk, please use the Daily yr T Bill rate as the threshold

to calculate the Sharpe and Sortino ratios, please annualise the Aug Daily yr T Bill rate Daily Risk Free Rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock