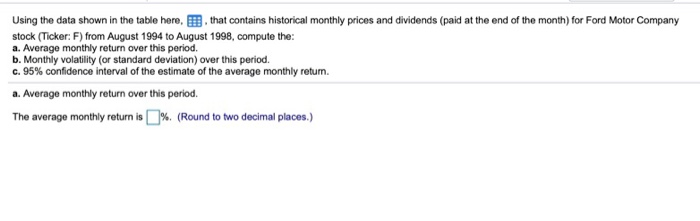

Question: using the data shown in the table here, , that contains historical monthly prices and dividends paid at the end of the month for Ford

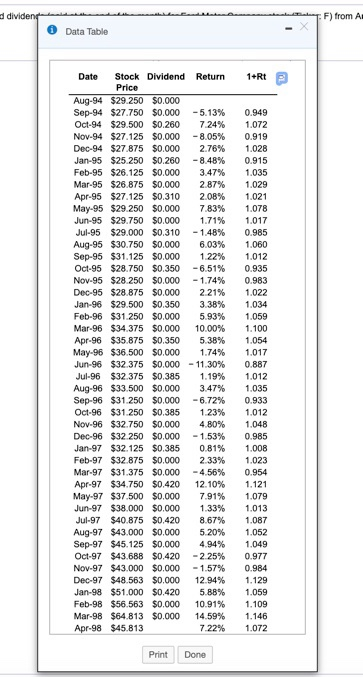

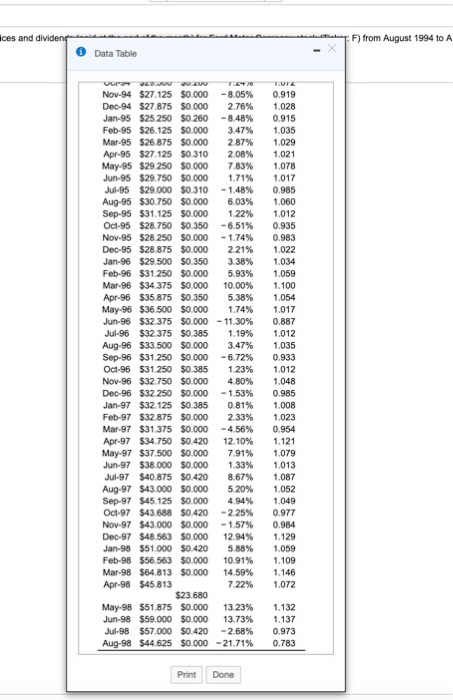

using the data shown in the table here, , that contains historical monthly prices and dividends paid at the end of the month for Ford Motor Company stock (Ticker: F) from August 1994 to August 1998, compute the: a. Average monthly return over this period. b. Monthly volatility (or standard deviation) over this period. c.95% confidence interval of the estimate of the average monthly return. a. Average monthly return over this period. The average monthly return is[ ]%. (Round to two decimal places.) F) from A Data Table Date Stock Dividend Return1+Rt Aug-94 Sep-94 Oct-94 Nov-94 Dec-94 Jan-95 Feb-95 Mar-95 Apr-95 May-95 Jun-95 Jul-95 Aug-95 Sep-95 Oct-95 Nov-95 Dec-95 Jan-96 Feb-96 Mar-96 Apr-96 May-96 Jun-96 Jul-96 Aug-96 Sep-96 Oct-96 Nov-96 Dec-96 Jan-97 Feb-97 Mar-97 Apr-97 May-97 Jun-97 Jul-97 Aug-97 Sep-97 Oct-97 Nov-97 Dec-97 Jan-98 Feb-98 Mar-98 Apr-98 Price $29.250 S27.750 S29.500 $27.125 S27875 $25.250 $26.125 S26 875 $27.125 $29.250 $29.750 $29.000 $30.750 $31.125 $28.750 $28.250 $28.875 $29.500 $31.250 $34.375 $35.875 $36.500 $32.375 $32.375 $33.500 $31.250 $31.250 $32.750 $32.250 $32.125 $32.875 $31.375 $34.750 $37.500 $38.000 $40.875 $43.000 $45.125 $43.688 $43.000 $48.563 $51.000 $56.563 $64.813 $45.813 $0.000 $0.000-5.13% S0.260 7.24% $0.000-8.05% $0.000 2.76% $0.260-8.48% $0.000 3.47% $0.000 2.87% $0.310 2.08% $0.000 7.83% $0.000 1.71% $0.310-1.48% $0.000 6.03% $0.000 1.22% $0.350-6.51% $0.000-1.74% $0.000 2.21% $0.350 3.38% $0.000 5.93% $0.000 10.00% $0.350 5.38% $0.000 1.74% $0.000-11.30% $0.385 1.19% $0.000 3.47% $0.000-6.72% $0.385 1.23% $0.000 4.80% $0.000-1.53% $0.385 0.81% $0.000 2.33% $0.000-4.56% $0.420 12.10% $0.000 7.91% $0.000 1.33% $0.420 8.67% $0.000 5.20% $0.000 4.94% $0.420-2.25% $0.000-1.57% $0.000 12.94% $0.420 5.88% $0.000 10.91% $0.000 14.59% 0.949 1.072 0.919 1.028 0.915 1.035 1.029 1.021 1.078 1.017 0.985 1.060 1.012 0.935 0.983 1.022 1.034 1.059 1.100 1.054 1.017 0.887 1.012 1.035 0.933 1.012 1.048 0.985 1.008 1.023 0.954 1.121 1.079 1.013 1.087 1.052 1.049 0.977 0.984 1.129 1.059 1.109 1.146 722% 1072 Print Done ces and divident F) from August 1994 to A Data Table Nov-94 $27 125 $0.000-8.05% Dec-94$27.875$0.000 2.76% Jan-95 S25250 $0260-8.48% Feb-95 $26.125 $0.000 3.47% Mar-95 $26.875 $0.000 2.87% Apr-95 $27125 $0.310 2.08% May-95$29250 $0.000 7.83% Jun-95$29 750$0 000 1.71% Jul-95 $29 000 $0.310-1.48% Aug-95530 750$0000 6.03% Sep-95$31 125$0.000 1.22% Oct-95 $28.750$0.350-6.51% Nov-95$28.250$0.000-1.74% Dec-95 S28875$0.000 2.21% Jan-96 $29.500$0.350 3.38% Feb-96 $31.250 $0.000 5.93% Mar-96534375 $0.000 10.00% Apr-96 $35.875$0.350 5.38% May-96$36.500$0.000 1.74% Jun-96 $32.375 $0.000-11.30% Jul-96$32.375 $0.385 1.19% Aug-96 $33.500$0.000 3.47% Sep-96$31.250$0 000-6.72% Oct-96 $31.250$0.385 1.23% Nov-96$32.750$0.000 4.80% Dec-96$32.250$0.000-1.53% Jan-97 $32.125 $0.385 0.81% Feb-97$32.875$0.000 2.33% Mar-97 $31.375 $0.000-4.56% Apr-97$34.750$0.420 12.10% May-97$37.500 SO 7.91% Jun-97 $38.000$0.000 1.33% Jul-97 $40.875$0.420 8.67% Aug-97 $43.000 $0.000 5.20% Sep-97 $45.125 $0.000 4.94% Oct-97 $43 688 $0420-2.25% Nov-97 $43000$0000-1.57% Dec-97 $48.563 $0000 12.94% Jan-98$51.000$0.420 5.88% Feb-98$56.563 $0.000 10.91% Mar.98 $64.813$0.000 14.59% Apr-98 $45.813 0.919 1.028 0.915 1.035 1.029 1.021 1.078 1.017 0.985 1.060 1.012 0.935 O.983 1.022 1.034 1.059 1.100 1.054 1.017 0.887 1.012 1.035 0.933 1.012 1.048 0.985 1.008 1.023 0.954 1.121 1.079 1.013 1.087 1.052 1.049 0.977 0.984 1.129 1.059 1.109 1.146 7.22% 1.072 May-98 Jun-98 Jul-98 Aug-98 $51.875 $59.000 $57.000 $44.625 $0.000 13.23% $0.000 13.73% $0.420-2.68% $0.000-21.71% 1.132 1.137 0.973 0.783 Print Done using the data shown in the table here, , that contains historical monthly prices and dividends paid at the end of the month for Ford Motor Company stock (Ticker: F) from August 1994 to August 1998, compute the: a. Average monthly return over this period. b. Monthly volatility (or standard deviation) over this period. c.95% confidence interval of the estimate of the average monthly return. a. Average monthly return over this period. The average monthly return is[ ]%. (Round to two decimal places.) F) from A Data Table Date Stock Dividend Return1+Rt Aug-94 Sep-94 Oct-94 Nov-94 Dec-94 Jan-95 Feb-95 Mar-95 Apr-95 May-95 Jun-95 Jul-95 Aug-95 Sep-95 Oct-95 Nov-95 Dec-95 Jan-96 Feb-96 Mar-96 Apr-96 May-96 Jun-96 Jul-96 Aug-96 Sep-96 Oct-96 Nov-96 Dec-96 Jan-97 Feb-97 Mar-97 Apr-97 May-97 Jun-97 Jul-97 Aug-97 Sep-97 Oct-97 Nov-97 Dec-97 Jan-98 Feb-98 Mar-98 Apr-98 Price $29.250 S27.750 S29.500 $27.125 S27875 $25.250 $26.125 S26 875 $27.125 $29.250 $29.750 $29.000 $30.750 $31.125 $28.750 $28.250 $28.875 $29.500 $31.250 $34.375 $35.875 $36.500 $32.375 $32.375 $33.500 $31.250 $31.250 $32.750 $32.250 $32.125 $32.875 $31.375 $34.750 $37.500 $38.000 $40.875 $43.000 $45.125 $43.688 $43.000 $48.563 $51.000 $56.563 $64.813 $45.813 $0.000 $0.000-5.13% S0.260 7.24% $0.000-8.05% $0.000 2.76% $0.260-8.48% $0.000 3.47% $0.000 2.87% $0.310 2.08% $0.000 7.83% $0.000 1.71% $0.310-1.48% $0.000 6.03% $0.000 1.22% $0.350-6.51% $0.000-1.74% $0.000 2.21% $0.350 3.38% $0.000 5.93% $0.000 10.00% $0.350 5.38% $0.000 1.74% $0.000-11.30% $0.385 1.19% $0.000 3.47% $0.000-6.72% $0.385 1.23% $0.000 4.80% $0.000-1.53% $0.385 0.81% $0.000 2.33% $0.000-4.56% $0.420 12.10% $0.000 7.91% $0.000 1.33% $0.420 8.67% $0.000 5.20% $0.000 4.94% $0.420-2.25% $0.000-1.57% $0.000 12.94% $0.420 5.88% $0.000 10.91% $0.000 14.59% 0.949 1.072 0.919 1.028 0.915 1.035 1.029 1.021 1.078 1.017 0.985 1.060 1.012 0.935 0.983 1.022 1.034 1.059 1.100 1.054 1.017 0.887 1.012 1.035 0.933 1.012 1.048 0.985 1.008 1.023 0.954 1.121 1.079 1.013 1.087 1.052 1.049 0.977 0.984 1.129 1.059 1.109 1.146 722% 1072 Print Done ces and divident F) from August 1994 to A Data Table Nov-94 $27 125 $0.000-8.05% Dec-94$27.875$0.000 2.76% Jan-95 S25250 $0260-8.48% Feb-95 $26.125 $0.000 3.47% Mar-95 $26.875 $0.000 2.87% Apr-95 $27125 $0.310 2.08% May-95$29250 $0.000 7.83% Jun-95$29 750$0 000 1.71% Jul-95 $29 000 $0.310-1.48% Aug-95530 750$0000 6.03% Sep-95$31 125$0.000 1.22% Oct-95 $28.750$0.350-6.51% Nov-95$28.250$0.000-1.74% Dec-95 S28875$0.000 2.21% Jan-96 $29.500$0.350 3.38% Feb-96 $31.250 $0.000 5.93% Mar-96534375 $0.000 10.00% Apr-96 $35.875$0.350 5.38% May-96$36.500$0.000 1.74% Jun-96 $32.375 $0.000-11.30% Jul-96$32.375 $0.385 1.19% Aug-96 $33.500$0.000 3.47% Sep-96$31.250$0 000-6.72% Oct-96 $31.250$0.385 1.23% Nov-96$32.750$0.000 4.80% Dec-96$32.250$0.000-1.53% Jan-97 $32.125 $0.385 0.81% Feb-97$32.875$0.000 2.33% Mar-97 $31.375 $0.000-4.56% Apr-97$34.750$0.420 12.10% May-97$37.500 SO 7.91% Jun-97 $38.000$0.000 1.33% Jul-97 $40.875$0.420 8.67% Aug-97 $43.000 $0.000 5.20% Sep-97 $45.125 $0.000 4.94% Oct-97 $43 688 $0420-2.25% Nov-97 $43000$0000-1.57% Dec-97 $48.563 $0000 12.94% Jan-98$51.000$0.420 5.88% Feb-98$56.563 $0.000 10.91% Mar.98 $64.813$0.000 14.59% Apr-98 $45.813 0.919 1.028 0.915 1.035 1.029 1.021 1.078 1.017 0.985 1.060 1.012 0.935 O.983 1.022 1.034 1.059 1.100 1.054 1.017 0.887 1.012 1.035 0.933 1.012 1.048 0.985 1.008 1.023 0.954 1.121 1.079 1.013 1.087 1.052 1.049 0.977 0.984 1.129 1.059 1.109 1.146 7.22% 1.072 May-98 Jun-98 Jul-98 Aug-98 $51.875 $59.000 $57.000 $44.625 $0.000 13.23% $0.000 13.73% $0.420-2.68% $0.000-21.71% 1.132 1.137 0.973 0.783 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts