Question: Using the data that is shown below - (a) calculate the individual after-tax cash flow effect of each relevant item in each independent situation,

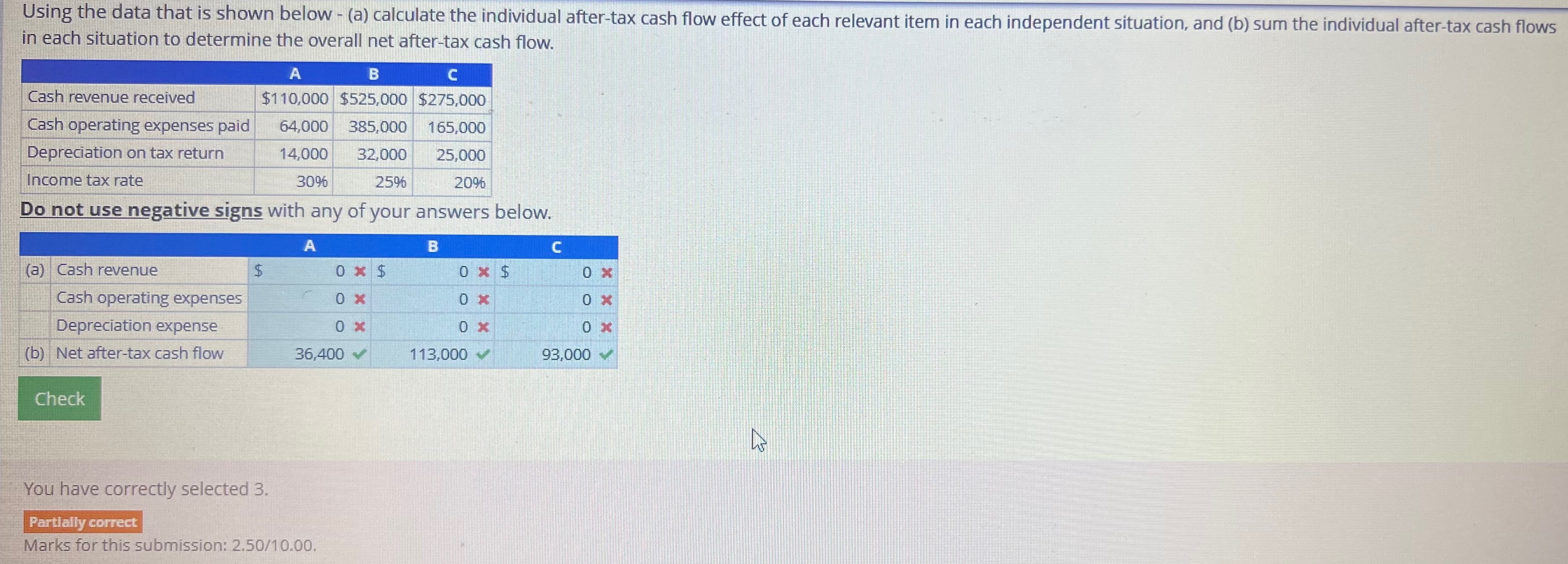

Using the data that is shown below - (a) calculate the individual after-tax cash flow effect of each relevant item in each independent situation, and (b) sum the individual after-tax cash flows in each situation to determine the overall net after-tax cash flow. A B Cash revenue received Cash operating expenses paid Depreciation on tax return C $110,000 $525,000 $275,000 64,000 385,000 165,000 14,000 32,000 25,000 30% 25% 20% Income tax rate Do not use negative signs with any of your answers below. A B C (a) Cash revenue $ 0 * $ 0 * $ 0 % Cash operating expenses Depreciation expense 0x 0* 0 % 0 % 0 % (b) Net after-tax cash flow 36,400 113,000 0 x 93,000 Check You have correctly selected 3. Partially correct Marks for this submission: 2.50/10.00. R

Step by Step Solution

There are 3 Steps involved in it

Answer To calculate the individual aftertax cash flow effect of each relevant item in each independent situation we need to apply the income tax rate ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

663e84246a622_955100.pdf

180 KBs PDF File

663e84246a622_955100.docx

120 KBs Word File