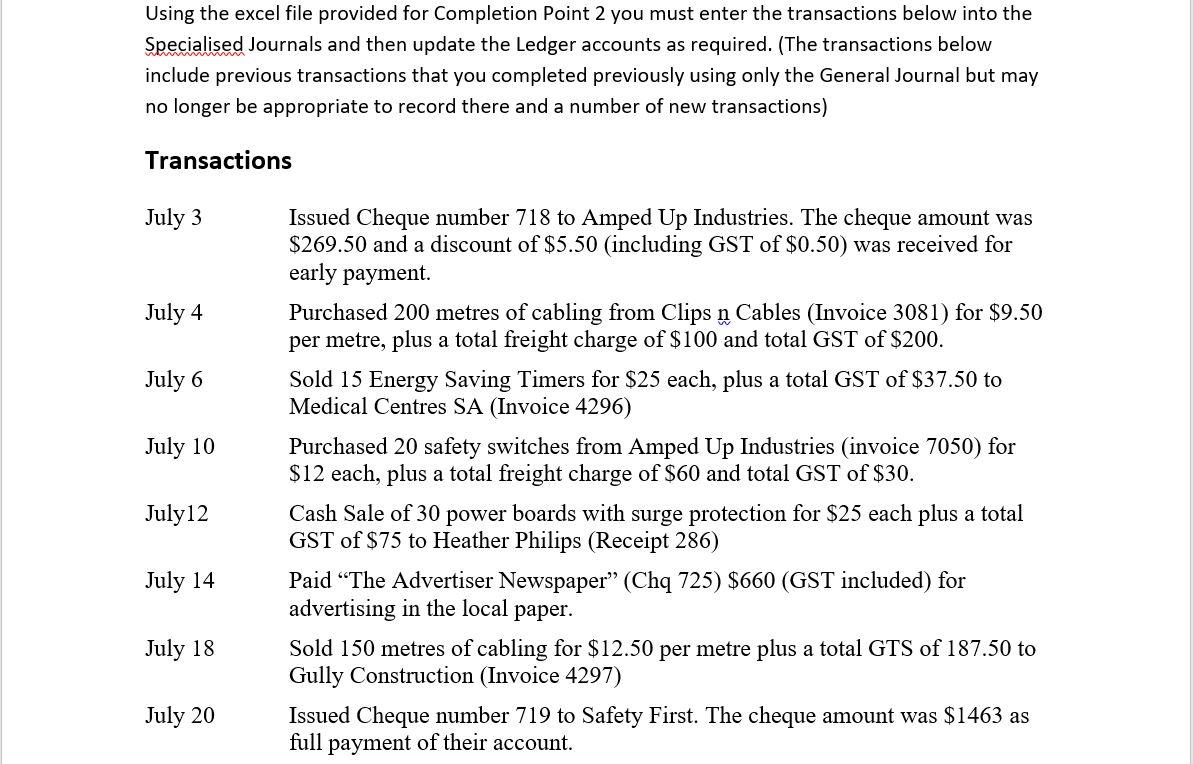

Question: Using the excel file provided for Completion Point 2 you must enter the transactions below into the Specialised Journals and then update the Ledger accounts

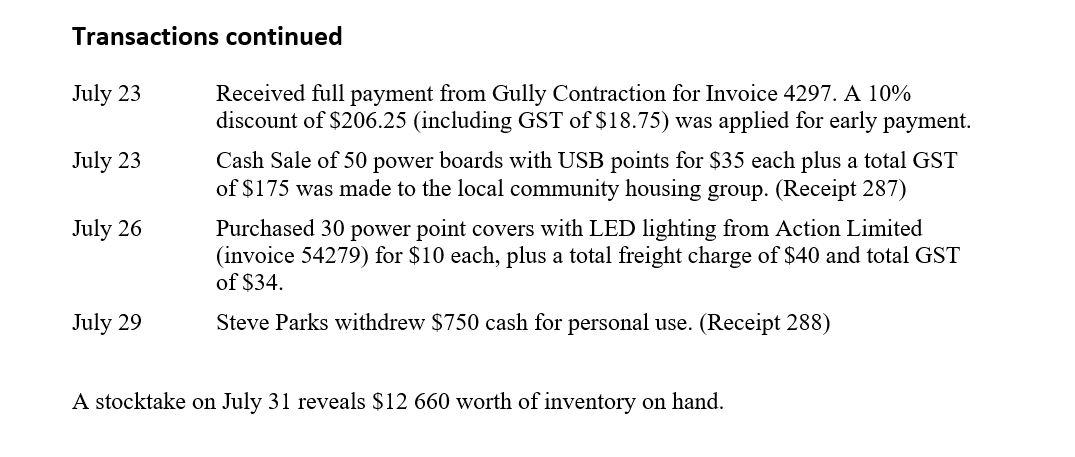

Using the excel file provided for Completion Point 2 you must enter the transactions below into the Specialised Journals and then update the Ledger accounts as required. (The transactions below include previous transactions that you completed previously using only the General Journal but may no longer be appropriate to record there and a number of new transactions) Transactions Transactions continued July 23 Received full payment from Gully Contraction for Invoice 4297. A 10% discount of \$206.25 (including GST of \$18.75) was applied for early payment. July 23 Cash Sale of 50 power boards with USB points for $35 each plus a total GST of $175 was made to the local community housing group. (Receipt 287) July 26 Purchased 30 power point covers with LED lighting from Action Limited (invoice 54279 ) for $10 each, plus a total freight charge of $40 and total GST of $34 July 29 Steve Parks withdrew $750 cash for personal use. (Receipt 288 ) A stocktake on July 31 reveals $12660 worth of inventory on hand. Once you have completed the data entry above, you will need complete Schedules for Accounts Receivable and Accounts Payable and you will need to create a Balance Sheet dated 31 July 2022. These additional reports should be placed on a new tab in the excel spreadsheet. Using the excel file provided for Completion Point 2 you must enter the transactions below into the Specialised Journals and then update the Ledger accounts as required. (The transactions below include previous transactions that you completed previously using only the General Journal but may no longer be appropriate to record there and a number of new transactions) Transactions Transactions continued July 23 Received full payment from Gully Contraction for Invoice 4297. A 10% discount of \$206.25 (including GST of \$18.75) was applied for early payment. July 23 Cash Sale of 50 power boards with USB points for $35 each plus a total GST of $175 was made to the local community housing group. (Receipt 287) July 26 Purchased 30 power point covers with LED lighting from Action Limited (invoice 54279 ) for $10 each, plus a total freight charge of $40 and total GST of $34 July 29 Steve Parks withdrew $750 cash for personal use. (Receipt 288 ) A stocktake on July 31 reveals $12660 worth of inventory on hand. Once you have completed the data entry above, you will need complete Schedules for Accounts Receivable and Accounts Payable and you will need to create a Balance Sheet dated 31 July 2022. These additional reports should be placed on a new tab in the excel spreadsheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts