Question: Using the expectations theory of the term structure, it is better to invest in one-year bonds, reinvested over two years, than to invest in a

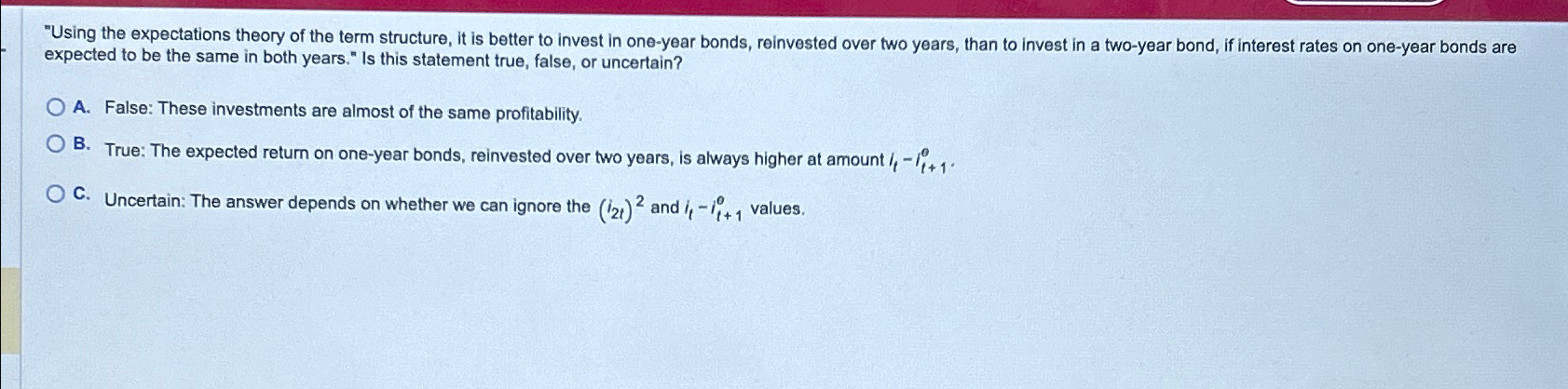

"Using the expectations theory of the term structure, it is better to invest in one-year bonds, reinvested over two years, than to invest in a two-year bond, if interest rates on one-year bonds are expected to be the same in both years." Is this statement true, false, or uncertain?\ A. False: These investments are almost of the same profitability.\ B. True: The expected return on one-year bonds, reinvested over two years, is always higher at amount

t_(t)-i_(t+1)^(\\\\theta ).\ C. Uncertain: The answer depends on whether we can ignore the

(i_(2t))^(2)and

i_(t)-i_(t+1)^(0)values.

"Using the expectations theory of the term structure, it is better to invest in one-year bonds, reinvested over two years, than to invest in a two-year bond, if interest rates on one-year bonds are expected to be the same in both years." Is this statement true, false, or uncertain? A. False: These investments are almost of the same profitability. B. True: The expected return on one-year bonds, reinvested over two years, is always higher at amount itit+1. C. Uncertain: The answer depends on whether we can ignore the (i2t)2 and itit+10 values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts