Question: Using the factor beta estimates in Table 1 below and the expected return estimates in Table 2 below, calculate the risk premium of General Electric

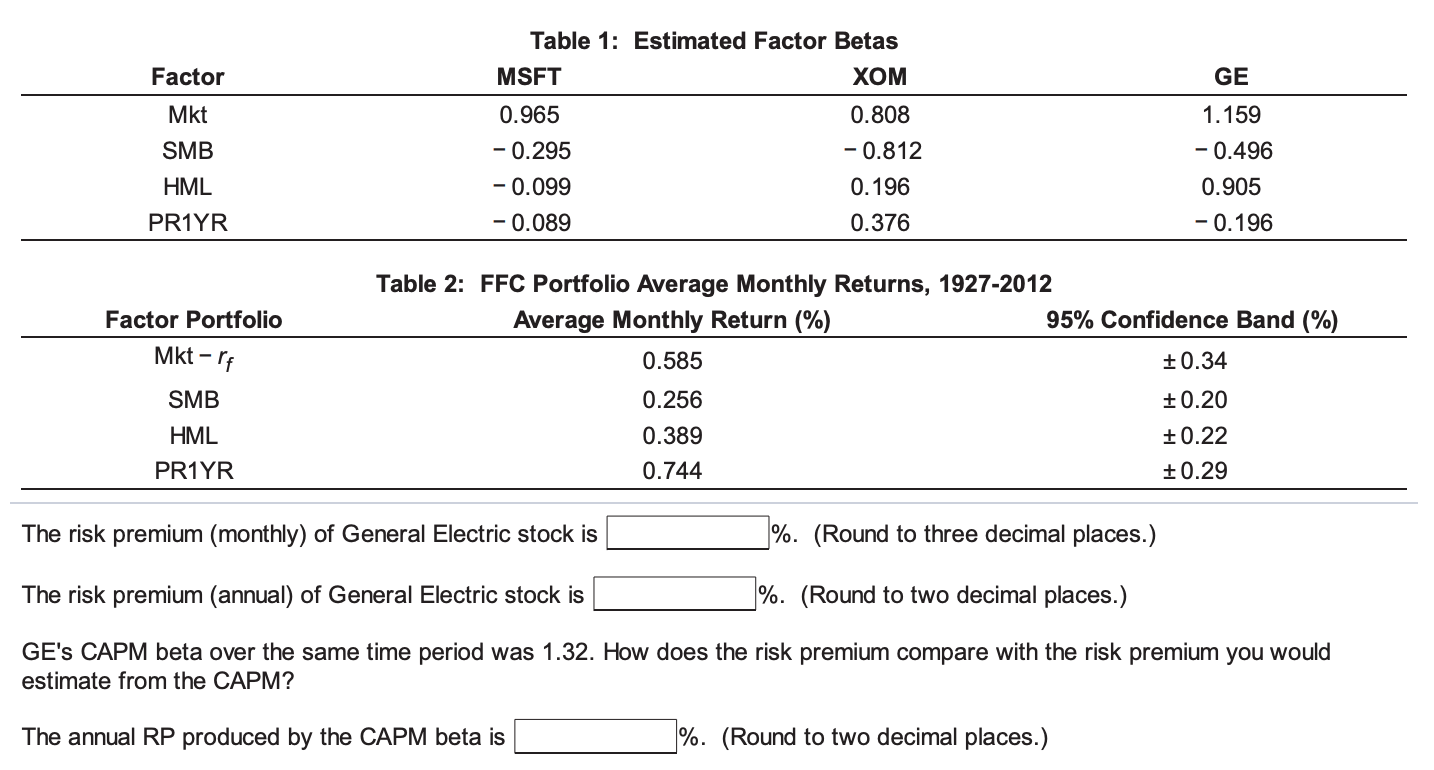

Using the factor beta estimates in Table 1 below and the expected return estimates in Table 2 below, calculate the risk premium of General Electric stock (ticker: GE) using the FFC factor specification. (Annualize your result by multiplying by 12.) GE's CAPM beta over the same time period was 1.32. How does the risk premium compare with the risk premium you would estimate from the CAPM?

PLEASE SHOW WORKINGS :)

PLEASE SHOW WORKINGS :)

these are the ANSWERS but i need help with how to get there....

a) 0.757

b) 9.08

c) 9.27

The risk premium (monthly) of General Electric stock is \%. (Round to three decimal places.) The risk premium (annual) of General Electric stock is \%. (Round to two decimal places.) GE's CAPM beta over the same time period was 1.32. How does the risk premium compare with the risk premium you would estimate from the CAPM? The annual RP produced by the CAPM beta is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts