Question: Rework Problem 9-18, Parts a, b, and c, using a spreadsheet model. For Part b, calculate the price, dividend yield, and capital gains yield as

Rework Problem 9-18, Parts a, b, and c, using a spreadsheet model. For Part b, calculate the price, dividend yield, and capital gains yield as called for in the problem. After completing Parts a through c, answer the following additional question using the spreadsheet model.

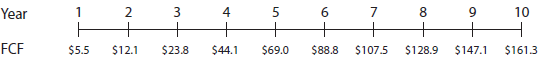

d. TTC recently introduced a new line of products that has been wildly successful. On the basis of this success and anticipated future success, the following free cash flows were projected:

After the tenth year, TTC’s financial planners anticipate that its free cash flow will grow at a constant rate of 6%. Also, the firm concluded that the new product caused the WACC to fall to 9%. The market value of TTC’s debt is $1,200 million, it uses no preferred stock, and there are 20 million shares of common stock outstanding. Use the corporate valuation model approach to value the stock.

2 5 Year 1 9. 10 + $12.1 + $69.0 + $107.5 $128.9 FCF $5.5 $44.1 $147.1 $23.8 $88.8 $161.3

Step by Step Solution

3.35 Rating (176 Votes )

There are 3 Steps involved in it

a 1 Find the price today 2 Find the expected dividend yield Recall that the expected dividend yield is equal to the next expected annual dividend divi... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

43-B-A-I-A (483).docx

120 KBs Word File