Question: Using the financial statements from the most recent annual report for Kathmandu or Super Retail Group, update the calculation of ratios found in this chapter.

Using the financial statements from the most recent annual report for Kathmandu or Super Retail Group, update the calculation of ratios found in this chapter. Compare the ratios to the ones calculated in this chapter, and comment on the four key aspects of its financial performance: profitability, operating management, investment management and financial management. Using the sustainable growth rate calculated in this chapter, how indicative of Kathmandu or Super Retails growth to date has that ratio been?

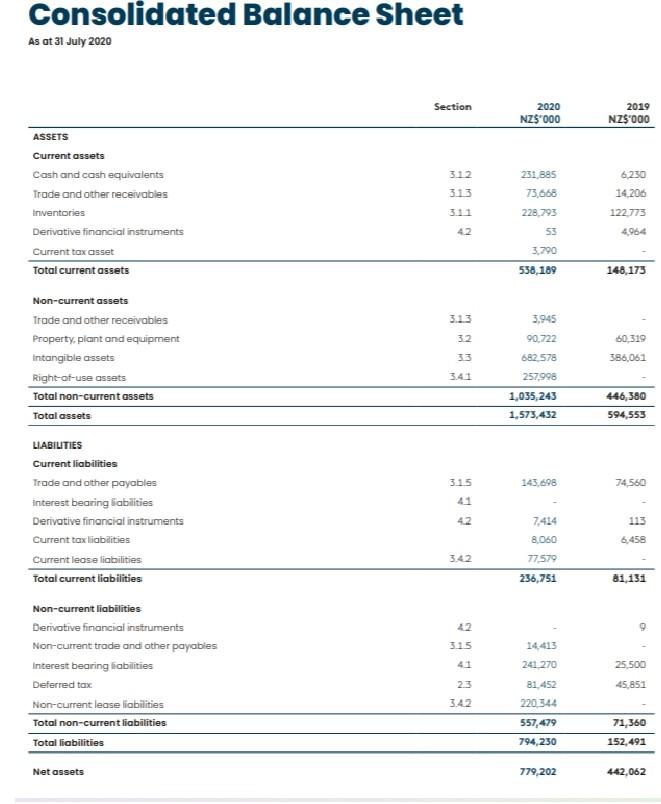

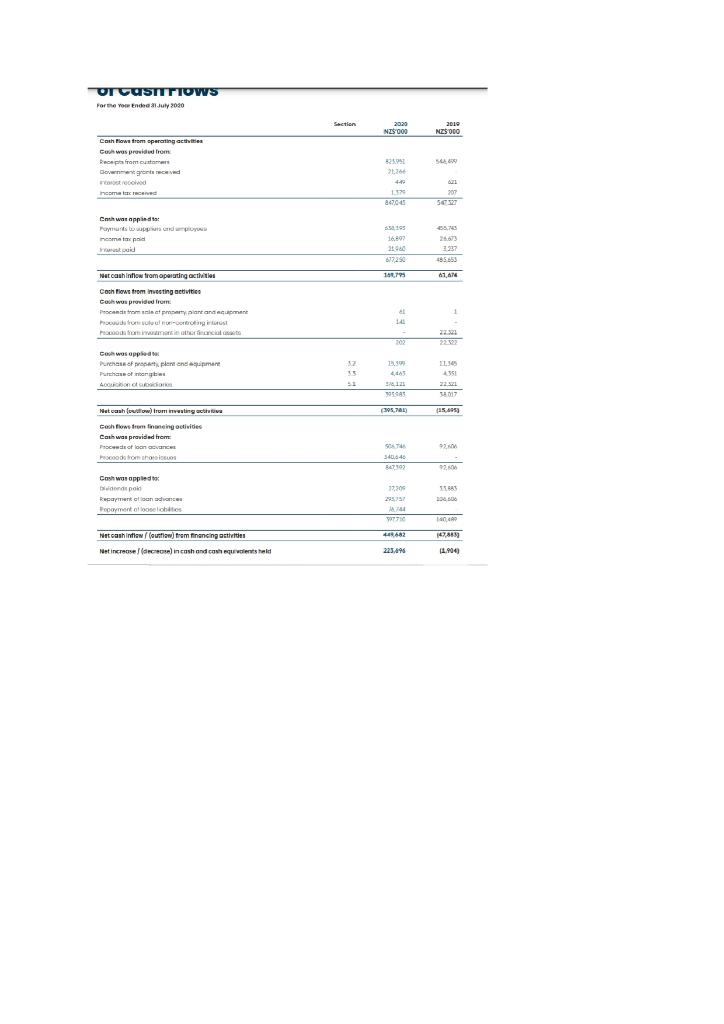

Consolidated Balance Sheet As at 31 July 2020 Section 2020 NZS000 2019 NZ$000 ASSETS Current assets Cash and cash equivalents Trade and other receivables 3.12 6230 3.13 14,206 122.773 Inventories 231.885 73.668 228.793 53 3.790 538, 189 42 4,964 Derivative financial instruments Current tax asset Total current assets 148,173 3.13 32 Non-current assets Trade and other receivables Property, plant and equipment Intangible assets Right-of-use assets Total non-current assets 3,945 90.722 682578 60,519 386,061 257,998 1,035,243 1,573,432 446,580 594,553 Total assets 3.15 145.698 74.560 41 42 113 6.458 3.42 8.060 77.579 236,751 81,1311 LIABILITIES Current liabilities Trade and other payables interest bearing liabilities Derivative financial instruments Current tax liabilities Current lease liabilities Total current liabilities Non-current liabilities Derivative financial instruments Non-current trade and other payables Interest bearing liabilities Deferred tax Non-current lease liabilities Total non-current liabilities Total liabilities 42 9 3.15 14 413 241 270 41 25.500 23 45,851 81 452 220 344 3.42 71,360 557,479 794,230 152,491 Net assets 779,202 442,062 or cusTriows For yow Endul 7010 Section 20:20 NIS000 2010 NZSODO 5. Cash Flow from sparating activities Cuth was provided from Bec from me Government grants received colod romance 21 1170 2006 307 50 6. Cath was applied to Paymuns loppupus ncome tax paid was puid 16,192 1986 677.250 19 195653 190,79 41 AM Netcoshiniwtram operating activities Coch Flowe trem investing activities Coun wus provided from Procesni pun Produtos out 1 140 37 Purchase of propers and man Purchase origet And 10 4S 12 455 22 99995 52017 (395,70 135.95 Netcash culow) trommesting the Cashflows from financingoctivities Cash was provided from Process of loan Procode from the US 92 SAL 47393 92.16 Cosh was applied to de poid Recament a london Payment tools 13,00 29331 eat 100 Netcashindow (oustio) trem financing its R607 14788) (1.904 Net increase lance in cash and comments 22349 Consolidated Balance Sheet As at 31 July 2020 Section 2020 NZS000 2019 NZ$000 ASSETS Current assets Cash and cash equivalents Trade and other receivables 3.12 6230 3.13 14,206 122.773 Inventories 231.885 73.668 228.793 53 3.790 538, 189 42 4,964 Derivative financial instruments Current tax asset Total current assets 148,173 3.13 32 Non-current assets Trade and other receivables Property, plant and equipment Intangible assets Right-of-use assets Total non-current assets 3,945 90.722 682578 60,519 386,061 257,998 1,035,243 1,573,432 446,580 594,553 Total assets 3.15 145.698 74.560 41 42 113 6.458 3.42 8.060 77.579 236,751 81,1311 LIABILITIES Current liabilities Trade and other payables interest bearing liabilities Derivative financial instruments Current tax liabilities Current lease liabilities Total current liabilities Non-current liabilities Derivative financial instruments Non-current trade and other payables Interest bearing liabilities Deferred tax Non-current lease liabilities Total non-current liabilities Total liabilities 42 9 3.15 14 413 241 270 41 25.500 23 45,851 81 452 220 344 3.42 71,360 557,479 794,230 152,491 Net assets 779,202 442,062 or cusTriows For yow Endul 7010 Section 20:20 NIS000 2010 NZSODO 5. Cash Flow from sparating activities Cuth was provided from Bec from me Government grants received colod romance 21 1170 2006 307 50 6. Cath was applied to Paymuns loppupus ncome tax paid was puid 16,192 1986 677.250 19 195653 190,79 41 AM Netcoshiniwtram operating activities Coch Flowe trem investing activities Coun wus provided from Procesni pun Produtos out 1 140 37 Purchase of propers and man Purchase origet And 10 4S 12 455 22 99995 52017 (395,70 135.95 Netcash culow) trommesting the Cashflows from financingoctivities Cash was provided from Process of loan Procode from the US 92 SAL 47393 92.16 Cosh was applied to de poid Recament a london Payment tools 13,00 29331 eat 100 Netcashindow (oustio) trem financing its R607 14788) (1.904 Net increase lance in cash and comments 22349

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts