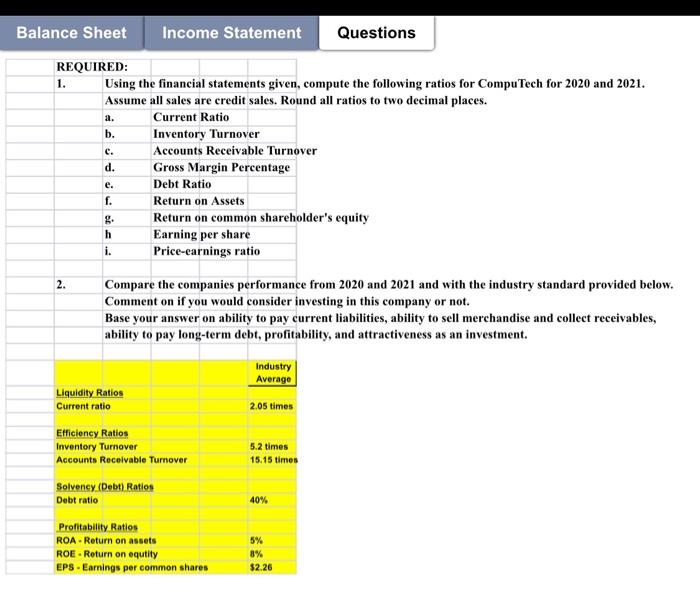

Question: Using the financial statements given, compute the following ratios for CompuTech for (2020 and 2021) Assume all sales are credit sales. Round all ratios to

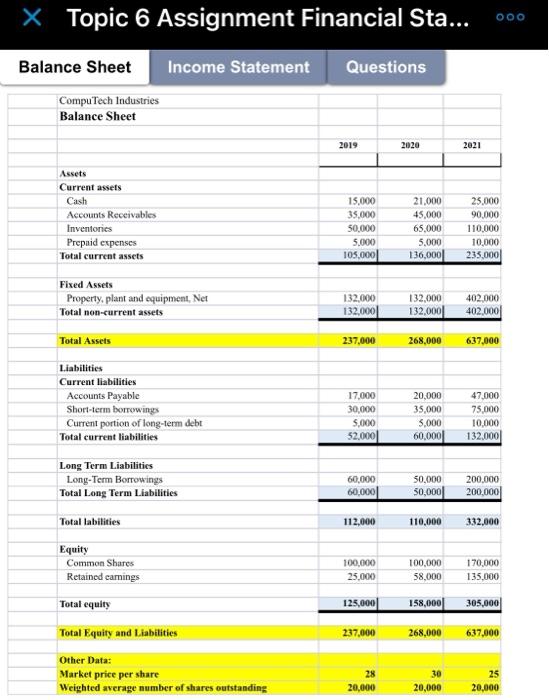

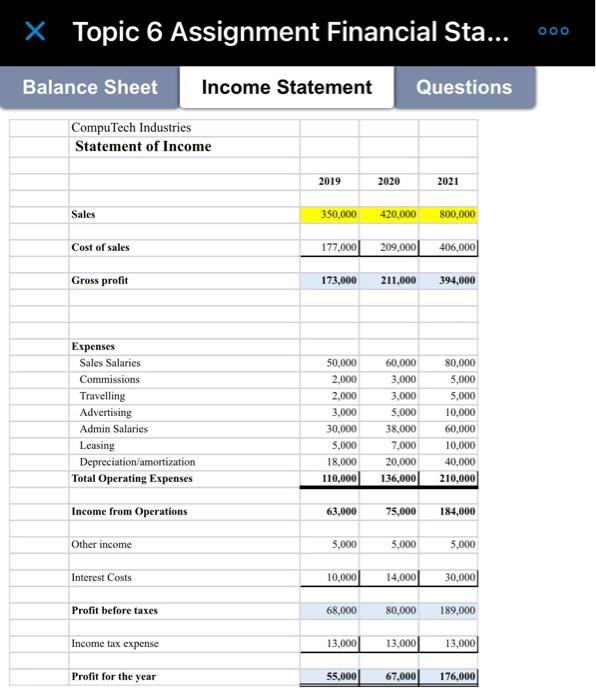

X Topic 6 Assignment Financial Sta... OOO Balance Sheet Income Statement Questions CompuTech Industries Balance Sheet 2019 2020 2021 Assets Current assets Cash Accounts Receivables Inventones Prepaid expenses Total current assets 15,000 35.000 50,000 5.000 105.000 21.000 45,000 65.000 5,000 136,000 25,000 90.000 110.000 10,000 235.000 Fixed Assets Property, plant and equipment, Net Total non-current assets 132,000 132,000 132,000 132.000 402,000 402.000 Total Assets 237,000 268,000 637,000 Liabilities Current liabilities Accounts Payable Short-term borrowings Current portion of long-term debt Total current liabilities 17,000 30,000 5,000 52.000 20,000 35,000 5,000 60,000 47.000 75,000 10.000 132,000 Long Term Liabilities Long-Term Borrowings Total Long Term Liabilities 60,000 60,000 50,000 50,000 200.000 200,000 Total labilities 112.000 110,000 332,000 Equity Common Shares Retained camnings 100.000 25.000 100,000 58.000 170,000 135,000 125,000 158,000 305,000 Total equity Total Equity and Liabilities 237,000 268,000 637,000 Other Data: Market price per share Weighted average number of shares outstanding 28 20,000 30 20,000 25 20,000 X Topic 6 Assignment Financial Sta... 000 Balance Sheet Income Statement Questions CompuTech Industries Statement of Income 2019 2020 2021 Sales 350,000 420.000 800,000 Cost of sales 177,000 209,000 406,000 Gross profit 173,000 211,000 394,000 Expenses Sales Salaries Commissions Travelling Advertising Admin Salaries Leasing Depreciation/amortization Total Operating Expenses 50,000 2.000 2.000 3,000 30,000 5,000 18,000 110,000 60.000 3,000 3.000 5.000 38.000 7.000 20,000 136,000 80,000 5,000 5,000 10,000 60,000 10,000 40,000 210,000 Income from Operations 63,000 75,000 184,000 Other income 5,000 5,000 5,000 Interest Costs 10,000 14,000 30,000 Profit before taxes 68,000 80,000 189,000 Income tax expense 13,000 13,00 13,000 Profit for the year 55,000 67,000 176,000 Balance Sheet Income Statement Questions a. b. c. REQUIRED: 1. Using the financial statements given, compute the following ratios for CompuTech for 2020 and 2021. Assume all sales are credit sales. Round all ratios to two decimal places. Current Ratio Inventory Turnover Accounts Receivable Turnover d. Gross Margin Percentage Debt Ratio f. Return on Assets g. Return on common shareholder's equity h Earning per share i. Price-earnings ratio e. 2. Compare the companies performance from 2020 and 2021 and with the industry standard provided below. Comment on if you would consider investing in this company or not. Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. Liquidity Ratios Current ratio Industry Average 2.05 times Efficiency Ratios Inventory Turnover Accounts Receivable Turnover Solvency (Debt) Ratios Debt ratio 5.2 times 15.15 times 40% Profitability Ratios ROA - Return on assets ROE - Return on equity EPS . Earnings per common shares 5% 8% $2 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts