Question: Using the following financial statement data, calculate the difference between total nonoperating assets and total nonoperating liabilities. If your result is a negative value, please

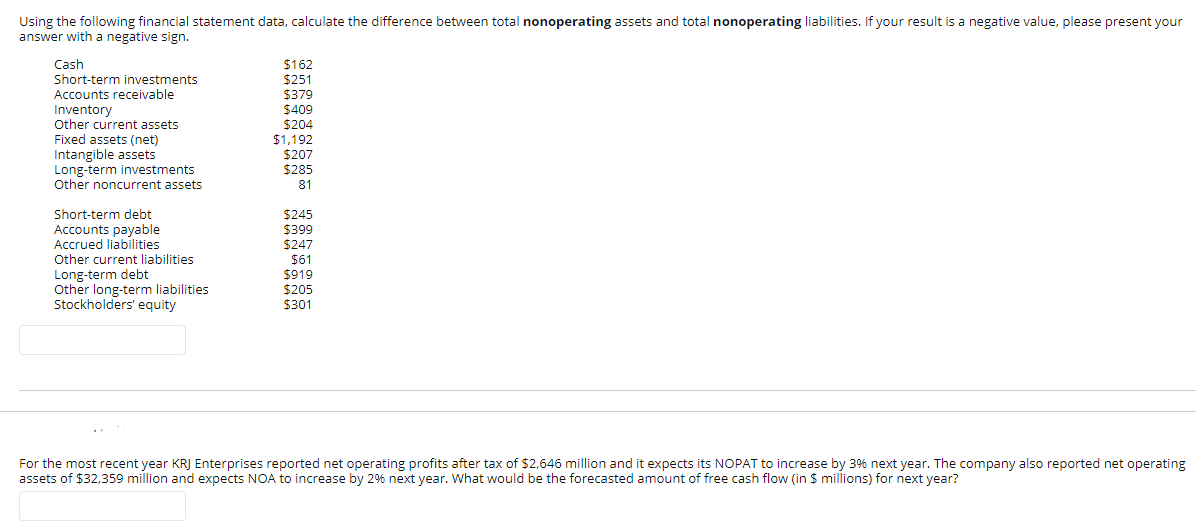

Using the following financial statement data, calculate the difference between total nonoperating assets and total nonoperating liabilities. If your result is a negative value, please present your answer with a negative sign. Cash Short-term investments Accounts receivable Inventory Other current assets Fixed assets (net) Intangible assets Long-term investments Other noncurrent assets $162 $251 $379 $409 $204 $1,192 $207 $285 81 $245 Short-term debt Accounts payable Accrued liabilities Other current liabilities Long-term debt Other long-term liabilities Stockholders' equity $399 $247 $61 $919 $205 $301 For the most recent year KRJ Enterprises reported net operating profits after tax of $2,646 million and it expects its NOPAT to increase by 396 next year. The company also reported net operating assets of $32,359 million and expects NOA to increase by 2% next year. What would be the forecasted amount of free cash flow in 5 millions) for next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts