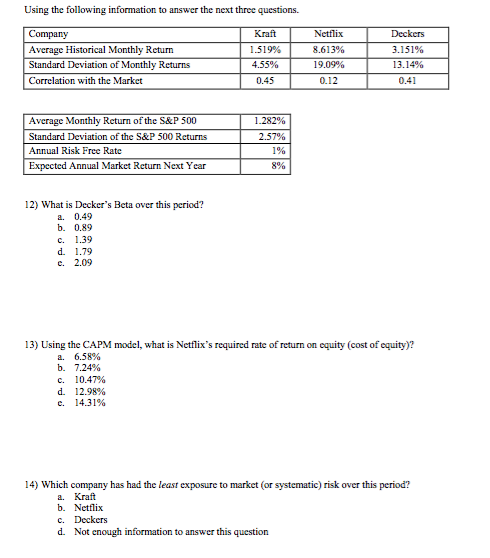

Question: Using the following information to answer the next three questions. Average Historical Monthly Return Standard Deviation of Monthly Returns Correlation with the Market Kraft 1.519%

Using the following information to answer the next three questions. Average Historical Monthly Return Standard Deviation of Monthly Returns Correlation with the Market Kraft 1.519% 4.55% 0.45 Netflix 8.613% 19.09% 0.12 Deckers 3.151% 13.14% 0.41 Average Monthly Return of the S&P 500 Standard Deviation of the S&P 500 Returns Annual Risk Free Rate Expected Annual Market Return Next Year 1.282% 2.57% 1% 890 12) What is Decker's Beta over this period? a. 0.49 b. 0.89 c. 1.39 d. 1.79 e. 2.09 13) Using the CAPM model, what is Netflix's required rate of return on equity (cost of equity)? a. b. ?. d. c. 6.58% 7.24% 10.47% 12.98% 14.31% 14) Which company has had the least exposure to market (or systematic) risk over this period? a. Kraft b. Netflix c. Deckers d. Not enough information to answer this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts